10 Dunbarton Ct Highlands Ranch, CO 80130

Eastridge NeighborhoodEstimated Value: $697,443 - $923,000

3

Beds

2

Baths

1,727

Sq Ft

$461/Sq Ft

Est. Value

About This Home

This home is located at 10 Dunbarton Ct, Highlands Ranch, CO 80130 and is currently estimated at $796,861, approximately $461 per square foot. 10 Dunbarton Ct is a home located in Douglas County with nearby schools including Fox Creek Elementary School, Cresthill Middle School, and Highlands Ranch High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 21, 2019

Sold by

The Delbert L And Billie G Meek Revocabl

Bought by

Connie L Stradtman Trust

Current Estimated Value

Purchase Details

Closed on

Jun 29, 2007

Sold by

Meek Delbert L and Meek Billie G

Bought by

Meek Delbert L and Meek Billie G

Purchase Details

Closed on

May 29, 2007

Sold by

Meek Billie G

Bought by

Meek Delbert L and Meek Billie G

Purchase Details

Closed on

Jul 16, 2001

Sold by

Beech Charles R and Beech Mary C

Bought by

Meek Billie G

Purchase Details

Closed on

Sep 18, 1989

Sold by

Shanahan William E and Shanahan Dorothy A

Bought by

Beech Charles R and Beech Mary C

Purchase Details

Closed on

Aug 28, 1987

Sold by

Biagiotti Stephen F and Biagiotti Sandra A

Bought by

Shanahan William E and Shanahan Dorothy A

Purchase Details

Closed on

May 21, 1986

Sold by

Mission Viejo Co

Bought by

Biagiotti Stephen F and Biagiotti Sandra A

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Connie L Stradtman Trust | -- | None Available | |

| Meek Delbert L | -- | None Available | |

| Meek Delbert L | -- | None Available | |

| Meek Billie G | $375,000 | First American Heritage Titl | |

| Beech Charles R | $175,000 | -- | |

| Shanahan William E | $185,000 | -- | |

| Biagiotti Stephen F | $177,000 | -- |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $4,463 | $51,040 | $13,340 | $37,700 |

| 2023 | $4,455 | $51,040 | $13,340 | $37,700 |

| 2022 | $3,363 | $36,810 | $9,130 | $27,680 |

| 2021 | $3,498 | $36,810 | $9,130 | $27,680 |

| 2020 | $3,517 | $37,920 | $9,020 | $28,900 |

| 2019 | $3,530 | $37,920 | $9,020 | $28,900 |

| 2018 | $2,665 | $35,410 | $7,910 | $27,500 |

| 2017 | $2,427 | $35,410 | $7,910 | $27,500 |

| 2016 | $2,102 | $31,930 | $7,220 | $24,710 |

| 2015 | $2,147 | $31,930 | $7,220 | $24,710 |

| 2014 | $1,868 | $27,230 | $7,470 | $19,760 |

Source: Public Records

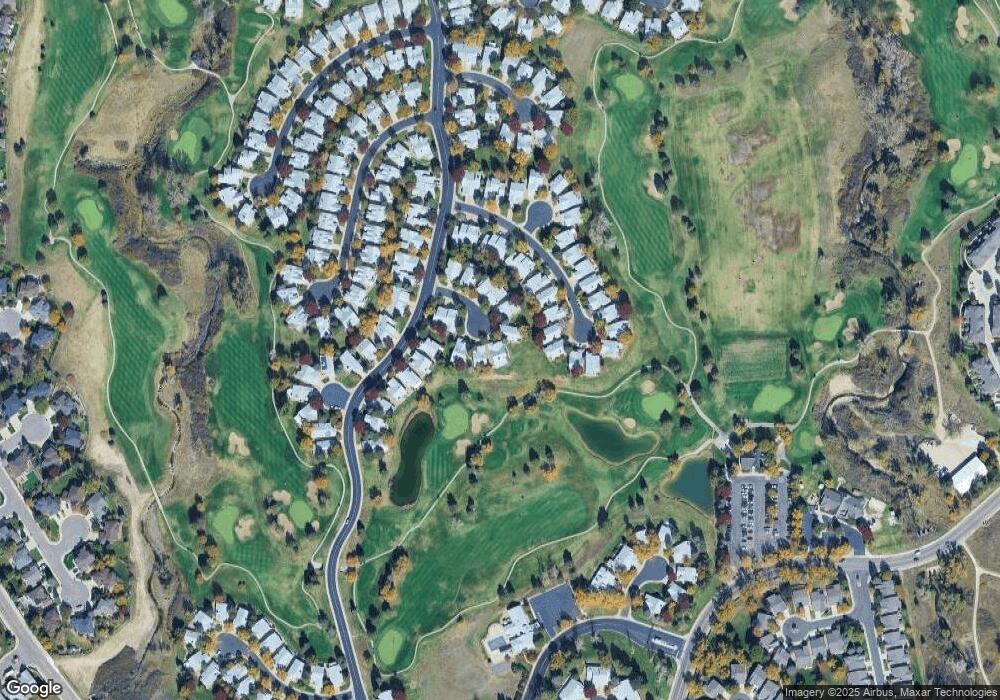

Map

Nearby Homes

- 41 Canongate Ln

- 14 Stonehaven Ct

- 6 Abernathy Ct

- 5126 Tuscany Ct

- 6418 Silver Mesa Dr Unit C

- 6428 Silver Mesa Dr Unit C

- 6404 Silver Mesa Dr Unit E

- 6434 Silver Mesa Dr Unit C

- 102 Canongate Ln

- 8766 Cresthill Ln

- 6444 Silver Mesa Dr Unit A

- 4927 Greenwich Way

- 8951 Greenwich St

- 9224 Weeping Willow Place

- 8611 Gold Peak Dr Unit D

- 8643 Gold Peak Dr Unit E

- 8734 Pochard St

- 8617 Gold Peak Dr Unit G

- 9222 Buttonhill Ct

- 8547 Gold Peak Dr Unit G

- 8 Dunbarton Ct

- 12 Dunbarton Ct

- 6 Dunbarton Ct

- 9 Dunbarton Ct

- 4 Dunbarton Ct

- 28 Sutherland Ct

- 7 Dunbarton Ct

- 30 Sutherland Ct

- 26 Sutherland Ct

- 36 Canongate Ln

- 5 Dunbarton Ct

- 2 Dunbarton Ct

- 24 Sutherland Ct

- 32 Sutherland Ct

- 34 Canongate Ln

- 22 Sutherland Ct

- 3 Dunbarton Ct

- 20 Sutherland Ct

- 16 Sutherland Ct

- 1 Dunbarton Ct