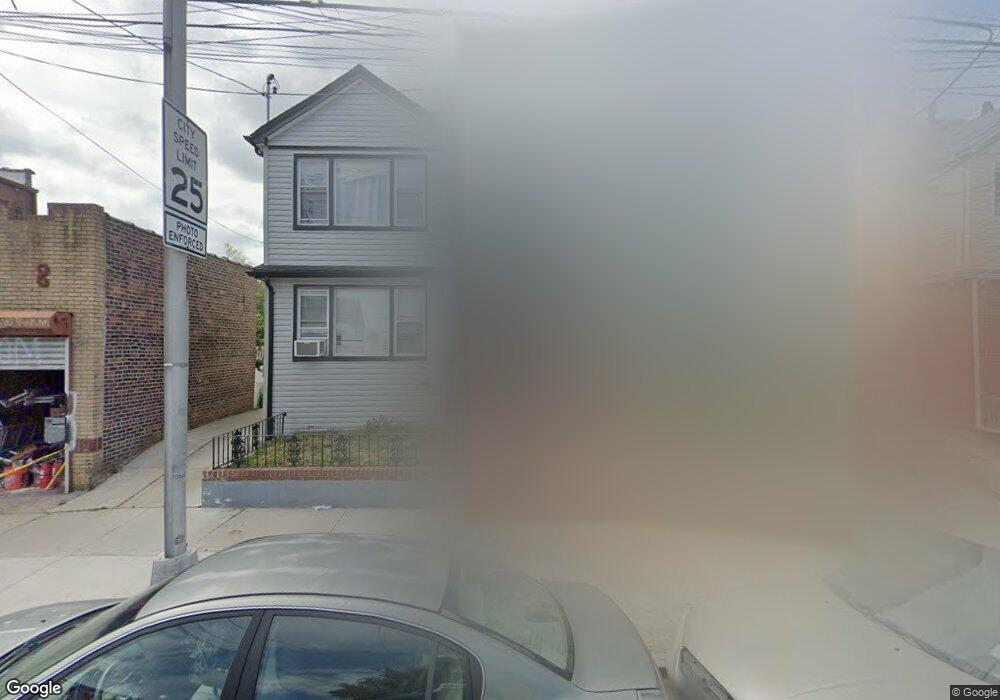

101-60 104th St Ozone Park, NY 11416

Richmond Hill NeighborhoodEstimated Value: $921,000 - $996,000

7

Beds

3

Baths

1,998

Sq Ft

$478/Sq Ft

Est. Value

About This Home

This home is located at 101-60 104th St, Ozone Park, NY 11416 and is currently estimated at $955,606, approximately $478 per square foot. 101-60 104th St is a home located in Queens County with nearby schools including P.S. 65 - The Raymond York Elementary School, Robert H. Goddard High School, and John Adams High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 11, 2021

Sold by

Maya Development Llc

Bought by

Chu Chao Wen

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$570,000

Outstanding Balance

$516,064

Interest Rate

2.9%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$439,542

Purchase Details

Closed on

Oct 23, 2020

Sold by

Lacey Andrew and Lacey Ethelene E

Bought by

Maya Development Llc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$710,000

Interest Rate

2.8%

Mortgage Type

New Conventional

Purchase Details

Closed on

Feb 8, 2008

Sold by

Cleary Stacey A and Jonason Lawrence

Bought by

Lacey Andrew and Lay Carol

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Chu Chao Wen | $950,000 | -- | |

| Maya Development Llc | $645,000 | -- | |

| Lacey Andrew | $225,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Chu Chao Wen | $570,000 | |

| Previous Owner | Maya Development Llc | $710,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,321 | $38,635 | $9,629 | $29,006 |

| 2024 | $7,321 | $36,449 | $10,090 | $26,359 |

| 2023 | $6,907 | $34,387 | $9,118 | $25,269 |

| 2022 | $6,557 | $52,440 | $14,700 | $37,740 |

| 2021 | $6,912 | $46,260 | $14,700 | $31,560 |

| 2020 | $6,815 | $45,240 | $14,700 | $30,540 |

| 2019 | $6,354 | $40,320 | $14,700 | $25,620 |

| 2018 | $5,842 | $28,656 | $9,724 | $18,932 |

| 2017 | $5,579 | $27,370 | $11,847 | $15,523 |

| 2016 | $5,472 | $27,370 | $11,847 | $15,523 |

| 2015 | $2,895 | $26,830 | $15,899 | $10,931 |

| 2014 | $2,895 | $25,312 | $15,232 | $10,080 |

Source: Public Records

Map

Nearby Homes

- 10152 103rd St

- 103-22 104th St

- 103-18 103rd St

- 10154 102nd St

- 10208 101st Ave

- 103-37 102nd St

- 10349A 104th St

- 103-10 106th St

- 103-50 102nd St

- 100-08 101st Ave

- 10370 103rd St

- 97-56 101st St

- 105-02 Liberty Ave

- 97-25 102nd St

- 97-17 106th St

- 10805 103rd Ave

- 10417 106th St

- 10438 107th St

- 10109 97th Ave

- 95-26 107th St

- 101-60 104th St Unit 1FL

- 10160 104th St

- 10158 104th St

- 101-56 104th St Unit 1

- 101-56 104th St Unit 2 Fl

- 101-56 104th St

- 10224 104th St

- 10230 104th St

- 10156 104th St

- 10319 103rd Ave

- 10315 103rd Ave

- 10154 104th St

- 10313 103rd Ave

- 10319 103rd Ave

- 103-13 103rd Ave Unit House

- 103-13 103rd Ave

- 103-11 103rd Ave

- 10311 103rd Ave

- 10204 104th St

- 10206 104th St