1008 Hidden Landing Trail Unit 132 Dayton, OH 45449

Estimated Value: $81,495 - $95,000

2

Beds

2

Baths

943

Sq Ft

$91/Sq Ft

Est. Value

About This Home

This home is located at 1008 Hidden Landing Trail Unit 132, Dayton, OH 45449 and is currently estimated at $86,124, approximately $91 per square foot. 1008 Hidden Landing Trail Unit 132 is a home located in Montgomery County with nearby schools including West Carrollton High School and Bethel Baptist School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 25, 2021

Sold by

Forsee Beverly J

Bought by

Strong Olohana and Strong Kelly B

Current Estimated Value

Purchase Details

Closed on

Jul 5, 2018

Sold by

Forsee Beverly J And

Bought by

Forsee Beverly J

Purchase Details

Closed on

Apr 15, 2016

Sold by

Vanzant Roger and Kelsey Marsha

Bought by

Forsee Beverly J and Fyffe Olahana

Purchase Details

Closed on

Aug 17, 2005

Sold by

Fulweiler Michael E and Fulweiler Krisztina

Bought by

Vanzant Beverley

Purchase Details

Closed on

Jun 29, 2001

Sold by

Martin Benjamin F and Martin Betty J

Bought by

Fulwiler Michael E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$46,400

Interest Rate

7.2%

Mortgage Type

FHA

Purchase Details

Closed on

Oct 29, 1993

Sold by

State Street Bank & Trust

Bought by

Martin Benjamin F and Martin Betty J

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Strong Olohana | -- | None Available | |

| Forsee Beverly J | -- | -- | |

| Forsee Beverly J | $25,900 | National Title Boy | |

| Vanzant Beverley | $45,500 | -- | |

| Fulwiler Michael E | $47,900 | -- | |

| Martin Benjamin F | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Fulwiler Michael E | $46,400 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $975 | $15,510 | $3,890 | $11,620 |

| 2023 | $975 | $15,510 | $3,890 | $11,620 |

| 2022 | $899 | $11,190 | $2,800 | $8,390 |

| 2021 | $900 | $11,190 | $2,800 | $8,390 |

| 2020 | $881 | $11,190 | $2,800 | $8,390 |

| 2019 | $900 | $10,570 | $2,800 | $7,770 |

| 2018 | $843 | $10,570 | $2,800 | $7,770 |

| 2017 | $837 | $10,570 | $2,800 | $7,770 |

| 2016 | $310 | $12,290 | $2,800 | $9,490 |

| 2015 | $287 | $12,290 | $2,800 | $9,490 |

| 2014 | $287 | $12,290 | $2,800 | $9,490 |

| 2012 | -- | $13,430 | $3,360 | $10,070 |

Source: Public Records

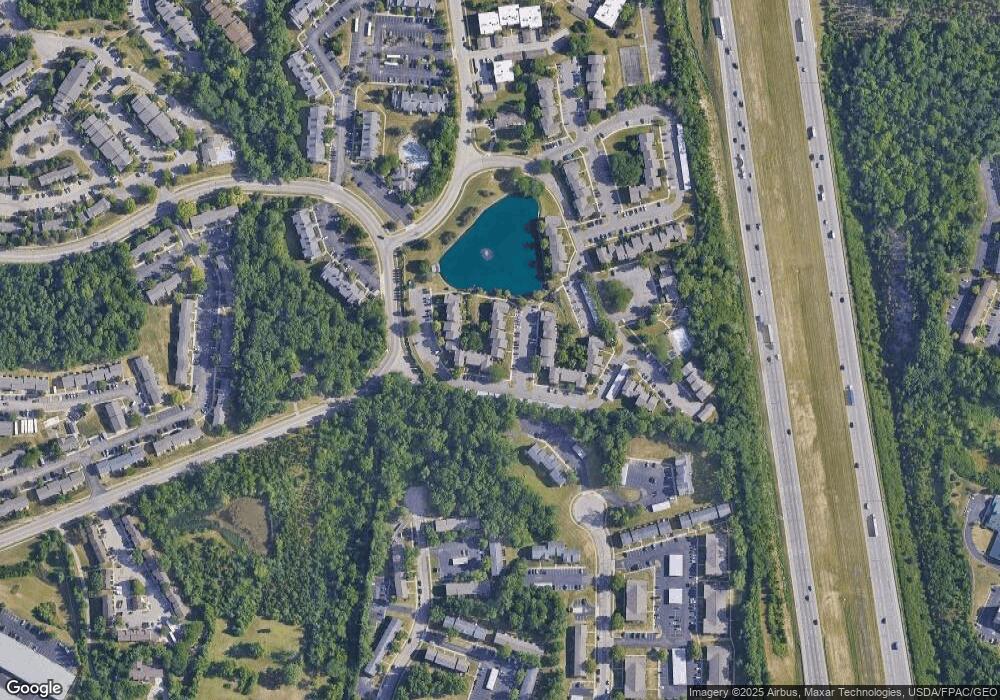

Map

Nearby Homes

- 1016 Hidden Landing Trail Unit F

- 1104 Arrowhead Crossing Unit B

- 1788 Cherokee Dr Unit F

- 1792 Cherokee Dr Unit A

- 1116 Eagle Feather Cir Unit E

- 1112 Eagle Feather Cir Unit A

- 1109 Arrowhead Crossing Unit A

- 1606 Pine Tree Ln Unit 38

- 3324 Ultimate Way Unit 36

- 6484 Quintessa Ct Unit 29

- 3316 Vanquil Trail Unit 387

- 3304 Ultimate Way Unit 399

- 6409 Interlude Ln Unit 415

- 3218 Gambit Square Unit 471

- 3254 Gambit Square Unit 451

- 6407 Kindred Square Unit 9-4

- 3034 Bright Bounty Ln Unit 29

- 7153 Springboro Pike Unit A

- 609 Kings Cross Ct

- 500 Lincoln Green Dr

- 1008 Hidden Landing Trail Unit D

- 1008 Hidden Landing Trail Unit 136

- 1008 Hidden Landing Trail Unit 135

- 1008 Hidden Landing Trail Unit 134

- 1008 Hidden Landing Trail Unit 133

- 1008 Hidden Landing Trail Unit 131

- 1008 Hidden Landing Trail Unit B

- 1008 Hidden Landing Trail Unit A

- 1008 Hidden Landing Trail Unit 33

- 1008 Hidden Landing Trail Unit 1-3

- 1014 Lookout Trail

- 1014 Lookout Trail Unit 130

- 1014 Lookout Trail Unit 29

- 1014 Lookout Trail Unit 128

- 1014 Lookout Trail Unit 127

- 1014 Lookout Trail Unit 125

- 1014 Lookout Trail Unit A

- 1014 Lookout Trail Unit 30 F

- 1014 Lookout Trail Unit F

- 1014 Lookout Trail Unit C