0 Road 22 Unit 701735 Dolores, CO 81323

Estimated Value: $405,217 - $500,000

2

Beds

2

Baths

1,192

Sq Ft

$382/Sq Ft

Est. Value

About This Home

This home is located at 0 Road 22 Unit 701735, Dolores, CO 81323 and is currently estimated at $455,304, approximately $381 per square foot. 0 Road 22 Unit 701735 is a home located in Montezuma County with nearby schools including Montezuma-Cortez High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 26, 2021

Sold by

Gima Michael D and Estate Of Michael David Gima

Bought by

Heath William Reginald and Heath Crystal Ann

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$314,153

Outstanding Balance

$281,616

Interest Rate

2.7%

Mortgage Type

FHA

Estimated Equity

$173,688

Purchase Details

Closed on

Jun 11, 2019

Sold by

Gima Michael D and Fisher Dorothy Helen

Bought by

Gima Michael D

Purchase Details

Closed on

Jan 31, 2017

Sold by

Feela David and Smith Pam

Bought by

Gima Michael D

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$210,000

Interest Rate

4.16%

Mortgage Type

USDA

Purchase Details

Closed on

Dec 28, 2007

Sold by

Gaines Terry A and Gaines Eve

Bought by

Feela David and Smith Pam

Purchase Details

Closed on

Nov 15, 2002

Sold by

Snyder Richard L and Snyder Barbara A

Bought by

Gaines Terry A and Gaines Eve

Purchase Details

Closed on

Jan 26, 1993

Sold by

Fulks Patricia

Bought by

Snyder Richard L and Snyder Barbara A

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Heath William Reginald | $325,000 | None Available | |

| Gima Michael D | -- | None Available | |

| Gima Michael D | $216,000 | Colorado Title & Closing Svc | |

| Feela David | -- | Colorado Land Title Co | |

| Gaines Terry A | $160,000 | -- | |

| Snyder Richard L | $42,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Heath William Reginald | $314,153 | |

| Previous Owner | Gima Michael D | $210,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $779 | $16,791 | $5,051 | $11,740 |

| 2023 | $779 | $21,169 | $6,368 | $14,801 |

| 2022 | $620 | $14,341 | $4,378 | $9,963 |

| 2021 | $630 | $14,341 | $4,378 | $9,963 |

| 2020 | $543 | $12,883 | $3,467 | $9,416 |

| 2019 | $543 | $12,883 | $3,467 | $9,416 |

| 2018 | $618 | $12,630 | $3,140 | $9,490 |

| 2017 | $591 | $12,630 | $3,140 | $9,490 |

| 2016 | $560 | $12,100 | $3,470 | $8,630 |

| 2015 | $555 | $176,220 | $0 | $0 |

| 2014 | $542 | $12,100 | $0 | $0 |

Source: Public Records

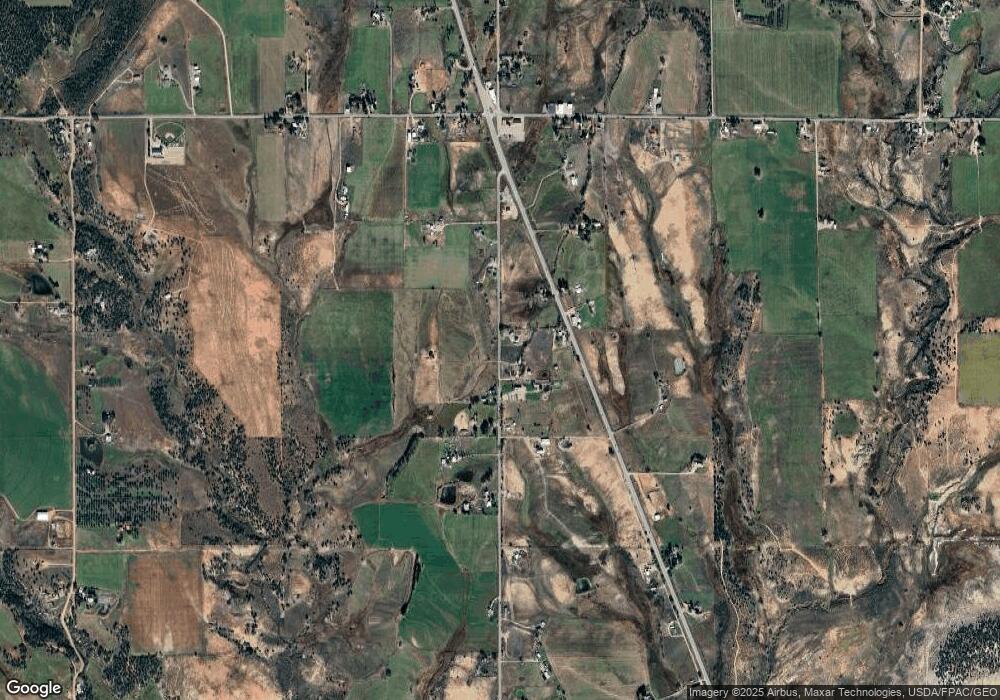

Map

Nearby Homes

- 15248 Road 22

- 16931 Highway 491

- 17001 Highway 491

- 13723 Road 23

- 17455 Hwy 491

- TBD Road 20

- 16513 Road 20

- 16390 Road 20

- 10681

- 17241 Road 24

- 12281 County Road 22

- 12665 Road 23

- 22259 County Road U 1

- 24764 Road S 85

- 0 Tbd Road 22 6 Lot 10 Unit 829159

- 0 Tbd Road 22 6 Lot 7 Unit 829157

- 0 Tbd Road 22 6 Lot 8 Unit 829156

- 12336 Road 23 25 Loop

- 12158 County Road 22

- 14075 Road 25

- 0 Road 22 Unit 753349

- 0 Road 22 Unit 744970

- 0 Road 22 Unit 650669

- 0 Road 22 Unit 731235

- 0 Road 22 Unit 621608

- 0 Road 22 Unit 650668

- 0 Road 22 Unit 654810

- 0 Road 22 Unit 663594

- 0 Road 22 Unit 672886

- 0 Road 22 Unit 696068

- 15505 Road 22

- 15557 Highway 491

- 15454 Road 22

- 15606 Highway 491

- 15660 Highway 491

- 15827 Road 22

- 15380 Road 22

- 15829 Road 22

- 15247 Road 22

- 15290 Highway 491