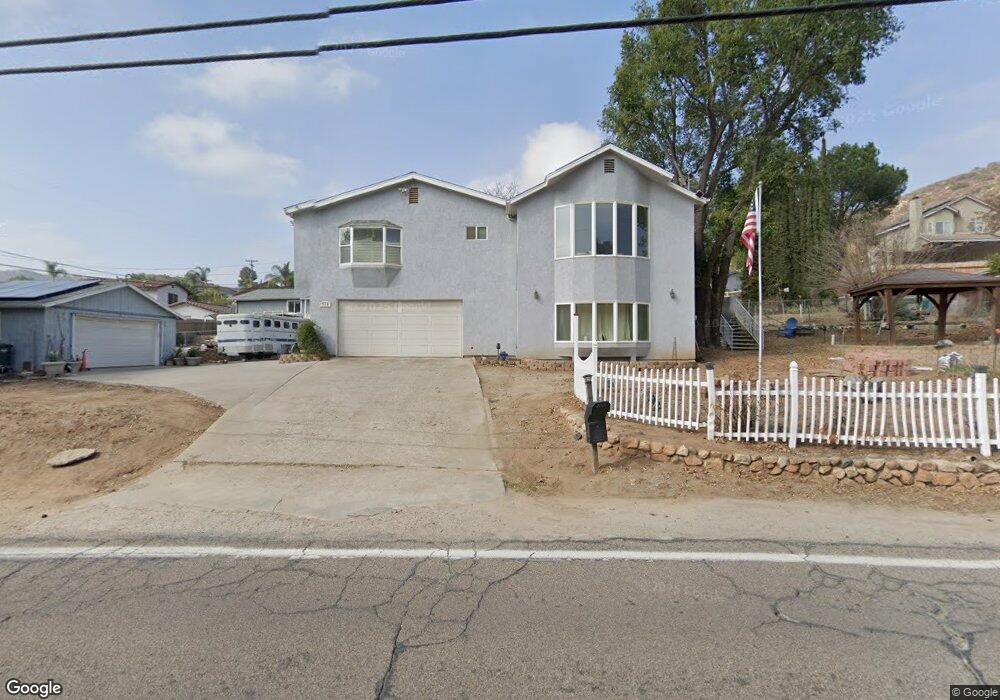

715 Harbison Canyon Rd El Cajon, CA 92019

Harbison Canyon NeighborhoodEstimated Value: $744,000 - $971,000

4

Beds

3

Baths

2,681

Sq Ft

$336/Sq Ft

Est. Value

About This Home

This home is located at 715 Harbison Canyon Rd, El Cajon, CA 92019 and is currently estimated at $899,724, approximately $335 per square foot. 715 Harbison Canyon Rd is a home located in San Diego County with nearby schools including Granite Hills High School and Cabrillo Point Academy.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 2, 2016

Sold by

Law William P and Law Heather

Bought by

Law William and Law Heather

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$542,325

Outstanding Balance

$435,393

Interest Rate

3.42%

Mortgage Type

VA

Estimated Equity

$464,331

Purchase Details

Closed on

Feb 20, 2007

Sold by

Law William P

Bought by

Law William P and Law Heather

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$417,000

Interest Rate

6.21%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jan 14, 2002

Sold by

Robbins Robert J

Bought by

Law William P

Purchase Details

Closed on

Nov 28, 2000

Sold by

Wilson Woodrow E S and Wanda La

Bought by

Robbins Robert J

Purchase Details

Closed on

Apr 19, 1999

Sold by

Silvia Robert Marshall and Silvia Sue Ann

Bought by

Law William P

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$183,600

Interest Rate

6.98%

Mortgage Type

VA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Law William | -- | Ticor Title Co San Diego | |

| Law William P | -- | Fidelity National Title San | |

| Law William P | $3,000 | First American Title | |

| Robbins Robert J | $7,552 | Chicago Title Co | |

| Law William P | $184,000 | Southland Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Law William | $542,325 | |

| Closed | Law William P | $417,000 | |

| Previous Owner | Law William P | $183,600 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,278 | $470,845 | $104,755 | $366,090 |

| 2024 | $5,278 | $461,613 | $102,701 | $358,912 |

| 2023 | $5,370 | $452,563 | $100,688 | $351,875 |

| 2022 | $5,335 | $443,690 | $98,714 | $344,976 |

| 2021 | $5,484 | $434,991 | $96,779 | $338,212 |

| 2020 | $5,223 | $430,532 | $95,787 | $334,745 |

| 2019 | $5,124 | $422,091 | $93,909 | $328,182 |

| 2018 | $5,016 | $413,816 | $92,068 | $321,748 |

| 2017 | $511 | $405,703 | $90,263 | $315,440 |

| 2016 | $4,745 | $397,749 | $88,494 | $309,255 |

| 2015 | $4,721 | $391,775 | $87,165 | $304,610 |

| 2014 | $4,609 | $384,102 | $85,458 | $298,644 |

Source: Public Records

Map

Nearby Homes

- 0 Silverbrook Dr Unit PTP2505360

- 0 Silverbrook Dr Unit PTP2505357

- 723 Lingel Dr

- 833 Renfro Way

- 1119 Saint George Dr

- 965 Harbison Canyon Rd

- 221 Frances Dr

- 1010 1/2 Wilson Ave

- 447 Patrick Dr

- 250 Editha Dr

- 1152 Stoneridge Rd

- 1140 Old Mountain View Rd

- 0 Harbison Canyon Rd Unit PTP2505101

- 1631 Harbison Canyon Rd Unit 26

- 1631 Harbison Canyon Rd Unit 24

- 1631 Harbison Canyon Rd Unit 77

- 434 Mountain View Rd

- 6433 Dehesa Rd

- 328 Amy Way

- 2 La Cresta Rd Unit 2

- 700 Saint George Dr

- 731 Harbison Canyon Rd

- 638 Saint George Dr

- 716 Harbison Canyon Rd

- 722 Saint George Dr

- 726 Harbison Canyon Rd

- 739 Harbison Canyon Rd

- 445 Snowden Place

- 728 Saint George Dr

- 624 Saint George Dr

- 0 St George Dr Unit 100057635

- 637 Saint George Dr

- 717 Silverbrook Dr

- 744 Harbison Canyon Rd

- 0 Silverbrook Dr Unit CRPTP2403333

- 0 Silverbrook Dr Unit PTP2403333

- 0 Silverbrook Dr Unit PTP2305877

- 0 Silverbrook Dr Unit 3 & 4 180012496

- 0 Silverbrook Trail Unit 3 & 4

- 0 Silverbrook Dr