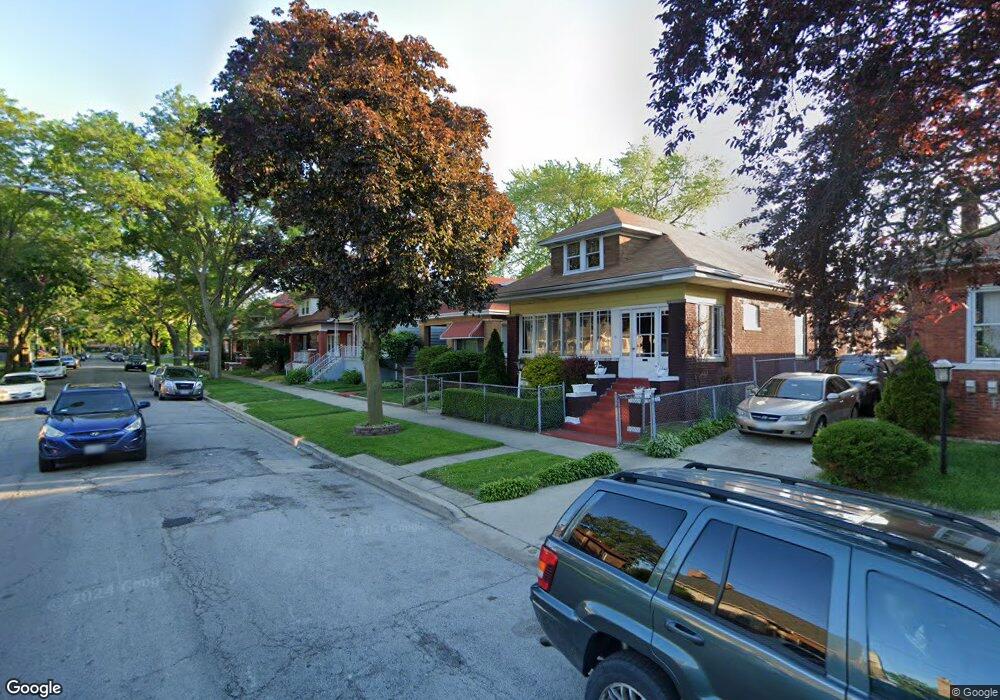

8136 S Avalon Ave Chicago, IL 60619

Grand Crossing NeighborhoodEstimated Value: $138,000 - $292,000

2

Beds

1

Bath

1,035

Sq Ft

$179/Sq Ft

Est. Value

About This Home

This home is located at 8136 S Avalon Ave, Chicago, IL 60619 and is currently estimated at $185,420, approximately $179 per square foot. 8136 S Avalon Ave is a home located in Cook County with nearby schools including Emil G. Hirsch Metropolitan High School, Betty Shabazz Academy, and CICS Avalon.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 29, 2024

Sold by

Arcel Investments Inc and Jd Solutions Llc

Bought by

Shogbuyi Taofiq Olayinka

Current Estimated Value

Purchase Details

Closed on

Aug 17, 2020

Sold by

Nr Deed Llc

Bought by

Jd Solution Llc

Purchase Details

Closed on

Jan 10, 2019

Sold by

County Of Cook

Bought by

Nr Deed Llc

Purchase Details

Closed on

Jul 10, 2006

Sold by

Whitehorn Shirino

Bought by

Motley Shannon

Purchase Details

Closed on

Feb 16, 2004

Sold by

Whitehorn Barbara

Bought by

Whitehorn Barbara and Whitehorn Shirino

Purchase Details

Closed on

Oct 3, 1997

Sold by

Cole Taylor Bank

Bought by

Whitehorn Barbara

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$50,150

Interest Rate

11.74%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Shogbuyi Taofiq Olayinka | -- | None Listed On Document | |

| Jd Solution Llc | $28,000 | Greater Illinois Title Co | |

| Nr Deed Llc | -- | None Available | |

| Motley Shannon | -- | None Available | |

| Whitehorn Barbara | -- | -- | |

| Whitehorn Barbara | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Whitehorn Barbara | $50,150 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,055 | $10,401 | $2,288 | $8,113 |

| 2023 | $1,028 | $5,001 | $3,813 | $1,188 |

| 2022 | $1,028 | $5,001 | $3,813 | $1,188 |

| 2021 | $1,005 | $4,999 | $3,812 | $1,187 |

| 2020 | $1,851 | $11,412 | $2,745 | $8,667 |

| 2019 | $1,859 | $12,680 | $2,745 | $9,935 |

| 2018 | $1,826 | $12,680 | $2,745 | $9,935 |

| 2017 | $1,549 | $10,569 | $2,440 | $8,129 |

| 2016 | $1,617 | $10,569 | $2,440 | $8,129 |

| 2015 | $1,456 | $10,569 | $2,440 | $8,129 |

| 2014 | $1,445 | $10,359 | $2,135 | $8,224 |

| 2013 | $1,406 | $10,359 | $2,135 | $8,224 |

Source: Public Records

Map

Nearby Homes

- 8055 S Avalon Ave

- 8101 S Kimbark Ave

- 8048 S Avalon Ave

- 8227 S Avalon Ave

- 1129 E 81st St

- 8007 S Avalon Ave

- 1130 E 81st St Unit A

- 8235 S Woodlawn Ave

- 7521 S Kimbark Ave

- 8250 S Kenwood Ave

- 1117 E 82nd Place

- 1059 E 80th St

- 8106 S Dobson Ave

- 8036 S Dobson Ave

- 1133 E 83rd St Unit 177

- 8041 S Blackstone Ave

- 8035 S Blackstone Ave

- 8106 S Harper Ave

- 8138 S Harper Ave

- 8200 S Harper Ave

- 8132 S Avalon Ave

- 8128 S Avalon Ave

- 8142 S Avalon Ave

- 8146 S Avalon Ave

- 8126 S Avalon Ave

- 8148 S Avalon Ave

- 8137 S Woodlawn Ave

- 8133 S Woodlawn Ave

- 8141 S Woodlawn Ave

- 8122 S Avalon Ave

- 8129 S Woodlawn Ave

- 8143 S Woodlawn Ave

- 8147 S Woodlawn Ave

- 8127 S Woodlawn Ave

- 8133 S Avalon Ave

- 8114 S Avalon Ave

- 8149 S Woodlawn Ave

- 8137 S Avalon Ave

- 8139 S Avalon Ave

- 8141 S Avalon Ave