10 John Morton Bldg Unit 10 Blackwood, NJ 08012

Washington Township NeighborhoodEstimated Value: $204,826 - $235,000

--

Bed

--

Bath

1,250

Sq Ft

$177/Sq Ft

Est. Value

About This Home

This home is located at 10 John Morton Bldg Unit 10, Blackwood, NJ 08012 and is currently estimated at $221,207, approximately $176 per square foot. 10 John Morton Bldg Unit 10 is a home located in Gloucester County with nearby schools including Washington Township High School, Birches Elementary School, and Bunker Hill Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 10, 2023

Sold by

Reagan Brendan

Bought by

Peterson Andrew E

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$138,800

Outstanding Balance

$136,101

Interest Rate

7.18%

Mortgage Type

New Conventional

Estimated Equity

$85,106

Purchase Details

Closed on

Aug 3, 2022

Sold by

Regan Sharon L

Bought by

Reagan Brendan

Purchase Details

Closed on

Mar 30, 2001

Sold by

King Mary M and Trout Frances King

Bought by

Reagan Sharon L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$47,600

Interest Rate

6.97%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Peterson Andrew E | $173,500 | Simplifile | |

| Reagan Brendan | -- | Alice John A | |

| Reagan Brendan | -- | Alice John A | |

| Reagan Sharon L | $59,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Peterson Andrew E | $138,800 | |

| Previous Owner | Reagan Sharon L | $47,600 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,058 | $109,700 | $35,000 | $74,700 |

| 2024 | $3,944 | $109,700 | $35,000 | $74,700 |

| 2023 | $3,944 | $109,700 | $35,000 | $74,700 |

| 2022 | $3,814 | $109,700 | $35,000 | $74,700 |

| 2021 | $3,766 | $109,700 | $35,000 | $74,700 |

| 2020 | $3,709 | $109,700 | $35,000 | $74,700 |

| 2019 | $3,452 | $94,700 | $25,000 | $69,700 |

| 2018 | $3,413 | $94,700 | $25,000 | $69,700 |

| 2017 | $3,370 | $94,700 | $25,000 | $69,700 |

| 2016 | $2,791 | $78,900 | $25,000 | $53,900 |

| 2015 | $3,502 | $100,400 | $25,000 | $75,400 |

| 2014 | $3,392 | $100,400 | $25,000 | $75,400 |

Source: Public Records

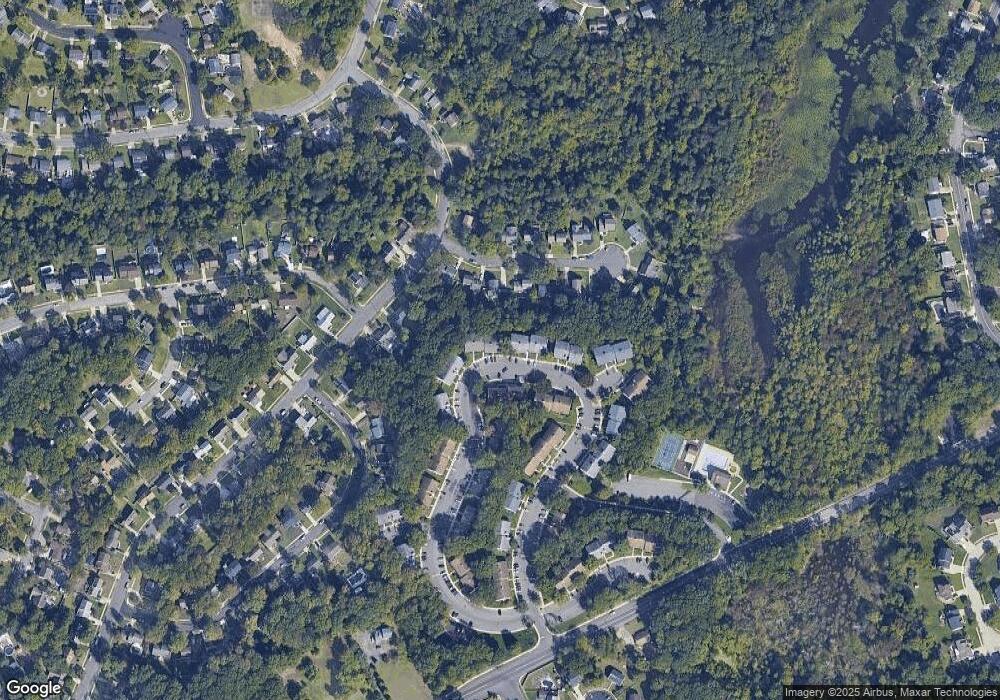

Map

Nearby Homes

- 1 Matthew Thornton Bldg

- 8 John Hancock Bldg Unit 8

- 7 John Hancock Bldg Unit 7

- 9 Samuel Adams Bldg

- 8 Charles Carroll Bldg

- 1755 Congress Dr

- 102 Sherwood Dr

- 14 Benner Rd

- 300 Westminster Blvd

- 371 Wedgewood Dr

- 323 Westminster Blvd

- 18 Brighton Place

- 63 Cranford Rd

- 130 Hurffville Rd

- 13 Camelot Place

- 5 Kent Place

- 10 Birch Grove Ln

- 15 Ipswich Place Unit BUILDING N

- 22 Woodbrook Rd

- 8 Michele Ct

- 8 John Morton Bldg

- 7 John Morton Bldg Unit 7

- 6 John Morton Bldg Unit 6

- 9 John Morton Bldg

- 3 John Morton Building

- 1 John Morton Bldg Unit 1

- 5 Robert Morris Bldg

- 4 Robert Morris Bldg Unit 4

- 2 John Morton Bldg

- 5 John Morton Bldg Unit 5

- 2 Robert Morris Bldg Unit 2

- 3 Robert Morris Bldg

- 4 John Morton Bldg Unit 4

- 1 Robert Morris Bldg Unit 1

- 10 Robert Morris Bldg Unit 10

- 8 Thomas Mckean Bldg Unit 8

- 10 Thomas Mckean Bldg Unit 10

- 7 Thomas McKean Building

- 4 Francis Lee Bldg Unit 4

- 9 Thomas Mckean Bldg Unit 9