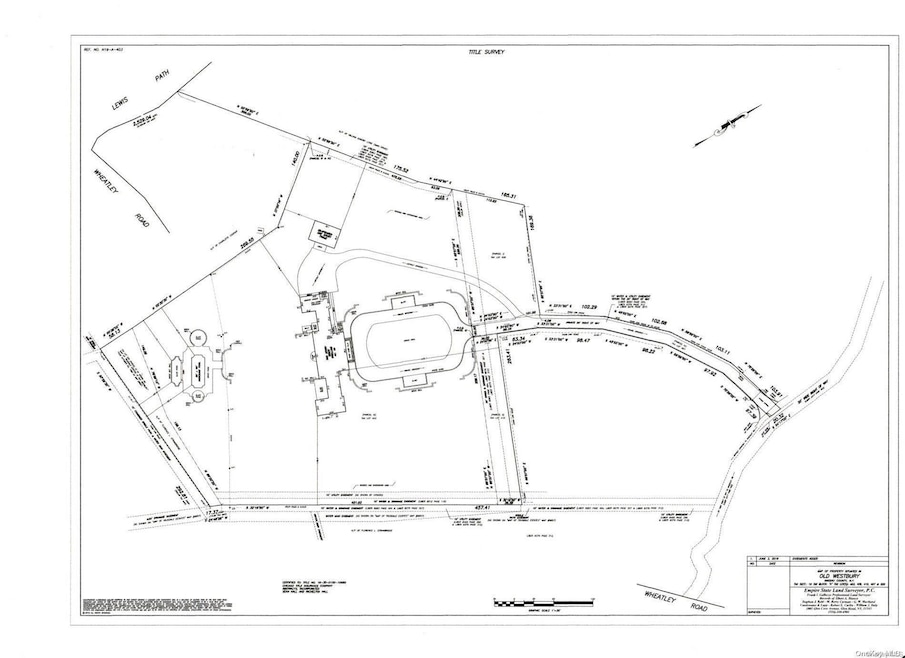

98 Wheatley Rd Old Westbury, NY 11568

Old Westbury NeighborhoodEstimated payment $19,574/month

Highlights

- 5.07 Acre Lot

- Wooded Lot

- Level Lot

- Jericho Middle School Rated A+

About This Lot

Old Westbury. Jericho SD. Build Your Dream Home on this Private & Flat 5+ Acre Parcel Set on a Quiet Private Road of 7 Homes. Set Approx 1/4 Mile back off of Wheatley Rd, This Serene Property Provides the Discerning Buyer a Chance to Build Their Dream Home. Close to Glen Oaks Country Club & Old Westbury Golf & CC. Easy & Close Access to All Major Highways & Parkways.

Listing Agent

Automatic Real Estate Assoc Brokerage Phone: 516-626-4444 License #31BE1078705 Listed on: 10/20/2024

Property Details

Property Type

- Land

Est. Annual Taxes

- $30,299

Lot Details

- 5.07 Acre Lot

- Level Lot

- Wooded Lot

Schools

- Jericho Middle School

- Jericho Senior High School

Utilities

- Cesspool

Listing and Financial Details

- Legal Lot and Block 403 / A

- Assessor Parcel Number 2231-19-A-00-0403-0

Map

Home Values in the Area

Average Home Value in this Area

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,668 | $1,570 | $1,569 | $1 |

| 2024 | $2,668 | $1,482 | $1,482 | $0 |

| 2023 | $33,631 | $1,754 | $1,754 | $0 |

| 2022 | $33,631 | $1,754 | $1,754 | $0 |

| 2021 | $33,712 | $6,059 | $1,754 | $4,305 |

| 2020 | $118,438 | $8,968 | $3,286 | $5,682 |

| 2019 | $110,655 | $8,968 | $3,286 | $5,682 |

| 2018 | $105,031 | $8,968 | $0 | $0 |

| 2017 | $83,302 | $8,968 | $3,005 | $5,963 |

| 2016 | $94,744 | $9,495 | $2,821 | $6,674 |

| 2015 | $12,442 | $9,805 | $2,672 | $7,133 |

| 2014 | $12,442 | $9,805 | $2,672 | $7,133 |

| 2013 | $13,358 | $11,060 | $3,014 | $8,046 |

Property History

| Date | Event | Price | Change | Sq Ft Price |

|---|---|---|---|---|

| 06/12/2025 06/12/25 | For Sale | $3,200,000 | 0.0% | -- |

| 06/02/2025 06/02/25 | Off Market | $3,200,000 | -- | -- |

| 12/05/2024 12/05/24 | Off Market | $3,200,000 | -- | -- |

| 12/03/2024 12/03/24 | For Sale | $3,200,000 | 0.0% | -- |

| 10/20/2024 10/20/24 | For Sale | $3,200,000 | 0.0% | -- |

| 09/19/2024 09/19/24 | Pending | -- | -- | -- |

| 06/02/2024 06/02/24 | For Sale | $3,200,000 | -- | -- |

Purchase History

| Date | Type | Sale Price | Title Company |

|---|---|---|---|

| Bargain Sale Deed | $3,000,000 | Abstracts Incorporated | |

| Deed | -- | American Title Insurance | |

| Deed | -- | American Title Insurance | |

| Deed | -- | -- | |

| Interfamily Deed Transfer | -- | -- | |

| Interfamily Deed Transfer | -- | -- |

Source: OneKey® MLS

MLS Number: L3555857

APN: 2231-19-A-00-0403-0

- 87 Wheatley Rd

- 0 Wheatley Rd Unit 11509872

- 22 Wren Dr

- 200 Hummingbird Dr

- 203 Store Hill Rd

- 20 Waldo Ave

- 300 Locust Ln

- 15 Parkway Dr

- 29 Locust St

- 27 Circle Dr

- 333 Warner Ave Unit 206

- 333 Warner Ave Unit 312

- 333 Warner Ave Unit 215

- 333 Warner Ave Unit 304

- 333 Warner Ave Unit 301

- 333 Warner Ave Unit 414

- 2 John St

- 300 Main St

- 65 Oriole Way

- 1433 Old Northern Blvd