818 Old Oyster Trail Sugar Land, TX 77478

Sugar Land Towne Square NeighborhoodEstimated Value: $735,000 - $797,000

3

Beds

3

Baths

3,418

Sq Ft

$222/Sq Ft

Est. Value

About This Home

This home is located at 818 Old Oyster Trail, Sugar Land, TX 77478 and is currently estimated at $760,469, approximately $222 per square foot. 818 Old Oyster Trail is a home located in Fort Bend County with nearby schools including Highlands Elementary School, Dulles Middle School, and Dulles High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 28, 2020

Sold by

Wagner Randolph and Sheely Sonia M

Bought by

Kennedy Steven and Kennedy Mona

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$402,600

Outstanding Balance

$357,233

Interest Rate

3.6%

Mortgage Type

New Conventional

Estimated Equity

$403,236

Purchase Details

Closed on

Oct 30, 2013

Sold by

Taylor Morrison Of Texas Inc

Bought by

Certel Sombat Christine

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$417,000

Interest Rate

4.37%

Mortgage Type

New Conventional

Purchase Details

Closed on

Oct 30, 2012

Sold by

Ll Enclave Sugar Land Lp

Bought by

Certel Sombat Christine

Purchase Details

Closed on

Aug 31, 2011

Sold by

Amegy Bank National Association

Bought by

Certel Sombat Christine

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Kennedy Steven | -- | Capital Title | |

| Certel Sombat Christine | -- | Advantage Title Of Ft Bend | |

| Certel Sombat Christine | -- | -- | |

| Certel Sombat Christine | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Kennedy Steven | $402,600 | |

| Previous Owner | Certel Sombat Christine | $417,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $12,018 | $744,682 | $352,170 | $392,512 |

| 2024 | $12,018 | $705,740 | $352,170 | $353,570 |

| 2023 | $12,336 | $712,265 | $270,900 | $441,365 |

| 2022 | $12,223 | $654,440 | $270,900 | $383,540 |

| 2021 | $14,434 | $625,270 | $270,900 | $354,370 |

| 2020 | $14,824 | $636,520 | $270,900 | $365,620 |

| 2019 | $15,967 | $660,730 | $270,900 | $389,830 |

| 2018 | $15,788 | $655,750 | $270,900 | $384,850 |

| 2017 | $15,432 | $633,330 | $270,900 | $362,430 |

| 2016 | $15,394 | $631,780 | $270,900 | $360,880 |

| 2015 | $11,660 | $593,970 | $210,000 | $383,970 |

| 2014 | $11,424 | $572,740 | $210,000 | $362,740 |

Source: Public Records

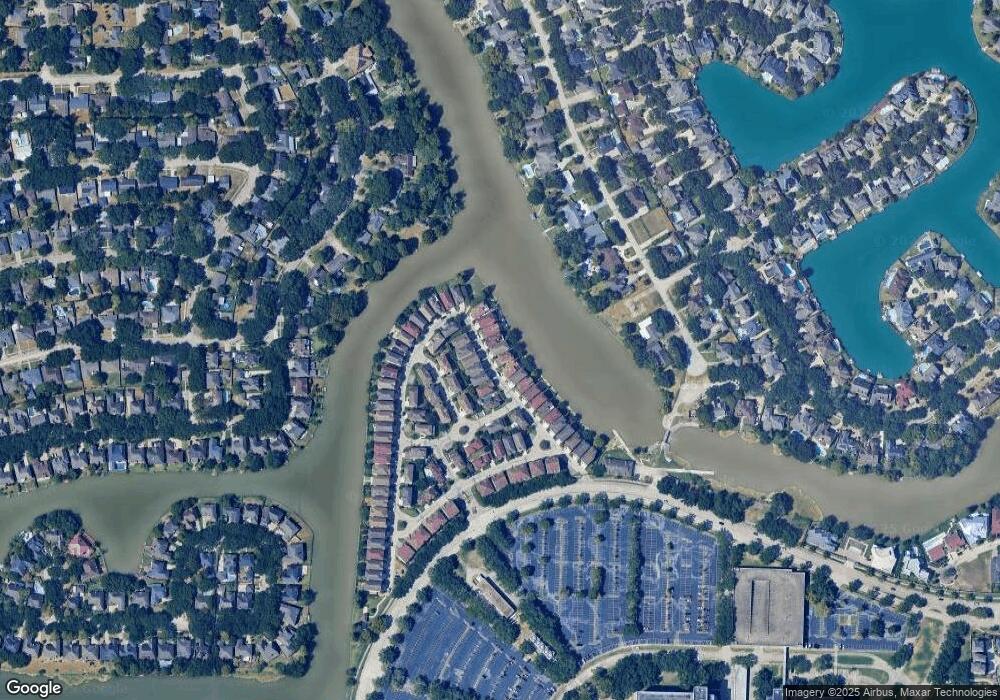

Map

Nearby Homes

- 15903 Court St

- 1015 Old Oyster Trail

- 711 Oyster Creek Dr

- 112 Dogwood St

- 130 S Hall Dr

- 15618 Oyster Cove Dr

- 135 S Hall Dr

- 15611 Oyster Cove Dr

- 15618 Meeting St

- 403 Brook Shore Ct

- 402 Bay Bridge Dr

- 614 Kyle St

- 170 S Hall Dr

- 512 Venice St

- 1139 Lake Pointe Pkwy

- 1131 Lake Pointe Pkwy

- 1135 Lake Pointe Pkwy

- 1206 Lake Pointe Pkwy

- 1007 Oyster Bank Cir

- 423 Brook Shore Ct

- 822 Old Oyster Trail

- 814 Old Oyster Trail

- 826 Old Oyster Trail

- 830 Old Oyster Trail

- 806 Old Oyster Trail

- 823 Old Oyster Trail

- 819 Old Oyster Trail

- 815 Old Oyster Trail

- 827 Old Oyster Trail

- 811 Old Oyster Trail

- 802 Old Oyster Trail

- 834 Old Oyster Trail

- 807 Old Oyster Trail

- 831 Old Oyster Trail

- 15902 Court St

- 734 Old Oyster Trail

- 803 Old Oyster Trail

- 909 Amelia St

- 905 Amelia St

- 901 Amelia St