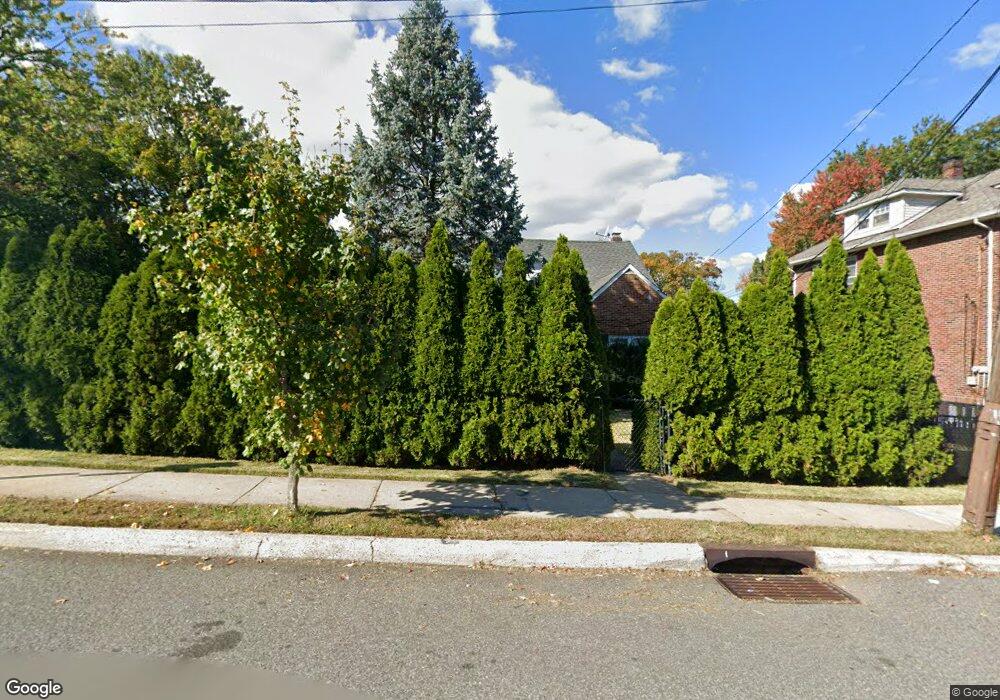

10 Clair St Clifton, NJ 07013

Athenia NeighborhoodEstimated Value: $697,964 - $819,000

5

Beds

3

Baths

2,072

Sq Ft

$364/Sq Ft

Est. Value

About This Home

This home is located at 10 Clair St, Clifton, NJ 07013 and is currently estimated at $754,241, approximately $364 per square foot. 10 Clair St is a home located in Passaic County with nearby schools including Clifton High School, St Andrew Elementary School, and New Hope School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 20, 2018

Sold by

Kaczynska Zofia

Bought by

Ramos Antonio Cano and Canada-Gonzalez Concepcion

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$530,219

Outstanding Balance

$473,452

Interest Rate

5.5%

Mortgage Type

FHA

Estimated Equity

$280,789

Purchase Details

Closed on

Apr 5, 2000

Sold by

Belak Bertha

Bought by

Kaczynski Mieczyslaw and Kaczynska Zofia

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$208,000

Interest Rate

7.25%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Ramos Antonio Cano | $540,000 | Elite Title Group Llc | |

| Kaczynski Mieczyslaw | $260,000 | Chicago Title Insurance Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Ramos Antonio Cano | $530,219 | |

| Previous Owner | Kaczynski Mieczyslaw | $208,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $13,635 | $229,700 | $103,500 | $126,200 |

| 2024 | $13,309 | $229,700 | $103,500 | $126,200 |

| 2022 | $13,116 | $229,700 | $103,500 | $126,200 |

| 2021 | $12,576 | $229,700 | $103,500 | $126,200 |

| 2020 | $12,617 | $229,700 | $103,500 | $126,200 |

| 2019 | $12,064 | $221,200 | $103,500 | $117,700 |

| 2018 | $11,996 | $221,200 | $103,500 | $117,700 |

| 2017 | $11,865 | $221,200 | $103,500 | $117,700 |

| 2016 | $11,635 | $221,200 | $103,500 | $117,700 |

| 2015 | $11,522 | $221,200 | $103,500 | $117,700 |

| 2014 | $11,286 | $221,200 | $103,500 | $117,700 |

Source: Public Records

Map

Nearby Homes

- 124 Thanksgiving Ln

- 54 Village Rd

- 82 van Breeman Dr

- 83 Larkspur Ln

- 69 Larkspur Ln

- 16 Marie Place

- 375 Colfax Ave

- 678 Broad St Unit A003

- 678 Broad St Unit A3

- 32 Greendale Rd

- 7 Barrister St Unit 170

- 159 George Russell Way Unit 311

- 23 Devonshire Dr Unit 118

- 23 Devonshire Dr

- 11 Greendale Rd

- 148 Urma Ave

- 176 Winchester Ct

- 1110 Wickham Terrace

- 405 Clifton Blvd

- 6102 Harcourt Rd Unit 519