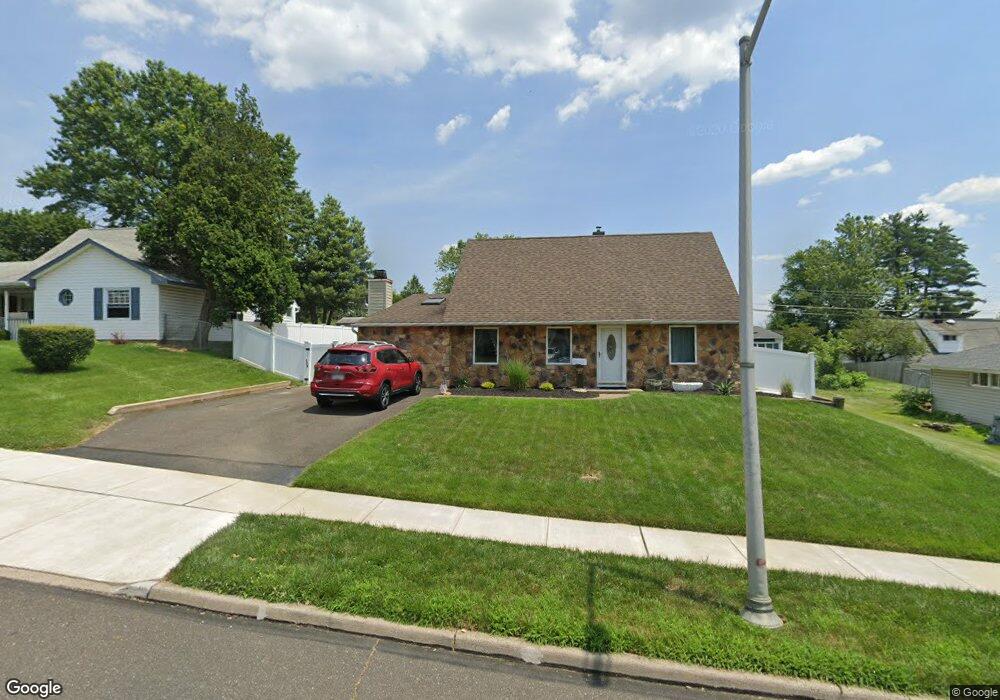

10 Cactus Rd Levittown, PA 19057

Estimated Value: $393,000 - $421,000

3

Beds

2

Baths

1,572

Sq Ft

$260/Sq Ft

Est. Value

About This Home

This home is located at 10 Cactus Rd, Levittown, PA 19057 and is currently estimated at $408,318, approximately $259 per square foot. 10 Cactus Rd is a home located in Bucks County with nearby schools including Walter Miller Elementary School, Sandburg Middle School, and Neshaminy High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 7, 2000

Sold by

Armstrong James David

Bought by

Armstrong James David and Armstrong Maria G

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$112,000

Interest Rate

7.45%

Purchase Details

Closed on

Nov 30, 1994

Sold by

Pasawicz Eric and Pasawicz Karen P

Bought by

Armstrong James David

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$105,210

Interest Rate

9%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Armstrong James David | -- | Old Republic Natl Title Ins | |

| Armstrong James David | $116,900 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | Armstrong James David | $112,000 | |

| Closed | Armstrong James David | $105,210 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,378 | $20,110 | $3,920 | $16,190 |

| 2024 | $4,378 | $20,110 | $3,920 | $16,190 |

| 2023 | $4,309 | $20,110 | $3,920 | $16,190 |

| 2022 | $4,195 | $20,110 | $3,920 | $16,190 |

| 2021 | $4,195 | $20,110 | $3,920 | $16,190 |

| 2020 | $4,145 | $20,110 | $3,920 | $16,190 |

| 2019 | $4,053 | $20,110 | $3,920 | $16,190 |

| 2018 | $3,978 | $20,110 | $3,920 | $16,190 |

| 2017 | $3,877 | $20,110 | $3,920 | $16,190 |

| 2016 | $3,877 | $20,110 | $3,920 | $16,190 |

| 2015 | $4,066 | $20,110 | $3,920 | $16,190 |

| 2014 | $4,066 | $20,110 | $3,920 | $16,190 |

Source: Public Records

Map

Nearby Homes

- 90 Cobalt Ridge Dr E Unit E

- 56 Indian Red Rd

- 24 Rose Apple Rd

- 122 Ivy Hill Rd

- 18 Jump Hill Rd

- 14 Iris Rd

- 5 June Rd

- 45 Indian Creek Entry

- 29 Spindletree Rd

- 541 Stanford Rd

- 49 Ice Pond Rd

- 169 Forsythia Dr N

- 137 Idlewild Rd

- L235.17 Edgely Rd

- 27 Spicebush Rd

- 48 Gridiron Rd

- 12 Geranium Rd

- 56 Goldenridge Dr

- 50 Red Cedar Dr

- 43 Petunia Rd

Your Personal Tour Guide

Ask me questions while you tour the home.