101 Autumn Way Unit 621 Montvale, NJ 07645

Estimated Value: $782,000 - $876,000

3

Beds

3

Baths

2,101

Sq Ft

$392/Sq Ft

Est. Value

About This Home

This home is located at 101 Autumn Way Unit 621, Montvale, NJ 07645 and is currently estimated at $823,397, approximately $391 per square foot. 101 Autumn Way Unit 621 is a home located in Bergen County with nearby schools including Memorial Elementary School, Fieldstone Middle School, and Pascack Hills High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 2, 2021

Sold by

Smith Evan D and Smith Jaclyn A

Bought by

Kim Byung Bok

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$300,000

Outstanding Balance

$226,456

Interest Rate

2.23%

Mortgage Type

New Conventional

Estimated Equity

$596,941

Purchase Details

Closed on

Jun 28, 2017

Sold by

H Hovnanian At Montvale Ii Llc

Bought by

Smith Evan D and Smith Jaclyn A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$515,050

Interest Rate

3.94%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Kim Byung Bok | $625,000 | Stewart Title Guaranty Co | |

| Kim Byung Bok | $625,000 | Stewart Title | |

| Smith Evan D | $647,798 | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Kim Byung Bok | $300,000 | |

| Closed | Kim Byung Bok | $300,000 | |

| Previous Owner | Smith Evan D | $515,050 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $12,728 | $506,100 | $250,000 | $256,100 |

| 2024 | $12,470 | $506,100 | $250,000 | $256,100 |

| 2023 | $12,506 | $506,100 | $250,000 | $256,100 |

| 2022 | $12,506 | $506,100 | $250,000 | $256,100 |

| 2021 | $12,440 | $506,100 | $250,000 | $256,100 |

| 2020 | $12,303 | $506,100 | $250,000 | $256,100 |

| 2019 | $11,959 | $506,100 | $250,000 | $256,100 |

| 2018 | $11,812 | $506,100 | $250,000 | $256,100 |

| 2017 | $2,418 | $105,000 | $105,000 | $0 |

| 2016 | $2,373 | $105,000 | $105,000 | $0 |

Source: Public Records

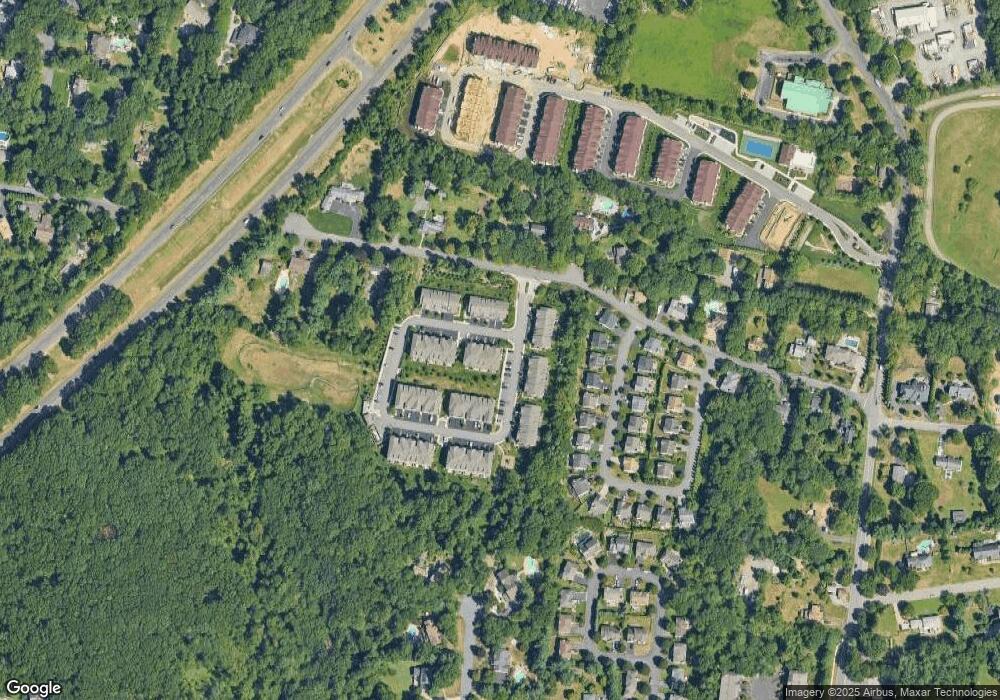

Map

Nearby Homes

- 4 Fox Hill Rd

- 49 North Ave

- 103 Gelnaw Ln

- 17 Midway Rd

- 1 Deepwood Ln

- 2 Hilton Place

- 39 Forshee Cir

- 8 Ronwood Rd

- 60 Van Buren St

- 29 Old Chestnut Ridge Rd

- 12 Capri Dr

- 38 Van Buren St

- 18 Fleetwood Ave

- 11 Fleetwood Ave

- 19 Paul Ct

- 20 Spring Valley Rd

- 13 Tice Ct

- 96 Old Pascack Rd

- 28 Williams Rd

- 4 Nicole Way

- 97 Autumn Way Unit 622

- 97 Autumn Way

- 95 Autumn Way Unit 612

- 93 Autumn Way Unit 623

- 93 Autumn Way

- 91 Autumn Way Unit 613

- 91 Autumn Way

- 91 Autumn Way Unit 31

- 99 Autumn Way Unit 611

- 89 Autumn Way Unit 624

- 87 Autumn Way Unit 614

- 87 Autumn Way

- 39 Autumn Way

- 14 Autumn Way Unit 203

- 12 Autumn Way Unit 202

- 16 Autumn Way Unit 201

- 80 Autumn Way

- 43 Autumn Way

- 43 Autumn Way Unit 43

- 85 Autumn Way Unit 521