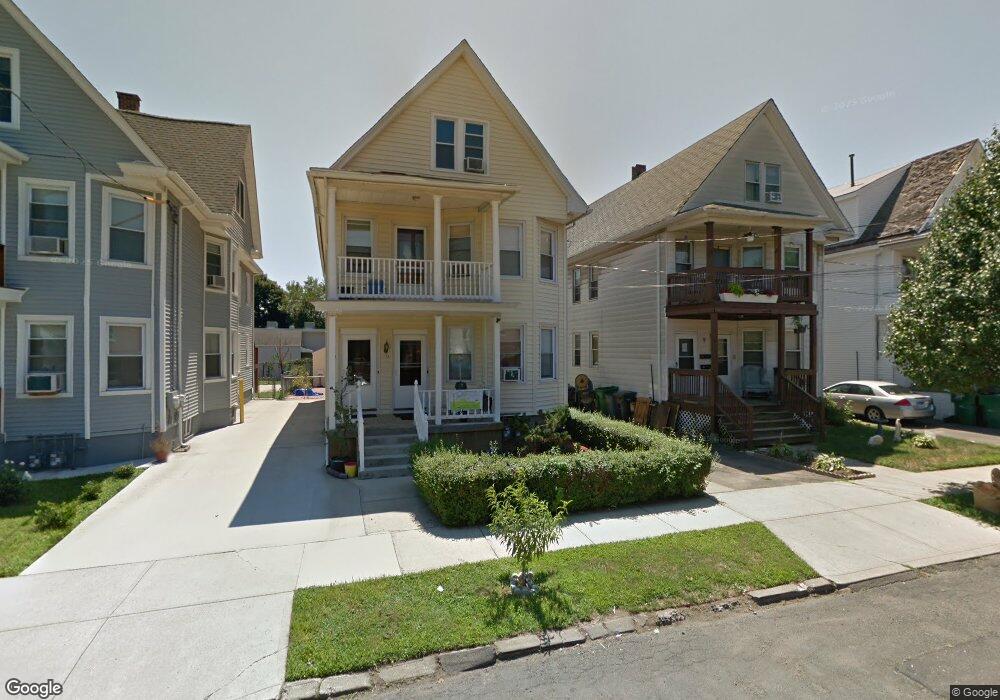

10 Alling St West Haven, CT 06516

Allingtown NeighborhoodEstimated Value: $438,072 - $507,000

4

Beds

2

Baths

2,859

Sq Ft

$165/Sq Ft

Est. Value

About This Home

This home is located at 10 Alling St, West Haven, CT 06516 and is currently estimated at $470,518, approximately $164 per square foot. 10 Alling St is a home located in New Haven County with nearby schools including Carrigan 5/6 Intermediate School, Harry M. Bailey Middle School, and West Haven High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 18, 2018

Sold by

Bueno-Perez Jose M and Montiel Maria G

Bought by

Carias-Salazar Odsman

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$260,200

Outstanding Balance

$224,041

Interest Rate

4.4%

Mortgage Type

FHA

Estimated Equity

$246,477

Purchase Details

Closed on

Jan 13, 2005

Sold by

Mangione Paul

Bought by

Bueno-Perez Jose M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$210,400

Interest Rate

5.81%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Apr 4, 2003

Sold by

Mazzara Josephine

Bought by

Mangione Paw

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Carias-Salazar Odsman | $265,000 | -- | |

| Carias-Salazar Odsman | $265,000 | -- | |

| Bueno-Perez Jose M | $217,000 | -- | |

| Bueno-Perez Jose M | $217,000 | -- | |

| Mangione Paw | $87,000 | -- | |

| Mangione Paw | $87,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Mangione Paw | $260,200 | |

| Closed | Mangione Paw | $260,200 | |

| Previous Owner | Mangione Paw | $210,400 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $9,366 | $271,250 | $58,520 | $212,730 |

| 2024 | $8,854 | $182,490 | $40,530 | $141,960 |

| 2023 | $8,488 | $182,490 | $40,530 | $141,960 |

| 2022 | $8,322 | $182,490 | $40,530 | $141,960 |

| 2021 | $8,322 | $182,490 | $40,530 | $141,960 |

| 2020 | $7,461 | $147,840 | $32,620 | $115,220 |

| 2019 | $7,195 | $147,840 | $32,620 | $115,220 |

| 2018 | $7,133 | $147,840 | $32,620 | $115,220 |

| 2017 | $6,750 | $147,840 | $32,620 | $115,220 |

| 2016 | $6,736 | $147,840 | $32,620 | $115,220 |

| 2015 | $6,327 | $156,800 | $36,330 | $120,470 |

| 2014 | $6,288 | $156,800 | $36,330 | $120,470 |

Source: Public Records

Map

Nearby Homes

- 897 1st Ave

- 155 Lamson St

- 57 Alling Street Extension

- 93 Spring St

- 43 Clifton St

- 14 Homestead Ave

- 104 Terrace Ave

- 14 Ely St

- 22 Thill St

- 161 W Spring St Unit B2

- 81 Homeside Ave

- 170 Wood St

- 49 Glade St Unit A4

- 38 Chauncey St

- 677 Washington Ave

- 194 Homeside Ave

- 524 1st Ave

- 47,47R,63,65R Coleman St

- 70 Coleman St

- 194 Ella T Grasso Blvd