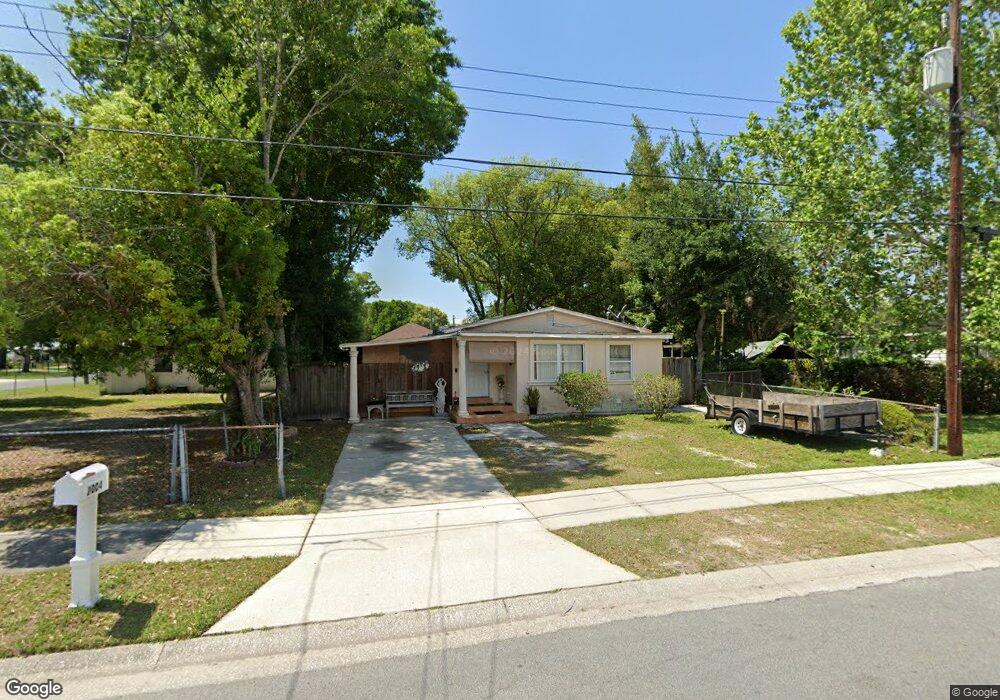

7004 N Clark Ave Tampa, FL 33614

Pinecrest West Park NeighborhoodEstimated Value: $291,000 - $366,000

3

Beds

1

Bath

1,018

Sq Ft

$320/Sq Ft

Est. Value

About This Home

This home is located at 7004 N Clark Ave, Tampa, FL 33614 and is currently estimated at $325,722, approximately $319 per square foot. 7004 N Clark Ave is a home located in Hillsborough County with nearby schools including Crestwood Elementary School, Pierce Middle School, and Leto High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 11, 2017

Sold by

Marrero Raciell and Barbara Josefa

Bought by

Burgos Castellano Carmen and Andujar Arelis

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$15,000

Outstanding Balance

$12,489

Interest Rate

3.88%

Mortgage Type

Stand Alone Second

Estimated Equity

$313,233

Purchase Details

Closed on

Feb 2, 2006

Sold by

Huynh Son Cam and Le Yen Thi Ngoc

Bought by

Marrero Raciel and Barbosa Josefa

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$100,000

Interest Rate

8.7%

Mortgage Type

Fannie Mae Freddie Mac

Purchase Details

Closed on

Apr 18, 1997

Sold by

Barness Joseph M and Barness Ippolito M

Bought by

Huynh Son C and Le Ngoc Yen T

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$30,000

Interest Rate

7.86%

Purchase Details

Closed on

Nov 14, 1995

Sold by

County Of Hillsborough

Bought by

Barness Joseph M and Ippolito Ilaria M

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Burgos Castellano Carmen | $157,000 | First American Title Ins Co | |

| Marrero Raciel | $125,000 | Sunbelt Title Agency | |

| Huynh Son C | $35,000 | -- | |

| Barness Joseph M | $17,200 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Burgos Castellano Carmen | $15,000 | |

| Previous Owner | Marrero Raciel | $100,000 | |

| Previous Owner | Barness Joseph M | $30,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,536 | $198,754 | $65,880 | $132,874 |

| 2023 | $3,183 | $171,795 | $60,390 | $111,405 |

| 2022 | $2,985 | $177,653 | $54,900 | $122,753 |

| 2021 | $2,616 | $128,370 | $43,920 | $84,450 |

| 2020 | $2,332 | $110,902 | $38,430 | $72,472 |

| 2019 | $2,269 | $109,375 | $32,940 | $76,435 |

| 2018 | $2,140 | $100,825 | $0 | $0 |

| 2017 | $1,611 | $82,323 | $0 | $0 |

| 2016 | $1,483 | $60,106 | $0 | $0 |

| 2015 | $1,386 | $54,642 | $0 | $0 |

| 2014 | $1,281 | $49,675 | $0 | $0 |

| 2013 | -- | $45,159 | $0 | $0 |

Source: Public Records

Map

Nearby Homes

- 3923 W Flora St

- 7216 Blossom Ave

- 7012 N Hubert Ave

- 3904 W Hamilton Ave

- 3914 W Sligh Ave

- 3916 W Broad St

- 7222 N Richard Ave

- 3801 Kimball Ave

- 3915 W Robson St

- 0 Blossom Ave

- 3920 Cedar Limb Ct

- 6624 N Hubert Ave

- 7210 N Manhattan Ave Unit 2423

- 7210 N Manhattan Ave Unit 1724

- 7210 N Manhattan Ave Unit 1122

- 7210 N Manhattan Ave Unit 1311

- 7210 N Manhattan Ave Unit 2624

- 7210 N Manhattan Ave Unit 1822

- 6420 N Thatcher Ave

- 4003 Oak Limb Ct

- 7006 N Clark Ave

- 7002 N Clark Ave

- 7001 N Cameron Ave

- 7003 N Cameron Ave

- 7010 N Clark Ave

- 7003 N Clark Ave

- 7005 N Clark Ave

- 7001 N Clark Ave

- 7012 N Clark Ave

- 7007 N Cameron Ave

- 7007 N Clark Ave

- 6923 N Cameron Ave

- 7009 N Clark Ave

- 6923 N Clark Ave

- 6922 N Clark Ave

- 7009 N Cameron Ave

- 0 N Cameron Ave

- 7014 N Clark Ave

- 6921 N Cameron Ave

- 7011 N Clark Ave