Estimated Value: $374,325 - $407,000

2

Beds

2

Baths

1,527

Sq Ft

$258/Sq Ft

Est. Value

About This Home

This home is located at 10 Fieldstone Ln, Avon, CT 06001 and is currently estimated at $394,081, approximately $258 per square foot. 10 Fieldstone Ln is a home located in Hartford County with nearby schools including Thompson Brook School, Pine Grove School, and Avon Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 29, 2014

Sold by

Weil David and Woods Kathleen D

Bought by

Scott Angela D

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$176,000

Outstanding Balance

$57,040

Interest Rate

4.18%

Estimated Equity

$337,041

Purchase Details

Closed on

Jan 3, 2012

Sold by

Weil David and Woods Kathleen D

Bought by

Weil David and Woods Kathleen D

Purchase Details

Closed on

Feb 2, 2009

Sold by

Woods Kathleen D

Bought by

Weil David

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$355,000

Interest Rate

5.28%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Scott Angela D | $220,000 | -- | |

| Scott Angela D | $220,000 | -- | |

| Scott Angela D | $220,000 | -- | |

| Weil David | -- | -- | |

| Weil David | -- | -- | |

| Weil David | $51,000 | -- | |

| Weil David | $51,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Scott Angela D | $176,000 | |

| Closed | Scott Angela D | $176,000 | |

| Previous Owner | Weil David | $355,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,644 | $216,070 | $0 | $216,070 |

| 2024 | $6,409 | $216,070 | $0 | $216,070 |

| 2023 | $5,264 | $148,730 | $0 | $148,730 |

| 2022 | $5,148 | $148,730 | $0 | $148,730 |

| 2021 | $5,088 | $148,730 | $0 | $148,730 |

| 2020 | $4,893 | $148,730 | $0 | $148,730 |

| 2019 | $4,893 | $148,730 | $0 | $148,730 |

| 2018 | $4,311 | $137,500 | $0 | $137,500 |

| 2017 | $4,206 | $137,500 | $0 | $137,500 |

| 2016 | $4,059 | $137,500 | $0 | $137,500 |

| 2015 | $3,960 | $137,500 | $0 | $137,500 |

| 2014 | $3,814 | $134,680 | $0 | $134,680 |

Source: Public Records

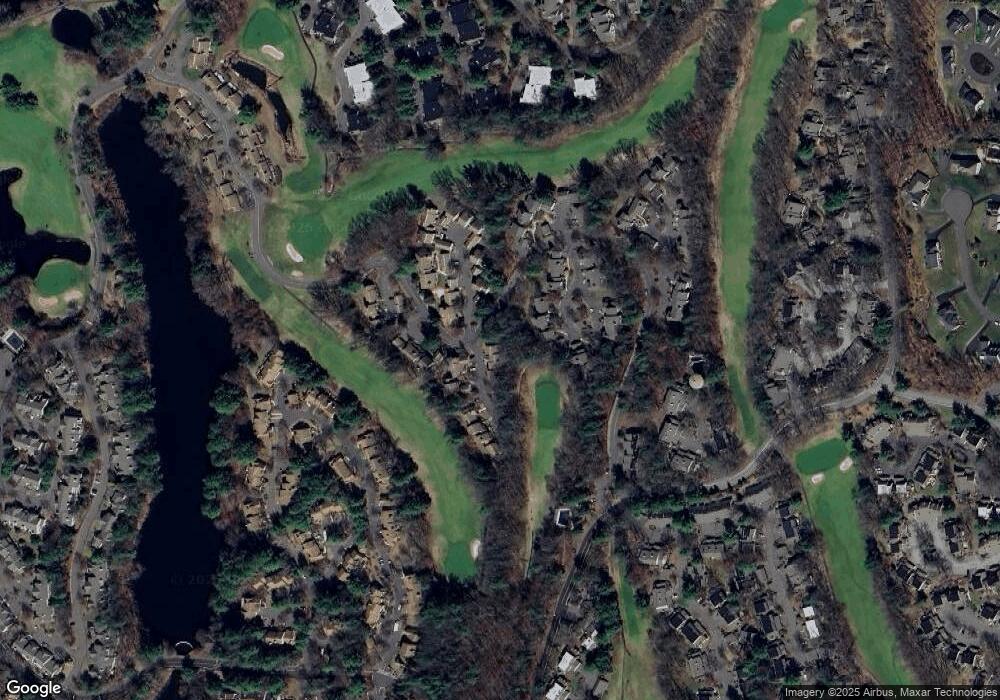

Map

Nearby Homes

- 4 Strathmore Ln Unit 4

- 15 Greenwich Ln Unit 15

- 67 Byron Dr

- 9 Maple Ln Unit 9

- 7 Chestnut Dr

- 39 Heritage Dr Unit 39

- 29 Crocus Ln

- 40 Homestead Ln

- 94 Perry St

- 32 Canterbury Ln

- 39 High Ridge Hollow

- 373 Collinsville Rd

- 50 Northwoods Rd

- 148 River Rd

- 4 Tanglewood Dr

- 5 Crosswood Rd

- 55 Depot Place

- 8919 Taine Mountain Rd

- 189 W Avon Rd

- 185 W Avon Rd

- 10 Fieldstone Ln

- 10 Fieldstone Ln Unit 92C

- 10 Fieldstone Ln Unit 10

- 9 Fieldstone Ln

- 8 Fieldstone Ln

- 7 Fieldstone Ln

- 1 Fieldstone Ln

- 1 Fieldstone Ln Unit 285-1

- 2 Fieldstone Ln

- 2 Fieldstone Ln Unit 2

- 10 Crossroads Ln

- 10 Crossroads Ln Unit 10

- 9 Crossroads Ln

- 9 Crossroads Ln Unit 9

- 13 Sweetbriar Ln

- 1 Sweetbriar Ln

- 1 Sweetbriar Ln

- 1 Sweetbriar Ln Unit 1

- 2 Sweetbriar Ln

- 2 Sweetbriar Ln Unit 2