819 Meadowood Blvd Madison, OH 44057

Estimated Value: $314,000 - $359,000

4

Beds

3

Baths

2,794

Sq Ft

$118/Sq Ft

Est. Value

About This Home

This home is located at 819 Meadowood Blvd, Madison, OH 44057 and is currently estimated at $330,550, approximately $118 per square foot. 819 Meadowood Blvd is a home located in Lake County with nearby schools including South Elementary School, Madison Middle School, and Madison High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 4, 2010

Sold by

Brawn Todd E and Brawn Karen L

Bought by

Vanpelt Laura J

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$154,969

Outstanding Balance

$108,455

Interest Rate

5.5%

Mortgage Type

FHA

Estimated Equity

$222,095

Purchase Details

Closed on

Sep 11, 2001

Sold by

Mead Marijane Trustee

Bought by

Brawn Todd E and Brawn Karen L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$151,235

Interest Rate

7.06%

Mortgage Type

FHA

Purchase Details

Closed on

Jun 28, 1993

Bought by

Mead Marijane Trustee

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Vanpelt Laura J | $159,000 | None Available | |

| Brawn Todd E | $169,000 | Enterprise Title Agency Inc | |

| Mead Marijane Trustee | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Vanpelt Laura J | $154,969 | |

| Previous Owner | Brawn Todd E | $151,235 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | -- | $96,020 | $18,210 | $77,810 |

| 2023 | $7,993 | $77,640 | $15,250 | $62,390 |

| 2022 | $4,434 | $77,640 | $15,250 | $62,390 |

| 2021 | $4,420 | $77,640 | $15,250 | $62,390 |

| 2020 | $4,177 | $64,700 | $12,710 | $51,990 |

| 2019 | $4,181 | $64,700 | $12,710 | $51,990 |

| 2018 | $4,149 | $47,980 | $8,470 | $39,510 |

| 2017 | $3,189 | $47,980 | $8,470 | $39,510 |

| 2016 | $2,940 | $47,980 | $8,470 | $39,510 |

| 2015 | $2,696 | $47,980 | $8,470 | $39,510 |

| 2014 | $2,761 | $47,980 | $8,470 | $39,510 |

| 2013 | $2,585 | $47,980 | $8,470 | $39,510 |

Source: Public Records

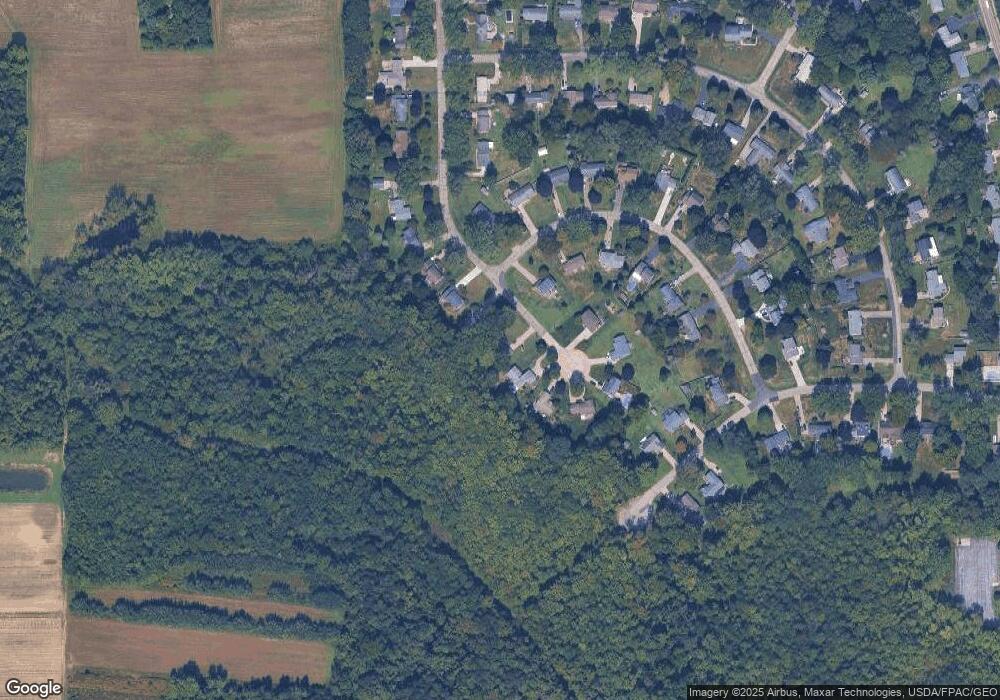

Map

Nearby Homes

- 224 Square Dr

- 12 Square Circle Dr

- 943 N Lake St

- 425 N Lake St

- 268 N Lake St

- 249 W Main St

- 6 E Main St

- 0 Norwood Dr Unit 5101897

- 3174 Bates Rd

- 533 E Main St

- 197 Parkway Blvd

- 2665 Stoneyridge Dr

- 227 W Parkway Dr

- 2656 Lake Breeze Dr

- 0 N Ridge (Us Rt 20) Rd Unit 4151016

- 321 Parkway Blvd

- 2631 Stoneyridge Dr

- 5734 Middle Ridge Rd

- 0 Bates Rd

- 561 Oak Hollow Dr

- 815 Meadowood Blvd

- 833 Meadowood Blvd

- 849 Meadowood Blvd

- 811 Meadowood Blvd

- 249 Willowbend Dr

- 812 Meadowood Blvd

- 863 Meadowood Blvd

- 807 Meadowood Blvd

- 237 Willowbend Dr

- 804 Meadowood Blvd

- 808 Meadowood Blvd

- 880 Meadowood Blvd

- 881 Meadowood Blvd

- 223 Willowbend Dr

- 244 Willowbend Dr

- 183 Willowbend Dr

- 122 Deerfield Dr

- 165 Willowbend Dr

- 901 Meadowood Blvd

- 120 Deerfield Dr