1 Swarthmore Rd Somers Point, NJ 08244

Estimated Value: $338,893 - $414,000

--

Bed

--

Bath

1,583

Sq Ft

$244/Sq Ft

Est. Value

About This Home

This home is located at 1 Swarthmore Rd, Somers Point, NJ 08244 and is currently estimated at $386,223, approximately $243 per square foot. 1 Swarthmore Rd is a home located in Atlantic County with nearby schools including Mainland Regional High School, ChARTer TECH High School for the Performing Arts, and Gospel of Grace Christian School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 30, 2002

Sold by

Settles Stephen J and Settles Sandra L

Bought by

Lanzetta Robyn A and Meade Christopher

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$132,905

Outstanding Balance

$55,750

Interest Rate

6.04%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$330,473

Purchase Details

Closed on

Oct 24, 2002

Sold by

Nassau Viking Associates

Bought by

420 Investors Inc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$132,905

Outstanding Balance

$55,750

Interest Rate

6.04%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$330,473

Purchase Details

Closed on

Sep 4, 1990

Sold by

Delgiudice Virgina P

Bought by

Martina Leanne E

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Lanzetta Robyn A | $139,900 | -- | |

| 420 Investors Inc | $75,000 | The Title Company Of Jersey | |

| Martina Leanne E | $116,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Lanzetta Robyn A | $132,905 | |

| Closed | 420 Investors Inc | $90,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,952 | $194,400 | $68,300 | $126,100 |

| 2024 | $6,952 | $194,400 | $68,300 | $126,100 |

| 2023 | $6,495 | $194,400 | $68,300 | $126,100 |

| 2022 | $6,495 | $194,400 | $68,300 | $126,100 |

| 2021 | $6,398 | $194,400 | $68,300 | $126,100 |

| 2020 | $6,267 | $194,400 | $68,300 | $126,100 |

| 2019 | $6,091 | $194,400 | $68,300 | $126,100 |

| 2018 | $6,063 | $197,700 | $68,300 | $129,400 |

| 2017 | $5,846 | $197,700 | $68,300 | $129,400 |

| 2016 | $5,581 | $197,700 | $68,300 | $129,400 |

| 2015 | $5,524 | $197,700 | $68,300 | $129,400 |

| 2014 | $5,338 | $197,700 | $68,300 | $129,400 |

Source: Public Records

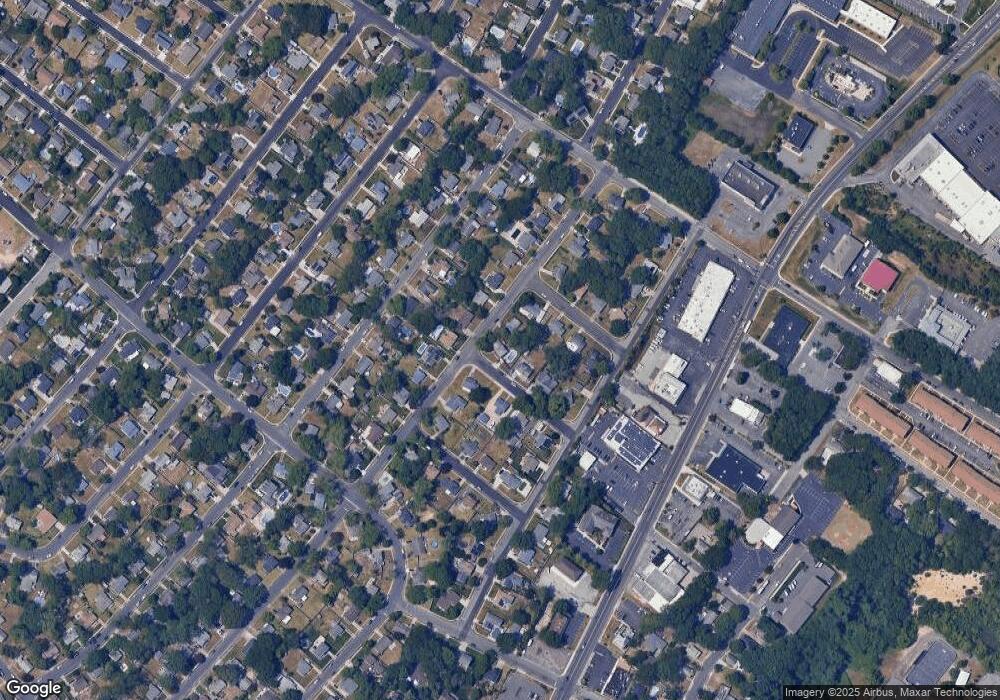

Map

Nearby Homes

- 1009 Massachusetts Ave

- 426 7th St

- 101 Haddon Rd

- 715 Massachusetts Ave

- 7 Nassau Rd

- 604 9th St

- 12 Cornell Rd

- 6 Colgate Rd

- 901 W New York Ave

- 15 Yale Blvd

- 36 Lehigh Dr

- 14 Edgewood Dr

- 120 Jordan Rd

- 192 Exton Rd

- 710 W New York Ave

- 7 Wilson Ave

- 32 Bucknell Rd

- 226 Bethel Rd

- 303 Garden Terrace

- 1105 Jesse Dr