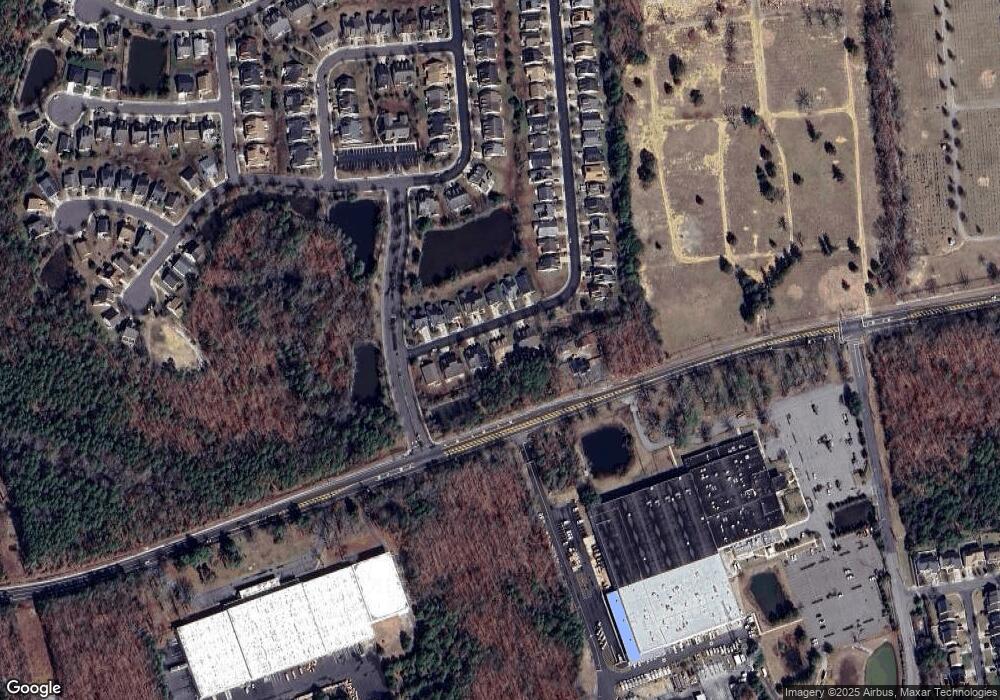

10 Gasko Rd Mays Landing, NJ 08330

Estimated Value: $317,993 - $359,000

2

Beds

2

Baths

1,668

Sq Ft

$200/Sq Ft

Est. Value

About This Home

This home is located at 10 Gasko Rd, Mays Landing, NJ 08330 and is currently estimated at $333,998, approximately $200 per square foot. 10 Gasko Rd is a home located in Atlantic County with nearby schools including George L. Hess Educational Complex, Joseph Shaner School, and William Davies Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 20, 2019

Sold by

Gulian Robert

Bought by

Gulian Ann

Current Estimated Value

Purchase Details

Closed on

Sep 29, 2011

Sold by

Baratta Richard and Baratta Diane P

Bought by

Gulian Robert and Gulian Ann

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$158,166

Outstanding Balance

$107,979

Interest Rate

4.12%

Mortgage Type

FHA

Estimated Equity

$226,019

Purchase Details

Closed on

Jul 12, 2004

Sold by

West Bay Ii Partners Llc

Bought by

Baratta Richard and Baratta Diane P

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$88,850

Interest Rate

6.33%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Gulian Ann | -- | None Available | |

| Gulian Robert | $174,000 | Group 21 Title Agency | |

| Baratta Richard | $178,735 | Surety Title Agency Of Atlan |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Gulian Robert | $158,166 | |

| Previous Owner | Baratta Richard | $88,850 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,431 | $158,300 | $35,200 | $123,100 |

| 2024 | $5,431 | $158,300 | $35,200 | $123,100 |

| 2023 | $5,107 | $158,300 | $35,200 | $123,100 |

| 2022 | $5,107 | $158,300 | $35,200 | $123,100 |

| 2021 | $4,845 | $150,500 | $32,200 | $118,300 |

| 2020 | $4,845 | $150,500 | $32,200 | $118,300 |

| 2019 | $4,857 | $150,500 | $32,200 | $118,300 |

| 2018 | $4,687 | $150,500 | $32,200 | $118,300 |

| 2017 | $4,613 | $150,500 | $32,200 | $118,300 |

| 2016 | $4,483 | $150,500 | $32,200 | $118,300 |

| 2015 | $4,331 | $150,500 | $32,200 | $118,300 |

| 2014 | $4,600 | $175,100 | $47,200 | $127,900 |

Source: Public Records

Map

Nearby Homes

- 112 Giunta Walk

- 109 Deal Ln

- 148 Marucci Place

- 76 Gasko Rd

- 98 Gasko Rd

- 105 Knights Bridge Way

- 1531 Hamilton Ct Unit 231

- 1531 Hamilton Ct

- 1553 John Adams Ct Unit 653

- 1535 Benjamin Franklin Ct

- 1544 Benjamin Franklin Ct

- 1574 John Adams Ct Unit 1574

- 1553 Madison Ct Unit 153

- 1544 Ben Franklin Ct

- 1410 Cantillon Blvd

- 4922 Denbigh Ct

- 4930 Denbigh Ct

- 4944 Flintshire Ct

- 5022 Laydon Ct

- 0 E Black Horse Unit 22520085