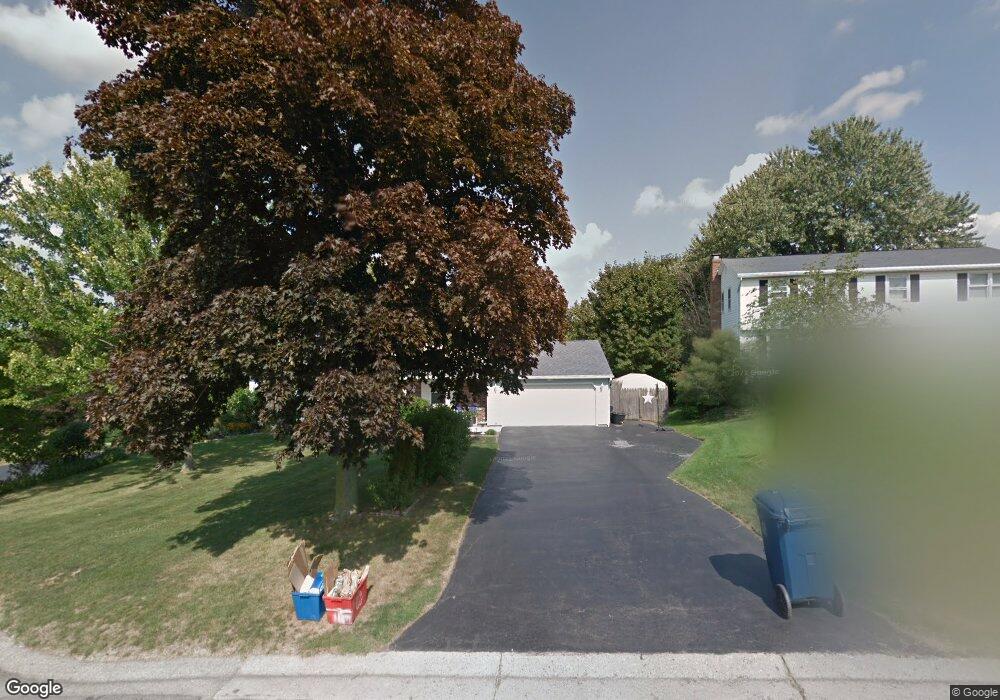

10 Meadow Glen Fairport, NY 14450

Estimated Value: $335,000 - $360,000

3

Beds

2

Baths

1,656

Sq Ft

$213/Sq Ft

Est. Value

About This Home

This home is located at 10 Meadow Glen, Fairport, NY 14450 and is currently estimated at $352,162, approximately $212 per square foot. 10 Meadow Glen is a home located in Monroe County with nearby schools including Brooks Hill School, Martha Brown Middle School, and Minerva Deland School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 20, 2011

Sold by

Toscano Robert J and Toscano Kristi

Bought by

Pedro Michael J and Pedro Meghan L

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$135,150

Outstanding Balance

$93,923

Interest Rate

4.88%

Mortgage Type

New Conventional

Estimated Equity

$258,239

Purchase Details

Closed on

Apr 30, 1999

Sold by

O'Brien Dennis M and O'Brien Monika M

Bought by

Toscano Robert J and Weese Kristi A

Purchase Details

Closed on

Sep 27, 1996

Sold by

Gibbardo Judith

Bought by

O'Brien Dennis M and O'Brien Monika M

Purchase Details

Closed on

Jun 26, 1996

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Pedro Michael J | $159,000 | None Available | |

| Toscano Robert J | $120,500 | -- | |

| Toscano Robert J | -- | Gaesser David A | |

| O'Brien Dennis M | $95,000 | -- | |

| -- | -- | -- | |

| -- | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Pedro Michael J | $135,150 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $6,588 | $177,200 | $44,800 | $132,400 |

| 2023 | $6,274 | $177,200 | $44,800 | $132,400 |

| 2022 | $6,613 | $177,200 | $44,800 | $132,400 |

| 2021 | $6,603 | $177,200 | $44,800 | $132,400 |

| 2020 | $5,773 | $177,200 | $44,800 | $132,400 |

| 2019 | $5,271 | $177,200 | $44,800 | $132,400 |

| 2018 | $5,564 | $177,200 | $44,800 | $132,400 |

| 2017 | $3,219 | $164,100 | $44,800 | $119,300 |

| 2016 | $5,271 | $164,100 | $44,800 | $119,300 |

| 2015 | -- | $164,100 | $44,800 | $119,300 |

| 2014 | -- | $164,100 | $44,800 | $119,300 |

Source: Public Records

Map

Nearby Homes

- 59 Cinnamon Cir

- 29 Treetop Dr

- 26 Hampton Ln

- 48 Dunbridge Heights

- 1 Brandywine Ln

- 12 Falling Brook Rd

- 36 Chardonnay Dr

- 4 Halstead Rise

- 14 Peppermill Dr

- 6 Eagle Hollow

- 18 Eagle Hollow

- 26 Heron Way S

- 1895 Turk Hill Rd

- 22 Foxcroft Trail

- 3 Eagle Hollow

- 15 Eagle Hollow

- 11 Eagle Hollow

- 1 Eagle Hollow

- 9 Eagle Hollow

- 28 Foxcroft Trail Unit 2

- 12 Meadow Glen

- 8 Meadow Glen

- 6 Meadow Glen

- 4 Meadow Glen

- 14 Meadow Glen

- 5 Sugarmills Cir

- 9 Sugarmills Cir

- 15 Sugarmills Cir

- 2 Center Crossing

- 11 Meadow Glen

- 5 Meadow Glen

- 15 Meadow Glen

- 2 Sugarmills Cir

- 6 Center Crossing

- 4 Sugarmills Cir

- 6 Sugarmills Cir

- 19 Sugarmills Cir

- 12 Sugarmills Cir

- 10 Sugarmills Cir

- 8 Sugarmills Cir