901 Foxboro Dr Norwalk, CT 06851

Cranbury NeighborhoodEstimated Value: $580,000 - $658,000

2

Beds

3

Baths

1,304

Sq Ft

$463/Sq Ft

Est. Value

About This Home

This home is located at 901 Foxboro Dr, Norwalk, CT 06851 and is currently estimated at $603,359, approximately $462 per square foot. 901 Foxboro Dr is a home located in Fairfield County with nearby schools including Cranbury Elementary School, West Rocks Middle School, and Norwalk High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 23, 2007

Sold by

Kingsley Thomas S and Kingsley Dawn S

Bought by

May Katherine L

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$172,000

Interest Rate

6.54%

Purchase Details

Closed on

Jul 27, 2000

Sold by

Tischio Patricia

Bought by

Kingsley Thomas and Kingsley Dawn

Purchase Details

Closed on

Aug 14, 1996

Sold by

Gasche Charles J

Bought by

Tischio Patricia

Purchase Details

Closed on

Oct 31, 1995

Sold by

Awerbuch Alison

Bought by

Gasche Charles J

Purchase Details

Closed on

Dec 1, 1989

Sold by

Baker Firestone Ltd

Bought by

Awerbuch Alison

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| May Katherine L | $507,000 | -- | |

| May Katherine L | $507,000 | -- | |

| Kingsley Thomas | $301,000 | -- | |

| Kingsley Thomas | $301,000 | -- | |

| Tischio Patricia | $210,254 | -- | |

| Tischio Patricia | $210,254 | -- | |

| Gasche Charles J | $210,000 | -- | |

| Gasche Charles J | $210,000 | -- | |

| Awerbuch Alison | $209,400 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Awerbuch Alison | $150,000 | |

| Closed | Awerbuch Alison | $172,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $8,423 | $354,790 | $0 | $354,790 |

| 2024 | $8,293 | $354,790 | $0 | $354,790 |

| 2023 | $7,362 | $294,890 | $0 | $294,890 |

| 2022 | $7,247 | $294,890 | $0 | $294,890 |

| 2021 | $6,166 | $294,890 | $0 | $294,890 |

| 2020 | $6,961 | $294,890 | $0 | $294,890 |

| 2019 | $6,873 | $294,890 | $0 | $294,890 |

| 2018 | $7,017 | $270,610 | $0 | $270,610 |

| 2017 | $6,772 | $270,610 | $0 | $270,610 |

| 2016 | $6,884 | $270,610 | $0 | $270,610 |

| 2015 | $6,183 | $270,610 | $0 | $270,610 |

| 2014 | $6,776 | $270,610 | $0 | $270,610 |

Source: Public Records

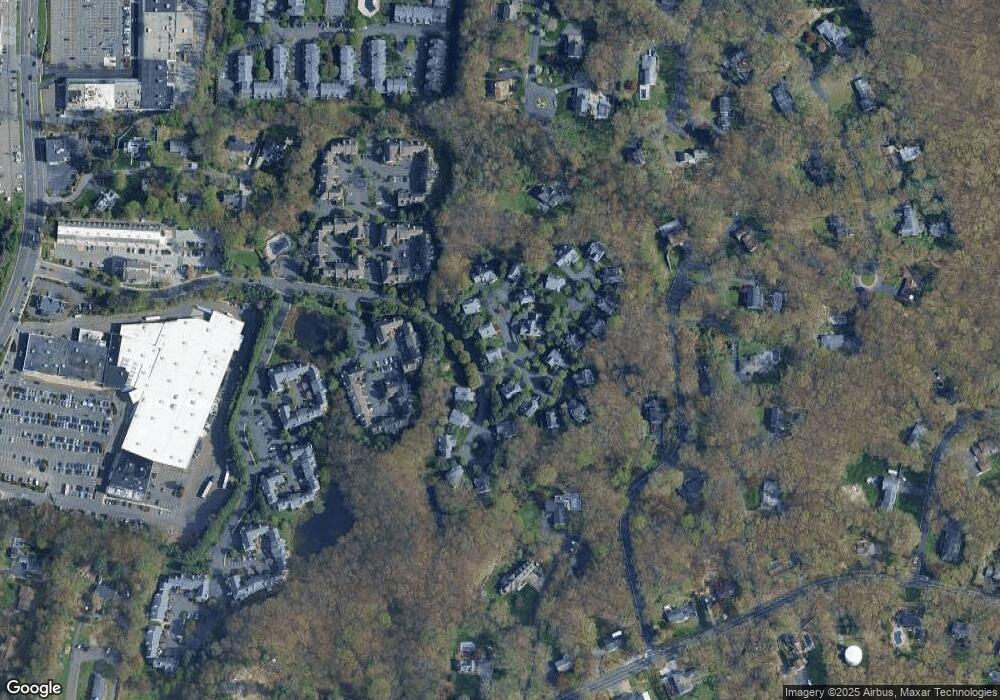

Map

Nearby Homes

- 510 Foxboro Dr

- 123 Old Belden Hill Rd Unit 40

- 28 Village Ct

- 515 Belden Hill Rd

- 29 Grumman Ave

- 442 Main Ave Unit A5

- 105 Danbury Rd

- 35 Mohawk Dr

- 41 Mohawk Dr

- 36 Donohue Dr

- 180 E Rocks Rd

- 6 Tulip Tree Ln

- 8 Caddy Rd

- 27 Stonecrop Rd

- 32 Thistle Rd

- 101 Chestnut Hill Rd

- 8 Stonecrop Rd

- 10 Wilton Hunt Rd

- 2 Wildgoose Ln

- 332 Belden Hill Rd

- 914 Foxboro Dr

- 913 Foxboro Dr

- 912 Foxboro Dr

- 911 Foxboro Dr

- 910 Foxboro Dr

- 909 Foxboro Dr

- 908 Foxboro Dr

- 907 Foxboro Dr

- 906 Foxboro Dr

- 905 Foxboro Dr

- 902 Foxboro Dr

- 914 Foxboro Dr Unit 914

- 911 Foxboro Dr Unit 911

- 910 Foxboro Dr Unit 910

- 913 Foxboro Dr Unit 913

- 10 Heathcote Rd

- 818 Foxboro Dr

- 817 Foxboro Dr

- 816 Foxboro Dr

- 815 Foxboro Dr