7281 W Baldwin Reserve Dr Middleburg Heights, OH 44130

Estimated Value: $275,635 - $323,000

2

Beds

2

Baths

1,408

Sq Ft

$217/Sq Ft

Est. Value

About This Home

This home is located at 7281 W Baldwin Reserve Dr, Middleburg Heights, OH 44130 and is currently estimated at $305,659, approximately $217 per square foot. 7281 W Baldwin Reserve Dr is a home located in Cuyahoga County with nearby schools including Big Creek Elementary School, Berea-Midpark Middle School, and Berea-Midpark High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 28, 2018

Sold by

Ritschel Anna and Ritschel Jeff

Bought by

Bondio Joan

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$120,000

Outstanding Balance

$99,475

Interest Rate

2.99%

Mortgage Type

Adjustable Rate Mortgage/ARM

Estimated Equity

$206,184

Purchase Details

Closed on

Jul 19, 2013

Sold by

Ritschel Kelly Marie

Bought by

Ritschel Frane and Ritschel Anna

Purchase Details

Closed on

Jul 19, 2002

Sold by

Kaiser Barbara A and Kaiser Wilbur C

Bought by

Kaiser Barbara A and Barbara A Kaiser Living Trust

Purchase Details

Closed on

Mar 17, 1994

Bought by

Kaiser Wilbur C

Purchase Details

Closed on

Jan 1, 1993

Bought by

Baldwin Reserve Co

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Bondio Joan | $180,000 | None Available | |

| Ritschel Jeff | -- | None Available | |

| Ritschel Frane | $170,000 | Maximum Title | |

| Kaiser Barbara A | -- | -- | |

| Kaiser Barbara A | -- | -- | |

| Kaiser Wilbur C | $142,900 | -- | |

| Baldwin Reserve Co | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Bondio Joan | $120,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $4,729 | $91,350 | $17,570 | $73,780 |

| 2023 | $4,323 | $68,990 | $12,110 | $56,880 |

| 2022 | $3,765 | $68,990 | $12,110 | $56,880 |

| 2021 | $3,743 | $68,990 | $12,110 | $56,880 |

| 2020 | $4,544 | $63,280 | $11,100 | $52,190 |

| 2019 | $4,415 | $180,800 | $31,700 | $149,100 |

| 2018 | $4,297 | $63,280 | $11,100 | $52,190 |

| 2017 | $4,262 | $57,970 | $10,540 | $47,430 |

| 2016 | $4,228 | $57,970 | $10,540 | $47,430 |

| 2015 | $3,756 | $57,970 | $10,540 | $47,430 |

| 2014 | $3,756 | $54,670 | $9,940 | $44,730 |

Source: Public Records

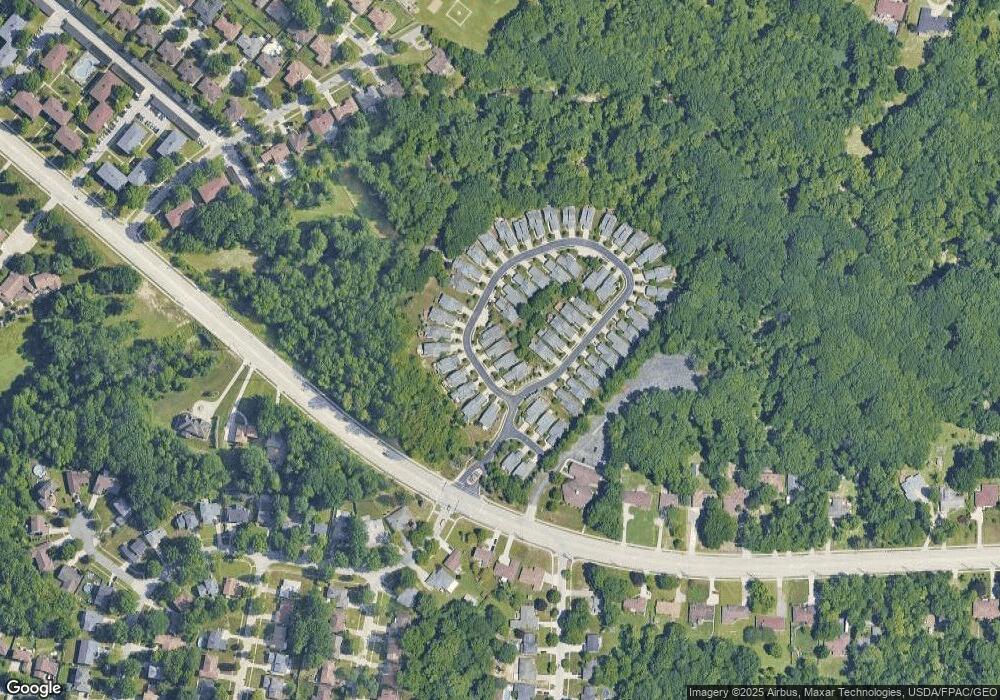

Map

Nearby Homes

- 7284 W Baldwin Reserve Dr

- 7241 Baldwin Reserve Dr

- 7432 Baldwin Creek Dr

- 14750 Seneca Trail

- 14330 Pawnee Trail

- 14280 Pawnee Trail

- 13505 Old Pleasant Valley Rd

- 7280 Pearl Rd

- 7364 Pearl Rd

- 13541 Indian Creek Dr

- 7444 Briarcliff Pkwy

- 7685 Saratoga Rd

- 15861 Glenridge Ave

- 7330 Maplewood Rd

- 7664 Gerald Dr

- 7601 W 130th St

- 7475 Lanier Dr

- 7547 N Linden Ln

- 6943 N Parkway Dr Unit H6943

- 14015 Byron Blvd

- 7269 W Baldwin Reserve Dr

- 7295 W Baldwin Reserve Dr

- 7299 W Baldwin Reserve Dr

- 7261 W Baldwin Reserve Dr

- 7252 Baldwin Reserve Dr

- 7253 W Baldwin Reserve Dr

- 7256 Baldwin Reserve Dr

- 7248 Baldwin Reserve Dr

- 7280 W Baldwin Reserve Dr

- 7276 W Baldwin Reserve Dr

- 7290 W Baldwin Reserve Dr

- 7270 W Baldwin Reserve Dr

- 7264 W Baldwin Reserve Dr

- 7249 W Baldwin Reserve Dr

- 7294 W Baldwin Reserve Dr

- 14272 Reserve Ln

- 7260 W Baldwin Reserve Dr

- 7244 Baldwin Reserve Dr

- 7298 W Baldwin Reserve Dr

- 7241 W Baldwin Reserve Dr