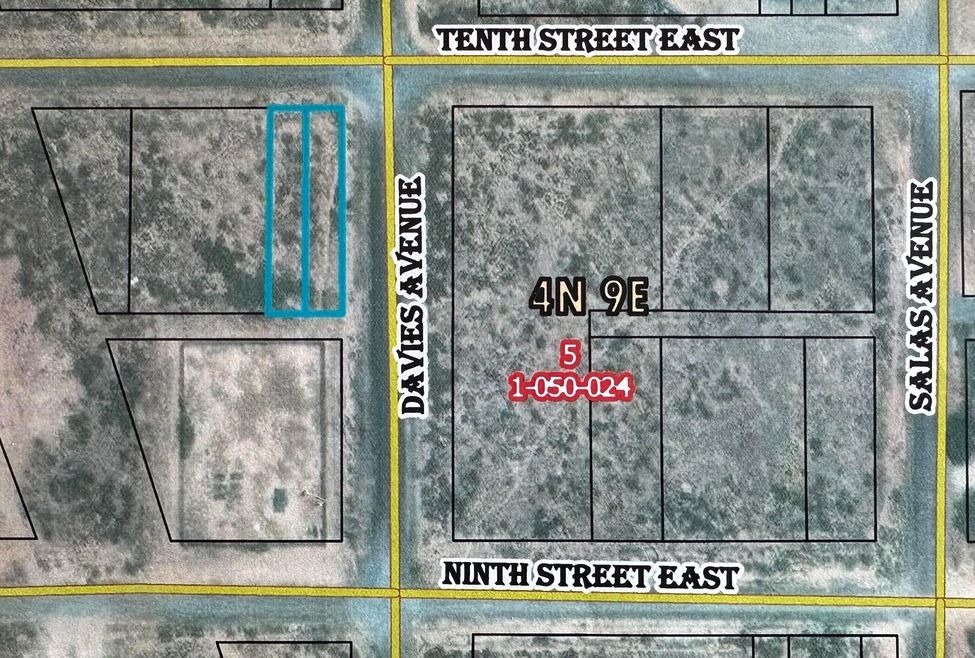

0 10th St Davies Ave Unit 1086723 Willard, NM 87063

Estimated payment $53/month

Total Views

970

0.17

Acre

$58,824

Price per Acre

7,419

Sq Ft Lot

About This Lot

Two adjacent vacant lots are sold together in the village of Willard, NM. One of the lots is a corner lot. Both lots are located on paved roads. The total size of the property being sold is 0.17 acre. It is nice flat land. It is suitable for a manufactured home. The lots can be connected to the village's water and sewer systems. No HOA. Electricity and natural gas are available in the area. Easy access to Highway 60 and Highway 41.The listing broker is the co-owner of the lots.

Property Details

Property Type

- Land

Est. Annual Taxes

- $5

Lot Details

- 7,419 Sq Ft Lot

- Level Lot

- 2 Lots in the community

- Zoning described as RR

Schools

- Estancia Elementary And Middle School

- Estancia High School

Community Details

- Willard Kelly Subdivision

Listing and Financial Details

- Legal Lot and Block 1 and 2 / 6

- Assessor Parcel Number 1050024061070000000

Map

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $5 | $53 | $53 | $0 |

| 2023 | $5 | $53 | $53 | $0 |

| 2022 | $1 | $53 | $53 | $0 |

| 2021 | $1 | $53 | $53 | $0 |

| 2020 | $1 | $53 | $53 | $0 |

| 2019 | $1 | $52 | $52 | $0 |

| 2018 | $1 | $52 | $52 | $0 |

| 2017 | $0 | $52 | $0 | $0 |

| 2016 | $0 | $0 | $0 | $0 |

| 2015 | -- | $0 | $0 | $0 |

| 2014 | -- | $47 | $47 | $0 |

Source: Public Records

Property History

| Date | Event | Price | List to Sale | Price per Sq Ft |

|---|---|---|---|---|

| 06/26/2025 06/26/25 | For Sale | $10,000 | -- | -- |

Source: Southwest MLS (Greater Albuquerque Association of REALTORS®)

Source: Southwest MLS (Greater Albuquerque Association of REALTORS®)

MLS Number: 1086723

APN: R000035201

Nearby Homes

- 0 9th 10th 11th Streets Unit 1078508

- Lot: 1-3 Block 15

- Lot: 13-14 Block 14

- Lot: 17-18 Block 8

- Lot: 1-4 Block 8

- Lot: 3-6 Block 12

- 810 Dunlavy Ave

- Lot: 1-2 Block 14

- Lot: 3 Block 3

- 0 10th St

- Lot: 15-18 Block 11

- Lot: 1 Block 11

- Lot: 7-8 Block 14

- 0 County Road B 038

- 211 State Highway 41

- Lot: 1-12 Block 28

- 11 S Akin Farm Rd

- 155 New Mexico 542

- SW4SE4 S Langley Rd

- Langley Langley Tract 2 40acre