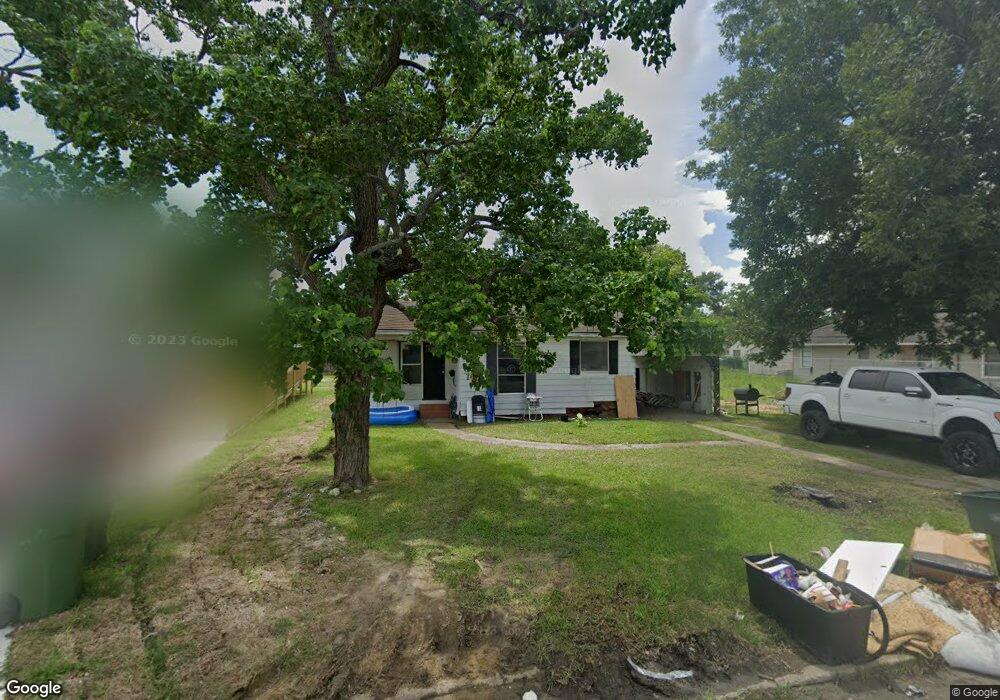

833 Rio Grande Ave Port Arthur, TX 77642

Estimated Value: $70,000 - $78,449

--

Bed

--

Bath

915

Sq Ft

$81/Sq Ft

Est. Value

About This Home

This home is located at 833 Rio Grande Ave, Port Arthur, TX 77642 and is currently estimated at $73,862, approximately $80 per square foot. 833 Rio Grande Ave is a home located in Jefferson County with nearby schools including Lakeview Elementary School, Jefferson Middle School, and Memorial High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 31, 2022

Sold by

219 Marshall Llc

Bought by

Pasadena Addition

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$46,499

Interest Rate

4.67%

Mortgage Type

Seller Take Back

Purchase Details

Closed on

Apr 1, 2022

Sold by

219 Marshall Llc

Bought by

Pasadena Addition

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$46,499

Interest Rate

4.67%

Mortgage Type

Seller Take Back

Purchase Details

Closed on

Dec 1, 2020

Sold by

Williams Louis and Jefferson County

Bought by

210 Marshall Llc

Purchase Details

Closed on

Mar 2, 2004

Sold by

Robinson Charles Theodore and Robinson Richard

Bought by

Williams Louis and Williams Edna W

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Pasadena Addition | -- | None Listed On Document | |

| Pasadena Addition | -- | None Listed On Document | |

| Guzman Johany Stephanie Ra | -- | None Listed On Document | |

| 210 Marshall Llc | $20,814 | None Available | |

| Williams Louis | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Guzman Johany Stephanie Ra | $46,499 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,947 | $59,426 | $6,750 | $52,676 |

| 2024 | $1,947 | $67,974 | $2,425 | $65,549 |

| 2023 | $1,947 | $67,974 | $2,425 | $65,549 |

| 2022 | $1,564 | $49,246 | $2,425 | $46,821 |

| 2021 | $1,341 | $40,467 | $2,425 | $38,042 |

| 2020 | $792 | $24,442 | $2,425 | $22,017 |

| 2019 | $662 | $20,780 | $2,430 | $18,350 |

| 2018 | $662 | $20,780 | $2,430 | $18,350 |

| 2017 | $644 | $20,780 | $2,430 | $18,350 |

| 2016 | $609 | $20,780 | $2,430 | $18,350 |

| 2015 | $620 | $20,780 | $2,430 | $18,350 |

| 2014 | $620 | $20,780 | $2,430 | $18,350 |

Source: Public Records

Map

Nearby Homes

- 1349 Jefferson Dr

- 4600 Lakeshore Dr

- 0 5th St

- 3945 12th St

- 4015 Lakeshore Dr

- 4100 Dryden Rd

- 2129 Neches Ave

- 3737 Lakeshore Dr

- 2515 Glenwood Dr

- 3512 7th St

- 1529 Main Ave

- 6121 13th St

- 248 Avant Ln

- 300 Dodge Place

- 3401 6th St

- 2434 Crescent Dr

- LOT 55 Royal Meadows Estate

- 2621 Evergreen Dr

- 3326 Thomas Blvd

- 000 16th St

- 839 Rio Grande Ave

- 829 Rio Grande Ave

- 849 Rio Grande Ave

- 849 Rio Grande Ave Unit 1

- 819 Rio Grande Ave

- 830 Pecos Ave

- 834 Pecos Ave

- 820 Pecos Ave

- 813 Rio Grande Ave

- 819 Stadium Rd

- 848 Pecos Ave

- 818 Pecos Ave

- 827 Stadium Rd

- 841 Stadium Rd

- 805 Rio Grande Ave

- 901 Rio Grande Ave

- 812 Pecos Ave

- 849 Stadium Rd

- 801 Rio Grande Ave

- 806 Pecos Ave