10003 NE 115th Ln Unit C2 Kirkland, WA 98033

South Juanita NeighborhoodEstimated Value: $732,408 - $776,000

2

Beds

2

Baths

1,318

Sq Ft

$572/Sq Ft

Est. Value

About This Home

This home is located at 10003 NE 115th Ln Unit C2, Kirkland, WA 98033 and is currently estimated at $754,352, approximately $572 per square foot. 10003 NE 115th Ln Unit C2 is a home located in King County with nearby schools including Alexander Graham Bell Elementary School, Finn Hill Middle School, and Juanita High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 6, 2021

Sold by

Bernard Robin D and Bernard Laura L

Bought by

Vesey Elaine

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$360,500

Outstanding Balance

$321,691

Interest Rate

2.7%

Mortgage Type

New Conventional

Estimated Equity

$432,661

Purchase Details

Closed on

Jul 8, 2005

Sold by

Brown Travis L

Bought by

Bernard Robin D and Bernard Laura L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$48,000

Interest Rate

5.51%

Purchase Details

Closed on

Nov 17, 2004

Sold by

Sperber Hans J and Sperber Karen A

Bought by

Brown Travis L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$204,000

Interest Rate

5.75%

Purchase Details

Closed on

Feb 27, 1985

Sold by

Sperber Evamaria

Bought by

Sperber Hans J

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Vesey Elaine | $515,000 | First American Title | |

| Bernard Robin D | $320,000 | Fidelity Natio | |

| Brown Travis L | $255,000 | Commonwealth L | |

| Sperber Hans J | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Vesey Elaine | $360,500 | |

| Previous Owner | Bernard Robin D | $48,000 | |

| Previous Owner | Brown Travis L | $204,000 | |

| Closed | Brown Travis L | $51,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $5,293 | $630,000 | $183,700 | $446,300 |

| 2023 | $4,863 | $686,000 | $183,700 | $502,300 |

| 2022 | $4,728 | $622,000 | $160,000 | $462,000 |

| 2021 | $4,724 | $514,000 | $148,100 | $365,900 |

| 2020 | $5,023 | $473,000 | $148,100 | $324,900 |

| 2018 | $4,047 | $502,000 | $148,100 | $353,900 |

| 2017 | $3,309 | $385,000 | $139,300 | $245,700 |

| 2016 | $3,199 | $325,000 | $130,400 | $194,600 |

| 2015 | $3,304 | $310,000 | $118,500 | $191,500 |

| 2014 | -- | $310,000 | $118,500 | $191,500 |

| 2013 | -- | $246,000 | $118,500 | $127,500 |

Source: Public Records

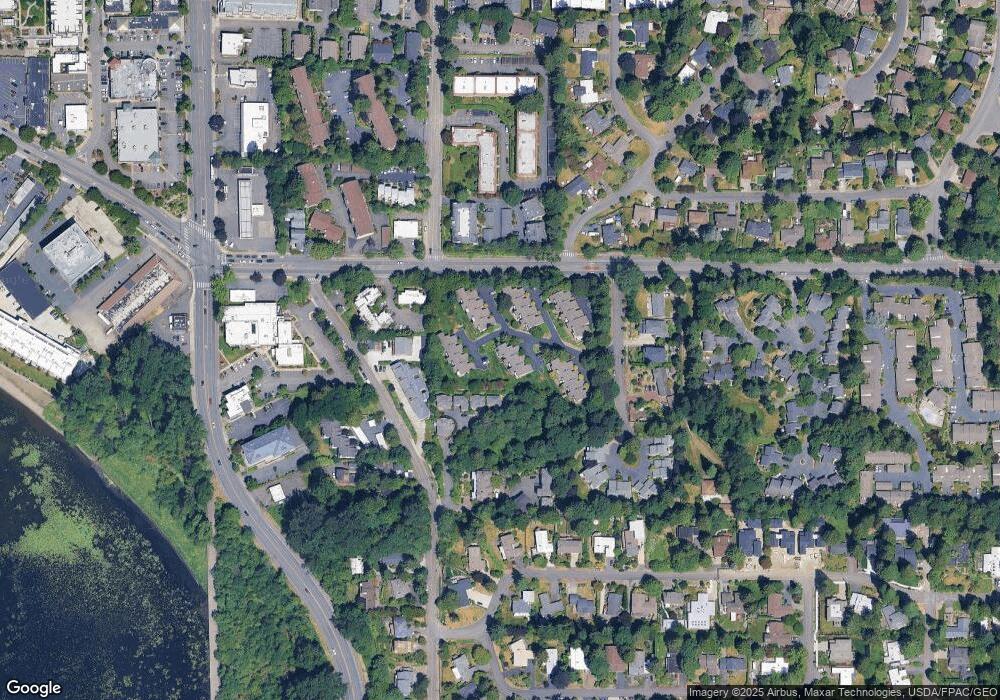

Map

Nearby Homes

- 11419 99th Place NE Unit 102

- 11419 99th Place NE Unit 301

- 11620 100th Ave NE Unit C212

- 11644 100th Ave NE Unit 308

- 10133 NE 113th Place

- 11801 100th Ave NE Unit A102

- 10126 NE 116th Place

- 10304 NE 113th Place Unit B

- 10304 NE 113th Place

- 9727 NE Juanita Dr Unit 308

- 10168 NE 112th Place

- 9920 NE 119th St Unit 107

- 11920 98th Ave NE Unit 213

- 11004 100th Ave NE

- 12003 100th Ave NE Unit 202

- 12014 98th Ave NE Unit 101

- 10030 NE 120th St Unit J2

- 12010 98th Ave NE Unit 107

- 10438 NE 116th St

- 12024 101st Ave NE Unit E2

- 10003 NE 115th Ln Unit C4

- 10003 NE 115th Ln Unit A1

- 10003 NE 115th Ln Unit D1

- 10003 NE 115th Ln Unit D3

- 10003 NE 115th Ln Unit E3

- 10003 NE 115th Ln Unit B4

- 10003 NE 115th Ln Unit D2

- 10003 NE 115th Ln Unit F4

- 10003 NE 115th Ln Unit F3

- 10003 NE 115th Ln Unit F2

- 10003 NE 115th Ln Unit F1

- 10003 NE 115th Ln Unit E2

- 10003 NE 115th Ln Unit E1

- 10003 NE 115th Ln Unit D4

- 10003 NE 115th Ln Unit C3

- 10003 NE 115th Ln Unit C1

- 10003 NE 115th Ln Unit B3

- 10003 NE 115th Ln Unit B2

- 10003 NE 115th Ln Unit B1

- 10003 NE 115th Ln Unit A4