10 Marshall St Norwich, NY 13815

Estimated Value: $175,000 - $213,000

4

Beds

3

Baths

1,860

Sq Ft

$107/Sq Ft

Est. Value

About This Home

This home is located at 10 Marshall St, Norwich, NY 13815 and is currently estimated at $199,782, approximately $107 per square foot. 10 Marshall St is a home located in Chenango County with nearby schools including Stanford J. Gibson Primary School, Perry Browne Intermediate School, and Norwich Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 30, 2009

Sold by

Cartus Financial Corporat Ion

Bought by

Crawford Stephen W

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$93,280

Outstanding Balance

$50,433

Interest Rate

4.86%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$149,349

Purchase Details

Closed on

Feb 13, 2009

Sold by

Bigalow-Kern Adrienne

Bought by

Cartus Financial Corp

Purchase Details

Closed on

Jul 3, 2002

Sold by

Setford Troy M and Setford Renee L

Bought by

Kern Stephen J

Purchase Details

Closed on

Apr 30, 1999

Sold by

Feitsma Eileen R

Bought by

Setford Troy M and Setford Renee L

Purchase Details

Closed on

Mar 29, 1999

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Crawford Stephen W | $116,600 | Thomas Emerson | |

| Cartus Financial Corp | $136,500 | Richard Sargent | |

| Kern Stephen J | $107,000 | Thomas C Emerson | |

| Setford Troy M | $88,000 | -- | |

| Setford Troy M | -- | Nelson Esq Ed | |

| -- | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Crawford Stephen W | $93,280 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $6,391 | $87,500 | $6,200 | $81,300 |

| 2023 | $6,260 | $87,500 | $6,200 | $81,300 |

| 2022 | $6,159 | $87,500 | $6,200 | $81,300 |

| 2021 | $6,259 | $87,500 | $6,200 | $81,300 |

| 2020 | $6,080 | $87,500 | $6,200 | $81,300 |

| 2019 | $7,162 | $87,500 | $6,200 | $81,300 |

| 2018 | $7,162 | $87,500 | $6,200 | $81,300 |

| 2017 | $2,220 | $87,500 | $6,200 | $81,300 |

| 2016 | $2,238 | $87,500 | $6,200 | $81,300 |

| 2015 | -- | $87,500 | $6,200 | $81,300 |

| 2014 | -- | $87,500 | $6,200 | $81,300 |

Source: Public Records

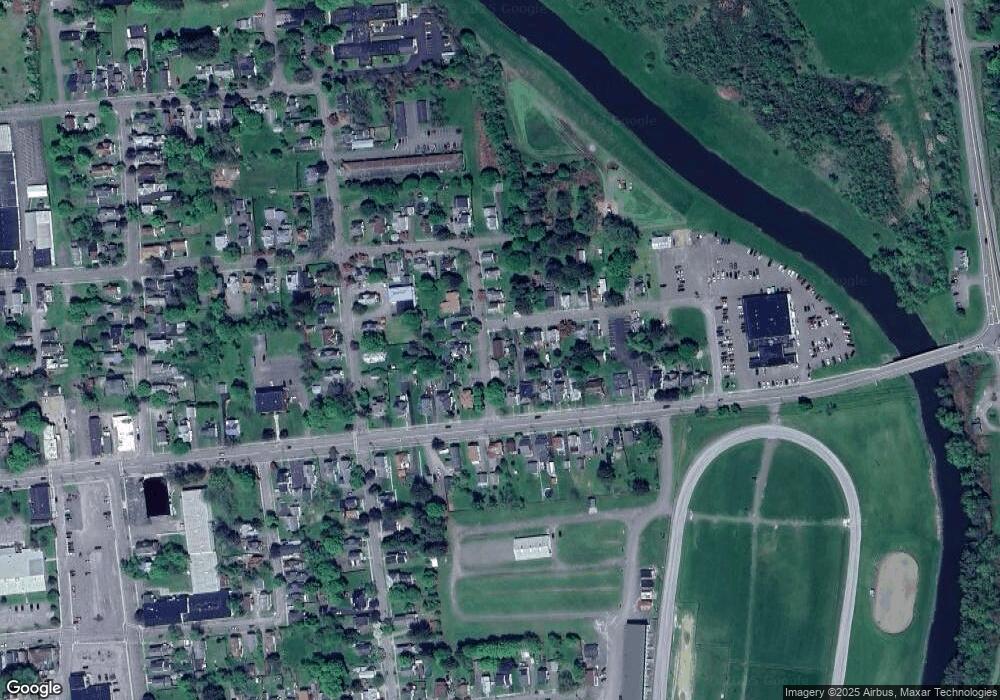

Map

Nearby Homes

- 72 Sheldon St

- L61.12 County Road 32

- 38 Grove Ave

- 37 Gold St

- 7 Sheldon St

- 18 Ross Ave

- 15 Gold St

- 13 Birdsall St

- 29 Birdsall St

- 30 Mitchell St

- 7 Adams St

- 29 Mitchell St

- 52 Front St

- 78-80 Silver St

- 104 Taragreen Ln

- 16 Columbia St

- 40 Brown Ave

- 0 Liberatore Ln Unit R1596265

- 61 S Broad St Unit 63

- 75 S Broad St