735 Hidden Valley Ct Fairborn, OH 45324

Estimated Value: $177,000 - $188,434

2

Beds

3

Baths

1,746

Sq Ft

$104/Sq Ft

Est. Value

About This Home

This home is located at 735 Hidden Valley Ct, Fairborn, OH 45324 and is currently estimated at $180,859, approximately $103 per square foot. 735 Hidden Valley Ct is a home located in Greene County with nearby schools including Fairborn Primary School, Fairborn Intermediate School, and Fairborn Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 15, 2014

Sold by

Federal Home Loan Mortgage Corporation

Bought by

Trame Robert J and Trame Janet M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$48,000

Outstanding Balance

$36,808

Interest Rate

3.95%

Mortgage Type

New Conventional

Estimated Equity

$144,051

Purchase Details

Closed on

Sep 26, 2014

Sold by

Oppenheim Susan G

Bought by

Federal National Mortgage Association

Purchase Details

Closed on

Mar 8, 2007

Sold by

Schroeder Michael D and Schroeder Lori C

Bought by

Oppenheim Susan G

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$101,000

Interest Rate

6.4%

Mortgage Type

Unknown

Purchase Details

Closed on

Mar 12, 1999

Sold by

Luers Gilbert C

Bought by

Schroeder Michael D and Schroeder Lori C

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$90,440

Interest Rate

6.8%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Trame Robert J | -- | Intitle Agency Inc | |

| Federal National Mortgage Association | $68,000 | None Available | |

| Oppenheim Susan G | $101,000 | Attorney | |

| Schroeder Michael D | $92,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Trame Robert J | $48,000 | |

| Previous Owner | Oppenheim Susan G | $101,000 | |

| Previous Owner | Schroeder Michael D | $90,440 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,262 | $47,230 | $3,150 | $44,080 |

| 2023 | $2,262 | $47,230 | $3,150 | $44,080 |

| 2022 | $1,891 | $33,240 | $3,150 | $30,090 |

| 2021 | $1,919 | $33,240 | $3,150 | $30,090 |

| 2020 | $1,929 | $33,240 | $3,150 | $30,090 |

| 2019 | $1,906 | $32,890 | $3,150 | $29,740 |

| 2018 | $1,926 | $32,890 | $3,150 | $29,740 |

| 2017 | $1,884 | $32,890 | $3,150 | $29,740 |

| 2016 | $1,894 | $32,320 | $3,150 | $29,170 |

| 2015 | $1,806 | $32,320 | $3,150 | $29,170 |

| 2014 | $161 | $32,320 | $3,150 | $29,170 |

Source: Public Records

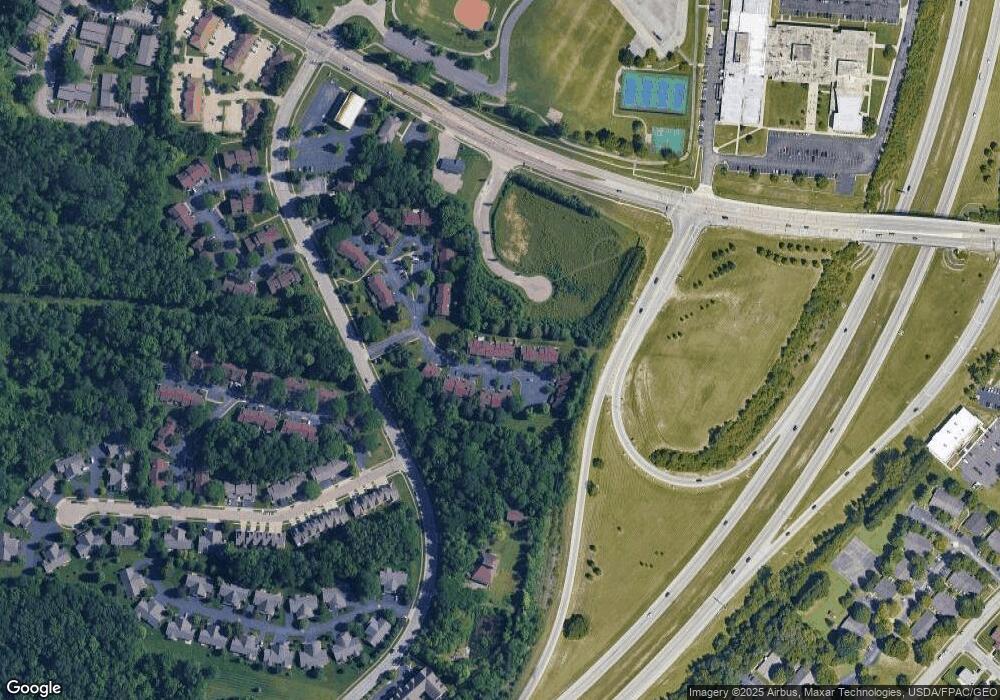

Map

Nearby Homes

- 631 Westwood Dr

- 523 Greene Tree Place

- 474 Kalynn Cir

- 474 Kalynn Cir Unit 19

- 479 Park Hills Crossing Unit 17

- 479 Park Hills Crossing

- 441 Kalynn Cir Unit 25

- 2133 Chapel Dr

- 1943 Fraternity Ct

- 2148 Beaver Valley Rd

- 1105 Windsong Trail

- 2348 Patrick Blvd

- 1606 Hillrose Place

- 1101 Arden Way

- 456 Glenhaven Way Unit 754-304

- 474 Glenhaven Way Unit 755-303

- 518 Glenhaven Way Unit 756-305

- 470 Glenhaven Way Unit 755-301

- 508 Glenhaven Way Unit 756-300

- 506 Glenhaven Way

- 741 Hidden Valley Ct

- 729 Hidden Valley Ct

- 753 Hidden Valley Ct

- 717 Hidden Valley Ct

- 759 Hidden Valley Ct

- 765 Hidden Valley Ct

- 732 Hidden Valley Ct

- 732 Hidden Valley Ct Unit 6344

- 718 Hidden Valley Ct

- 726 Hidden Valley Ct

- 738 Hidden Valley Ct Unit 6345

- 771 Hidden Valley Ct

- 744 Hidden Valley Ct

- 712 Hidden Valley Ct

- 706 Hidden Valley Ct

- 700 Hidden Valley Ct

- 671 Hidden Valley Ct

- 696 Hidden Valley Ct

- 780 Hidden Valley Ct

- 669 Hidden Valley Ct