Estimated Value: $489,000 - $541,000

3

Beds

3

Baths

2,270

Sq Ft

$226/Sq Ft

Est. Value

About This Home

This home is located at 10 Steven Louis Ct, Troy, IL 62294 and is currently estimated at $512,548, approximately $225 per square foot. 10 Steven Louis Ct is a home located in Madison County with nearby schools including Silver Creek Elementary School, Triad Middle School, and Triad High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 21, 2021

Sold by

Doussard Christopher R

Bought by

Pringle Gregory and Pringle Eileen

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$240,000

Outstanding Balance

$215,871

Interest Rate

2.63%

Mortgage Type

New Conventional

Estimated Equity

$296,677

Purchase Details

Closed on

Feb 10, 2009

Sold by

Doussard Jami Stone

Bought by

Doussard Christopher Roland

Purchase Details

Closed on

Nov 22, 2004

Sold by

Spotanski Markalan and Spotanski Amy Rae

Bought by

Doussard Christopher R and Doussard Jami S

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$291,600

Interest Rate

5.82%

Mortgage Type

Unknown

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Pringle Gregory | $365,000 | Abstracts & Titles | |

| Doussard Christopher Roland | -- | None Available | |

| Doussard Christopher R | $364,500 | Abstracts & Titles Inc |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Pringle Gregory | $240,000 | |

| Previous Owner | Doussard Christopher R | $291,600 | |

| Closed | Doussard Christopher R | $20,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $9,652 | $165,090 | $31,290 | $133,800 |

| 2023 | $9,652 | $150,780 | $28,580 | $122,200 |

| 2022 | $8,989 | $136,710 | $25,910 | $110,800 |

| 2021 | $8,236 | $123,590 | $24,490 | $99,100 |

| 2020 | $8,169 | $119,330 | $23,650 | $95,680 |

| 2019 | $8,107 | $117,520 | $23,290 | $94,230 |

| 2018 | $8,012 | $110,570 | $21,910 | $88,660 |

| 2017 | $7,759 | $106,790 | $21,160 | $85,630 |

| 2016 | $7,578 | $106,790 | $21,160 | $85,630 |

| 2015 | $6,569 | $103,340 | $20,480 | $82,860 |

| 2014 | $6,569 | $103,340 | $20,480 | $82,860 |

| 2013 | $6,569 | $103,340 | $20,480 | $82,860 |

Source: Public Records

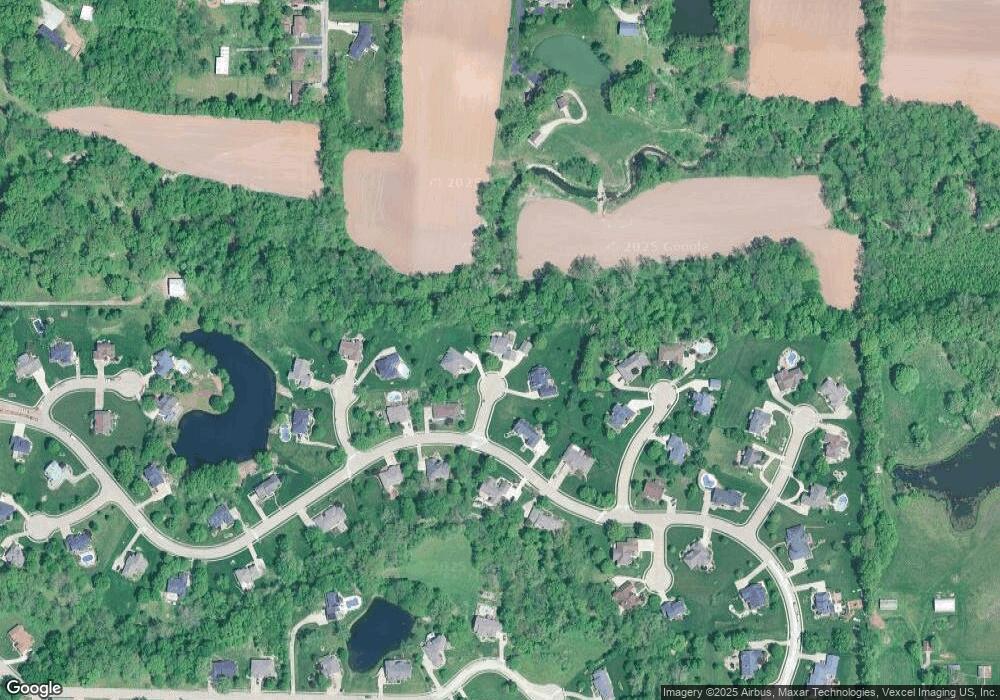

Map

Nearby Homes

- 220 Michael Dr

- 2335 Staunton Rd

- 2141 Willow Creek

- 8748 Wendell Creek Dr

- 0 Lower Marine Rd Unit MIS25066224

- 2854 Fawn Meadows Ct

- Tbd Lower Marine Rd

- 511 Ruddy Ct

- 8929 Rock Creek Dr

- 212 Red Bird St

- 106 James Dr

- 2001 Kensington Place

- 2016 Richview Dr

- 208 Powell St

- 304 Watt St

- 10 Ellington Dr

- 120 Collinsville Rd

- 501 Glendale Dr

- 102 W High St

- 513 Coventry Rd