8407 Sandestine Ct Houston, TX 77095

Copper Lakes NeighborhoodEstimated Value: $374,000 - $452,000

4

Beds

3

Baths

2,540

Sq Ft

$157/Sq Ft

Est. Value

About This Home

This home is located at 8407 Sandestine Ct, Houston, TX 77095 and is currently estimated at $399,524, approximately $157 per square foot. 8407 Sandestine Ct is a home located in Harris County with nearby schools including Copeland Elementary School, Aragon Middle School, and Langham Creek High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 3, 2015

Sold by

Sullivan James D O and Sullivan Kathleen A O

Bought by

Curiel Jose Luis

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$190,920

Interest Rate

3.9%

Mortgage Type

New Conventional

Purchase Details

Closed on

Dec 12, 2008

Sold by

Degges Chadwick and Degges Jennifer

Bought by

Osullivan James D and Osullivan Kathleen A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$182,700

Interest Rate

6.19%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Nov 21, 1997

Sold by

Weekley Homes Lp

Bought by

Degges Chadwick and Degges Jennifer

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$122,300

Interest Rate

7.23%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Curiel Jose Luis | -- | None Available | |

| Osullivan James D | -- | First American Title | |

| Degges Chadwick | -- | Priority Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | Curiel Jose Luis | $190,920 | |

| Previous Owner | Osullivan James D | $182,700 | |

| Previous Owner | Degges Chadwick | $122,300 | |

| Closed | Degges Chadwick | $13,900 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,582 | $379,458 | $77,036 | $302,422 |

| 2024 | $5,582 | $365,537 | $77,036 | $288,501 |

| 2023 | $5,582 | $403,770 | $77,036 | $326,734 |

| 2022 | $7,312 | $344,902 | $55,074 | $289,828 |

| 2021 | $7,045 | $275,884 | $55,074 | $220,810 |

| 2020 | $7,061 | $266,512 | $42,234 | $224,278 |

| 2019 | $7,278 | $266,512 | $42,234 | $224,278 |

| 2018 | $2,635 | $260,016 | $42,234 | $217,782 |

| 2017 | $7,219 | $260,016 | $42,234 | $217,782 |

| 2016 | $7,219 | $260,016 | $42,234 | $217,782 |

| 2015 | $4,830 | $246,891 | $42,234 | $204,657 |

| 2014 | $4,830 | $224,641 | $42,234 | $182,407 |

Source: Public Records

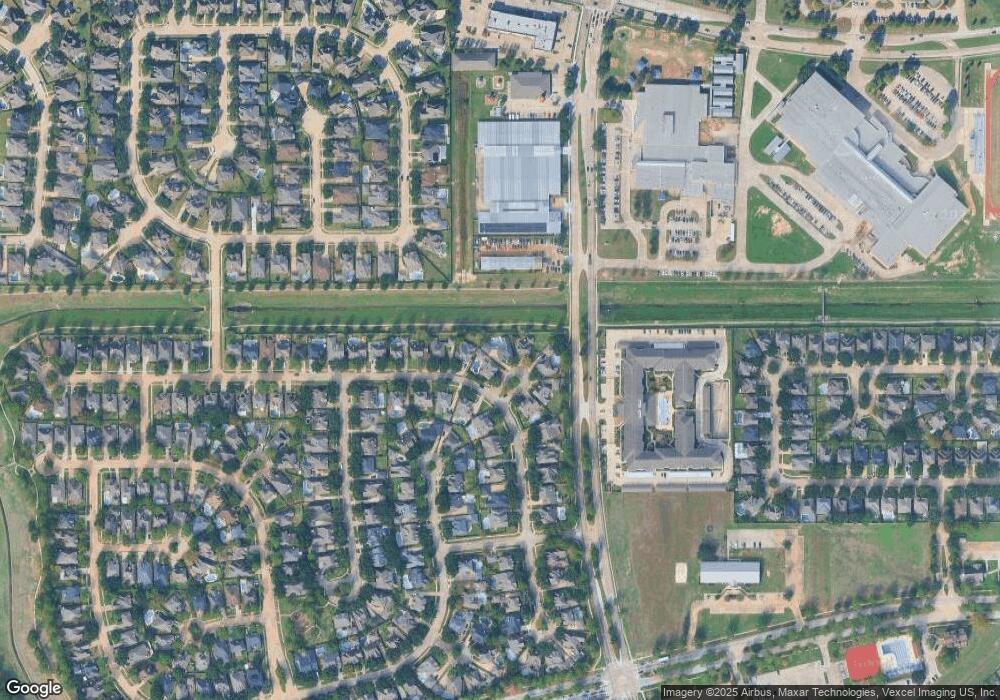

Map

Nearby Homes

- 8411 Sandestine Ct

- 8410 Castle Pond Ct

- 17215 Shallow Lake Ln

- 8711 Preston Field Ln

- 8902 Lilac Springs

- 16514 Innisbrook Dr

- 16606 Stoneside Dr

- 8519 Sunrise Meadow Ln

- 17414 Jade Ridge Ln

- 8803 Emerald Shore Ct

- 8855 Distant Woods Dr

- 8507 Forest Arbor Ct

- 17310 Crescent Canyon Dr

- 17514 Raven Canyon Ln

- 16827 Newlight Bend Dr

- 9023 Cobble Falls Ct

- 8823 Hollow Banks Ln

- 16611 Gentle Stone Dr

- 17531 Cypress Laurel St

- 16535 Oat Mill Dr

- 8403 Sandestine Ct

- 16926 Sandestine Dr

- 8410 Sandestine Ct

- 16930 Sandestine Dr

- 8406 Sandestine Ct

- 16927 Sandestine Dr

- 8402 Sandestine Ct

- 16931 Sandestine Dr

- 16923 Sandestine Dr

- 16934 Sandestine Dr

- 16935 Sandestine Dr

- 16918 Sandestine Dr

- 16919 Sandestine Dr

- 17002 Sandestine Dr

- 16903 Cross Springs Dr

- 17103 Kendall Ridge Ln

- 8502 River Cliff Ln

- 16914 Sandestine Dr

- 16911 Cross Springs Dr

- 17006 Sandestine Dr