10040 W Royal Oak Rd Unit 24 Sun City, AZ 85351

Estimated Value: $181,583 - $189,000

--

Bed

1

Bath

879

Sq Ft

$211/Sq Ft

Est. Value

About This Home

This home is located at 10040 W Royal Oak Rd Unit 24, Sun City, AZ 85351 and is currently estimated at $185,396, approximately $210 per square foot. 10040 W Royal Oak Rd Unit 24 is a home located in Maricopa County with nearby schools including Desert Mirage Elementary School, Ombudsman - Northwest Charter, and Peoria Accelerated High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 9, 2002

Sold by

Keller Robert D and Keller Joyce B

Bought by

Johnson Donna J

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$45,000

Outstanding Balance

$18,748

Interest Rate

6.74%

Mortgage Type

New Conventional

Estimated Equity

$166,648

Purchase Details

Closed on

Jan 8, 1999

Sold by

Deguire Leo J and Deguire Diane

Bought by

Keller Robert D and Keller Joyce B

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$40,000

Interest Rate

6.73%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Johnson Donna J | $60,250 | First American Title | |

| Keller Robert D | $62,250 | First American Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Johnson Donna J | $45,000 | |

| Previous Owner | Keller Robert D | $40,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $455 | $5,730 | -- | -- |

| 2024 | $407 | $5,457 | -- | -- |

| 2023 | $407 | $12,930 | $2,580 | $10,350 |

| 2022 | $386 | $11,020 | $2,200 | $8,820 |

| 2021 | $399 | $9,800 | $1,960 | $7,840 |

| 2020 | $387 | $8,510 | $1,700 | $6,810 |

| 2019 | $383 | $7,170 | $1,430 | $5,740 |

| 2018 | $371 | $6,200 | $1,240 | $4,960 |

| 2017 | $355 | $5,150 | $1,030 | $4,120 |

| 2016 | $190 | $4,320 | $860 | $3,460 |

| 2015 | $318 | $4,060 | $810 | $3,250 |

Source: Public Records

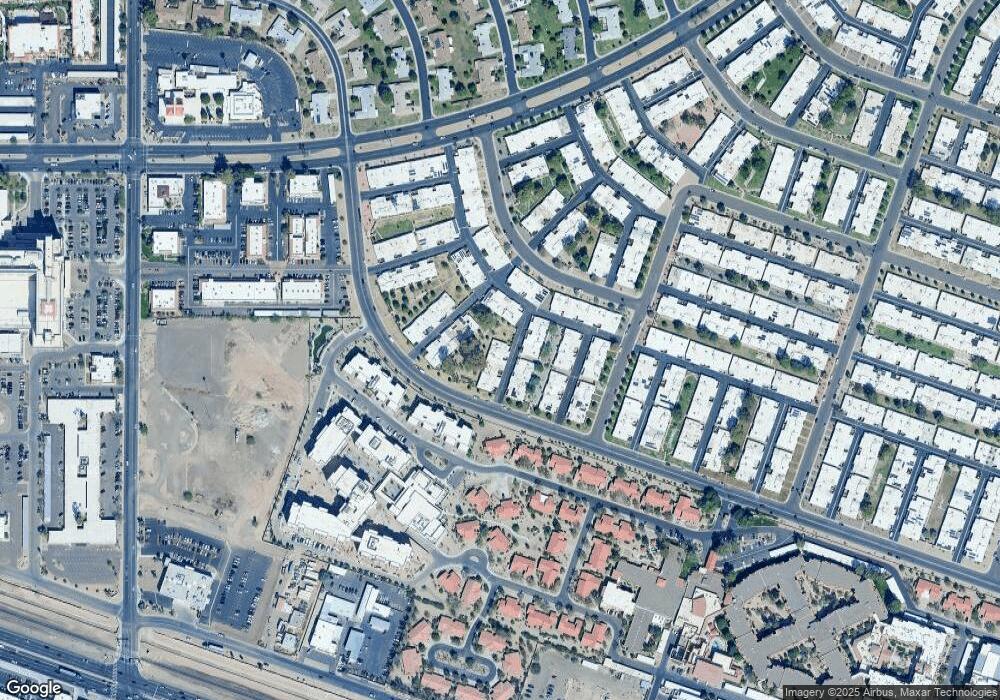

Map

Nearby Homes

- 10040 W Royal Oak Rd Unit B

- 10040 W Royal Oak Rd Unit H

- 10030 W Royal Oak Rd Unit C

- 13067 N 100th Dr

- 13039 N 100th Dr

- 13071 N 100th Dr

- 10020 W Royal Oak Rd Unit E

- 13050 N 100th Ave

- 10225 W Thunderbird Blvd

- 13054 N 100th Ave

- 13072 N 100th Ave

- 13442 N Emberwood Dr

- 13410 N Cedar Dr Unit 20

- 13058 N 100th Ave Unit 24A

- 10114 W Candlewood Dr

- 13420 N Emberwood Dr

- 10114 W Royal Oak Rd Unit 20

- 10112 W Forrester Dr

- 10127 W Forrester Dr

- 13433 N Emberwood Dr

- 10040 W Royal Oak Rd Unit A

- 10040 W Royal Oak Rd Unit F

- 10040 W Royal Oak Rd Unit C

- 10040 W Royal Oak Rd

- 10040 W Royal Oak Rd

- 10040 W Royal Oak Rd

- 10040 W Royal Oak Rd

- 10040 W Royal Oak Rd

- 10040 W Royal Oak Rd

- 10040 W Royal Oak Rd

- 10040 W Royal Oak Rd

- 10040 W Royal Oak Rd

- 10040 W Royal Oak Rd

- 10040 W Royal Oak Rd

- 10040 W Royal Oak Rd

- 10040 W Royal Oak Rd

- 10040 W Royal Oak Rd

- 10040 W Royal Oak Rd Unit L

- 10040 W Royal Oak Rd Unit P

- 13222 N Cedar Dr Unit 24