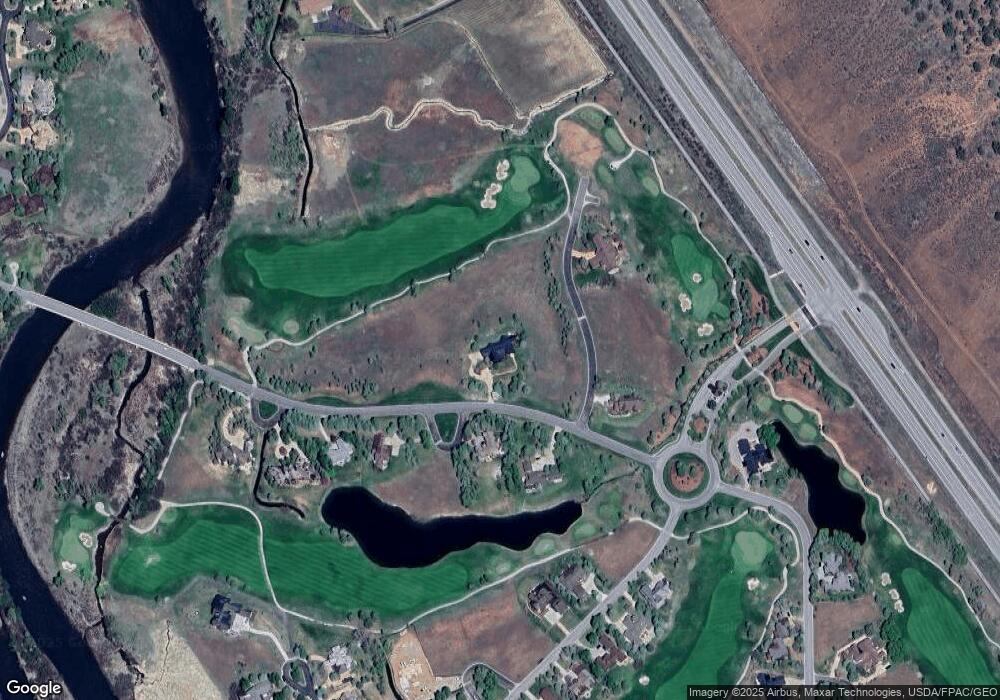

101 Bald Eagle Carbondale, CO 81623

Aspen Glen NeighborhoodEstimated Value: $2,590,000 - $4,264,000

5

Beds

6

Baths

4,834

Sq Ft

$763/Sq Ft

Est. Value

About This Home

This home is located at 101 Bald Eagle, Carbondale, CO 81623 and is currently estimated at $3,686,206, approximately $762 per square foot. 101 Bald Eagle is a home located in Garfield County with nearby schools including Carbondale Community Charter School, Ross Montessori School, and Colorado Rocky Mountain School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 13, 2006

Sold by

Kingen David M and Kingen Christine

Bought by

Reimer Kevin L and Reimer Lisa Anne

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$745,000

Interest Rate

6.58%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Nov 20, 2003

Sold by

Held Steven C and Held Michelle Long

Bought by

Kingen David M and Kingen Christine

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$910,000

Interest Rate

5%

Mortgage Type

Fannie Mae Freddie Mac

Purchase Details

Closed on

Aug 8, 2000

Sold by

Fitzsimmons William D

Bought by

Held Steven C and Held Michelle Long

Purchase Details

Closed on

Apr 27, 1995

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Reimer Kevin L | $1,490,000 | Land Title Guarantee Company | |

| Kingen David M | $1,400,000 | Land Title | |

| Held Steven C | $240,000 | -- | |

| -- | $156,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | Reimer Kevin L | $745,000 | |

| Previous Owner | Kingen David M | $910,000 | |

| Closed | Kingen David M | $210,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $13,715 | $167,640 | $22,620 | $145,020 |

| 2023 | $13,715 | $167,640 | $22,620 | $145,020 |

| 2022 | $8,539 | $96,560 | $15,640 | $80,920 |

| 2021 | $8,660 | $99,340 | $16,090 | $83,250 |

| 2020 | $7,847 | $94,610 | $16,090 | $78,520 |

| 2019 | $7,910 | $94,610 | $16,090 | $78,520 |

| 2018 | $8,062 | $97,100 | $20,520 | $76,580 |

| 2017 | $7,738 | $97,100 | $20,520 | $76,580 |

| 2016 | $8,172 | $100,800 | $18,310 | $82,490 |

| 2015 | $8,281 | $100,800 | $18,310 | $82,490 |

| 2014 | -- | $78,810 | $7,960 | $70,850 |

Source: Public Records

Map

Nearby Homes

- 57 Diamond A Ranch Rd

- TBD Leonis Ln

- 81 River Park Ln

- 0 River Glen Rd

- 65 Upland Unit 1

- 65 Upland Unit 2

- 625 Brookie

- 139 River Glen

- 48 Upland Unit 2

- 48 Upland Unit 1

- 21 Tellico Ct

- 52 Puma

- 80 Elk Track Ln

- 38 Puma

- 31 Royal Coachman

- 54 Thunderstorm Cir

- TBD Bald Eagle Way

- 49 Alpen Glo Ln

- 289 Sweet Grass Dr

- 42 Midland Loop

- 101 Bald Eagle Way

- 0 Tbd Bald Eagle Way Unit 176837

- 0 Tbd Bald Eagle Way Unit 166179

- 0156 Osprey Cir

- 140 Osprey Cir

- 68 Bald Eagle Way

- 170 Osprey Cir

- 102 Leonis Ln

- 18 Leonis Ln

- 156 Osprey Cir Unit Lot F-22

- 214 Bald Eagle

- 57 Diamond A Ranch Rd Unit West

- 244 Raptor Cir

- 87 Diamond A Ranch Rd

- 109 Diamond A Ranch Rd

- 109 W Diamond A Ranch Rd

- 177 W Diamond A Ranch Rd

- 177 Mountain Meadows Rd

- 38 Diamond A Ranch Rd

- 54 Diamond A Ranch Rd