10013 E Reflecting Mountain Way Unit 205 Scottsdale, AZ 85262

Desert Mountain NeighborhoodEstimated Value: $5,272,745 - $5,992,000

5

Beds

7

Baths

7,012

Sq Ft

$789/Sq Ft

Est. Value

About This Home

This home is located at 10013 E Reflecting Mountain Way Unit 205, Scottsdale, AZ 85262 and is currently estimated at $5,532,248, approximately $788 per square foot. 10013 E Reflecting Mountain Way Unit 205 is a home located in Maricopa County with nearby schools including Black Mountain Elementary School, Cactus Shadows High School, and Sonoran Trails Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 23, 2013

Sold by

Molbeck John N and Molbeck Teresa A

Bought by

Wilver Peter M and Wilver Michelle H

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$1,999,999

Outstanding Balance

$1,374,721

Interest Rate

2.52%

Mortgage Type

New Conventional

Estimated Equity

$4,157,527

Purchase Details

Closed on

Feb 25, 2008

Sold by

Saguaro Forest #205 Llc

Bought by

Molbeck John N and Molbeck Teresa A

Purchase Details

Closed on

Dec 19, 2007

Sold by

Tracy William P

Bought by

Saguaro Forest #205 Llc

Purchase Details

Closed on

Apr 12, 2006

Sold by

Saguaro Forest #205 Llc

Bought by

Tracy William P

Purchase Details

Closed on

Dec 12, 2000

Sold by

Desert Mountain Properties Ltd Prtnrshp

Bought by

Saguaro Forest #205 Llc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$495,000

Interest Rate

7.71%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Wilver Peter M | $3,400,000 | Pioneer Title Agency Inc | |

| Molbeck John N | $4,450,000 | The Talon Group Desert Ridge | |

| Saguaro Forest #205 Llc | -- | The Talon Group | |

| Tracy William P | -- | Chicago Title Insurance Co | |

| Tracy William P | -- | None Available | |

| Saguaro Forest #205 Llc | -- | None Available | |

| Saguaro Forest #205 Llc | -- | First American Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Wilver Peter M | $1,999,999 | |

| Previous Owner | Saguaro Forest #205 Llc | $495,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $15,116 | $296,259 | -- | -- |

| 2024 | $14,587 | $282,152 | -- | -- |

| 2023 | $14,587 | $324,310 | $64,860 | $259,450 |

| 2022 | $14,120 | $255,920 | $51,180 | $204,740 |

| 2021 | $15,846 | $252,470 | $50,490 | $201,980 |

| 2020 | $16,316 | $248,120 | $49,620 | $198,500 |

| 2019 | $17,251 | $249,700 | $49,940 | $199,760 |

| 2018 | $16,777 | $239,430 | $47,880 | $191,550 |

| 2017 | $16,158 | $233,210 | $46,640 | $186,570 |

| 2016 | $16,087 | $211,820 | $42,360 | $169,460 |

| 2015 | $17,556 | $232,820 | $46,560 | $186,260 |

Source: Public Records

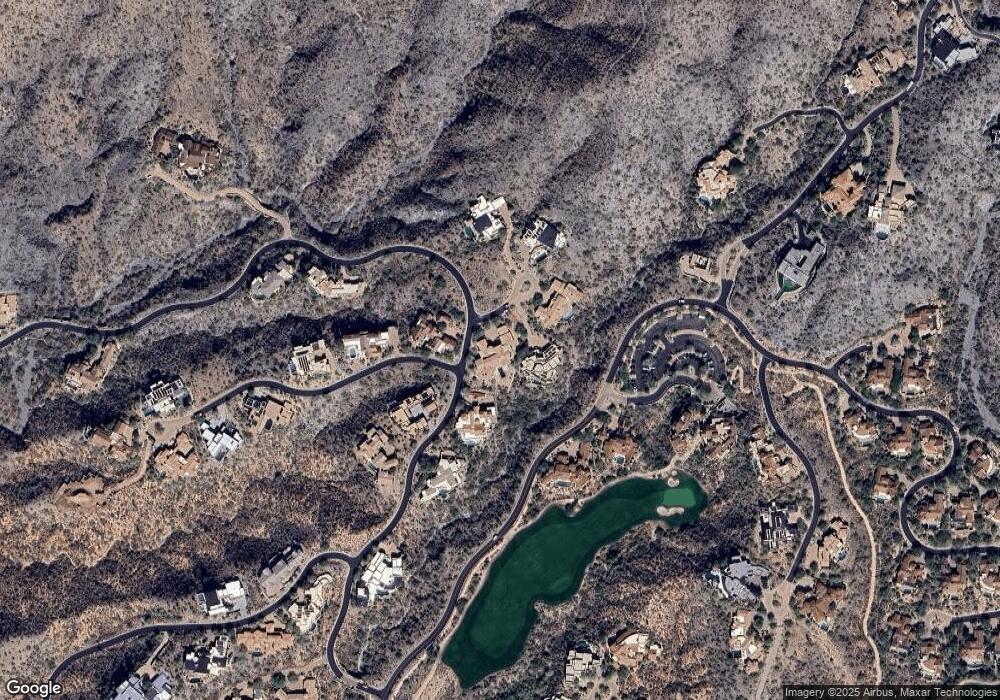

Map

Nearby Homes

- 01 Red Rover Mine Rd --

- 41996 N 100th Way Unit 165

- 41927 N Saguaro Forest Dr Unit 107

- 41862 N 101st Place Unit 103

- 41966 N Stone Cutter Dr Unit 25

- 43105 N 102nd St

- 42690 N 98th Place

- 41731 N Stone Cutter Dr

- 9808 E Honey Mesquite Dr

- 10020 E Relic Rock Rd Unit 18

- 41965 N Charbray Dr Unit 24

- 41353 N 106th St

- 41399 N 96th St

- 41588 N 107th Way

- 42242 N Charbray Dr Unit 25

- 41590 N 108th St

- 41248 N 96th St

- 42143 N 108th Place Unit 36

- 9643 E Cintarosa Pass

- 40980 N 97th St Unit 61

- 10029 E Reflecting Mountain Way Unit 204

- 9986 E Sienna Hills Dr Unit 191

- 42397 N 100th Way Unit 206

- 10035 E Reflecting Mountain Way Unit 203

- 9983 E Sienna Hills Dr Unit 181

- 9983 E Sienna Hills Dr

- 9993 E Reflecting Mountain Way Unit 192

- 9964 E Sienna Hills Dr

- 10010 E Reflecting Mountain Way Unit 199

- 10032 E Reflecting Mountain Way Unit 201

- 42253 N 100th Way Unit 207

- 42252 N Saguaro Forest Dr

- 10051 E Reflecting Mountain Way Unit 202

- 42395 N Saguaro Forest Dr

- 42290 N 100th Way

- 9967 E Reflecting Mountain Way Unit 193

- 10028 E Reflecting Mountain Way Unit 200

- 9952 E Sienna Hills Dr Unit 189

- 9952 E Sienna Hills Dr

- 9951 E Sienna Hills Dr Unit 182