1009 13th St La Grande, OR 97850

Estimated payment $2,193/month

Highlights

- Deck

- Private Yard

- Converted Garage

- Corner Lot

- No HOA

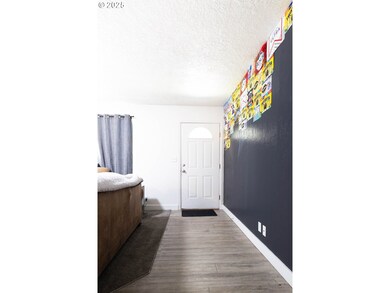

- Living Room

About This Home

This isn’t your typical remodel—it’s a full refresh with purpose. With five true bedrooms and three bathrooms, this corner-lot home offers room for everyone and everything. Need space for a home office, a guest suite, or just a little breathing room? You’ve got it.This brick beauty has been thoughtfully updated throughout, from the modern finishes inside to the new underground sprinkler system that keeps the yard green and effortless. Enjoy the deck for quiet mornings or casual gatherings, off-street parking for three, and a newer outbuilding that adds bonus storage or hobby space.Currently rented and generating excellent income, this property is a solid investment from day one. Or, if you’re ready to make it home, it’s waiting with open arms—freshly remodeled, move-in ready, and packed with potential. Whether you live in it or let it work for you, this property is a win either way!

Listing Agent

RE/MAX Real Estate Team Brokerage Phone: 541-963-1000 License #201208312 Listed on: 10/20/2025

Home Details

Home Type

- Single Family

Est. Annual Taxes

- $3,665

Year Built

- Built in 1958 | Remodeled

Lot Details

- 6,098 Sq Ft Lot

- Corner Lot

- Sprinkler System

- Private Yard

Home Design

- Brick Exterior Construction

- Composition Roof

- Cement Siding

Interior Spaces

- 1,700 Sq Ft Home

- 1-Story Property

- Family Room

- Living Room

- Dining Room

- Crawl Space

Kitchen

- Free-Standing Gas Range

- Disposal

Bedrooms and Bathrooms

- 5 Bedrooms

- 3 Full Bathrooms

Parking

- Parking Pad

- Converted Garage

- Off-Street Parking

Accessible Home Design

- Accessibility Features

- Level Entry For Accessibility

Outdoor Features

- Deck

- Outbuilding

Schools

- Central Elementary School

- La Grande Middle School

- La Grande High School

Utilities

- Forced Air Zoned Heating and Cooling System

- Heating System Uses Gas

- Heating System Mounted To A Wall or Window

- Gas Water Heater

Community Details

- No Home Owners Association

Listing and Financial Details

- Assessor Parcel Number 3320

Map

Home Values in the Area

Average Home Value in this Area

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,794 | $209,660 | $68,730 | $140,930 |

| 2024 | $3,665 | $203,560 | $66,730 | $136,830 |

| 2023 | $3,600 | $197,640 | $64,790 | $132,850 |

| 2022 | $3,147 | $172,337 | $62,909 | $109,428 |

| 2021 | $3,067 | $167,318 | $61,465 | $105,853 |

| 2020 | $2,818 | $162,445 | $59,702 | $102,743 |

| 2019 | $2,819 | $157,714 | $58,091 | $99,623 |

| 2018 | $2,720 | $153,121 | $49,549 | $103,572 |

| 2017 | $2,706 | $148,662 | $48,462 | $100,200 |

| 2016 | $2,543 | $144,333 | $47,174 | $97,159 |

| 2015 | $2,351 | $140,130 | $45,867 | $94,263 |

| 2014 | $2,078 | $136,049 | $44,624 | $91,425 |

| 2013 | -- | $132,087 | $43,297 | $88,790 |

Property History

| Date | Event | Price | List to Sale | Price per Sq Ft |

|---|---|---|---|---|

| 11/24/2025 11/24/25 | Price Changed | $359,900 | -0.7% | $212 / Sq Ft |

| 10/20/2025 10/20/25 | For Sale | $362,500 | -- | $213 / Sq Ft |

Purchase History

| Date | Type | Sale Price | Title Company |

|---|---|---|---|

| Warranty Deed | $155,000 | Eastern Oregon Title Inc | |

| Warranty Deed | $100,500 | Eastern Oregon Title Inc | |

| Warranty Deed | $128,500 | Atco |

Mortgage History

| Date | Status | Loan Amount | Loan Type |

|---|---|---|---|

| Open | $158,332 | New Conventional | |

| Previous Owner | $97,951 | FHA |

Source: Regional Multiple Listing Service (RMLS)

MLS Number: 387542397

APN: 03S3808AC-7800-0-101