1007 Leslie Rd Havre de Grace, MD 21078

Estimated Value: $354,000 - $452,000

--

Bed

2

Baths

1,596

Sq Ft

$247/Sq Ft

Est. Value

About This Home

This home is located at 1007 Leslie Rd, Havre de Grace, MD 21078 and is currently estimated at $394,915, approximately $247 per square foot. 1007 Leslie Rd is a home located in Harford County with nearby schools including Meadowvale Elementary School, Havre de Grace Middle School, and Havre de Grace High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 27, 1997

Sold by

Medeck Raymond J

Bought by

Wachsman Matthew and Gillespie Margaret B

Current Estimated Value

Purchase Details

Closed on

Jul 25, 1989

Sold by

Tarman Bryan Lloyd

Bought by

Medeck Raymond J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$50,000

Interest Rate

9.87%

Purchase Details

Closed on

Oct 22, 1987

Sold by

Snodgrass William F

Bought by

Tarman Bryan Lloyd

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$75,000

Interest Rate

11.58%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Wachsman Matthew | $152,000 | -- | |

| Medeck Raymond J | $139,900 | -- | |

| Tarman Bryan Lloyd | $95,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Medeck Raymond J | $50,000 | |

| Previous Owner | Tarman Bryan Lloyd | $75,000 | |

| Closed | Wachsman Matthew | -- |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,161 | $300,100 | $0 | $0 |

| 2024 | $3,161 | $284,500 | $85,500 | $199,000 |

| 2023 | $3,128 | $281,500 | $0 | $0 |

| 2022 | $3,095 | $278,500 | $0 | $0 |

| 2021 | $3,178 | $275,500 | $85,500 | $190,000 |

| 2020 | $3,178 | $270,233 | $0 | $0 |

| 2019 | $3,118 | $264,967 | $0 | $0 |

| 2018 | $3,030 | $259,700 | $100,800 | $158,900 |

| 2017 | $2,990 | $259,700 | $0 | $0 |

| 2016 | -- | $252,767 | $0 | $0 |

| 2015 | $3,062 | $249,300 | $0 | $0 |

| 2014 | $3,062 | $249,300 | $0 | $0 |

Source: Public Records

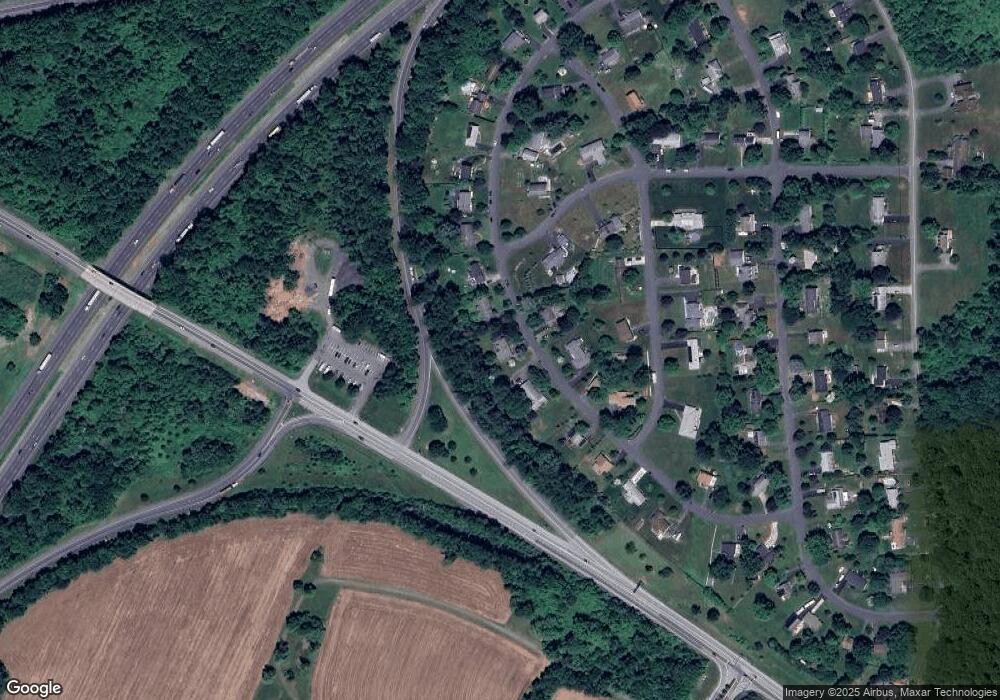

Map

Nearby Homes

- 1001 Morrison Blvd

- 146 Remington Cir

- 122 N Earlton Rd

- 0 Quail Way Unit MDHR2048234

- Columbia Plan at Scenic Vista

- Hudson Plan at Scenic Vista

- Allegheny Plan at Scenic Vista

- Lehigh Plan at Scenic Vista

- 4153 U Way

- 1514 Superior St

- 311 Sunrise Ct

- 1514 Lyon St

- 332 Pintail Dr

- 903 Eugene Dr

- 400 Brant Ct

- 221 War Admiral Way

- TBB-JORDAN II Justify Cir

- 126 A Snow Chief Dr

- 103 Flying Ebony Place

- TBB-SOPHIA Justify Cir