1010 Flat Rock St Greensboro, GA 30642

Estimated Value: $317,000 - $330,000

--

Bed

2

Baths

1,309

Sq Ft

$248/Sq Ft

Est. Value

About This Home

This home is located at 1010 Flat Rock St, Greensboro, GA 30642 and is currently estimated at $324,557, approximately $247 per square foot. 1010 Flat Rock St is a home located in Greene County with nearby schools including Greene County High School, Lake Oconee Academy Elementary, and Lake Oconee Academy High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 11, 2018

Sold by

Leplattenier Victor

Current Estimated Value

Purchase Details

Closed on

Jan 20, 2015

Sold by

Leplattenier Victor E

Bought by

Leplattenier Victor E and Leplattenier Nora

Purchase Details

Closed on

Jul 21, 2009

Sold by

Pulte Home Corporation

Bought by

Leplattenier Victor E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$178,825

Interest Rate

5.36%

Mortgage Type

FHA

Purchase Details

Closed on

Jan 29, 2008

Sold by

Vintage Communites Inc

Bought by

Pulte Home Corp

Purchase Details

Closed on

Feb 16, 2007

Sold by

Linger Longer Dev Co

Bought by

Vintage Communites Inc

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| -- | -- | -- | |

| Leplattenier Victor E | -- | -- | |

| Leplattenier Victor E | $185,000 | -- | |

| Pulte Home Corp | $4,403,600 | -- | |

| Vintage Communites Inc | $10,359,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Leplattenier Victor E | $178,825 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,065 | $127,880 | $30,000 | $97,880 |

| 2023 | $1,134 | $122,760 | $30,000 | $92,760 |

| 2022 | $1,134 | $106,840 | $18,000 | $88,840 |

| 2021 | $1,189 | $97,760 | $18,000 | $79,760 |

| 2020 | $1,291 | $74,760 | $6,000 | $68,760 |

| 2019 | $1,305 | $74,760 | $6,000 | $68,760 |

| 2018 | $1,283 | $74,760 | $6,000 | $68,760 |

| 2017 | $1,215 | $72,823 | $6,000 | $66,823 |

| 2016 | $1,216 | $73,534 | $6,000 | $67,534 |

| 2015 | $1,174 | $70,980 | $6,000 | $64,980 |

| 2014 | $1,198 | $69,269 | $12,000 | $57,269 |

Source: Public Records

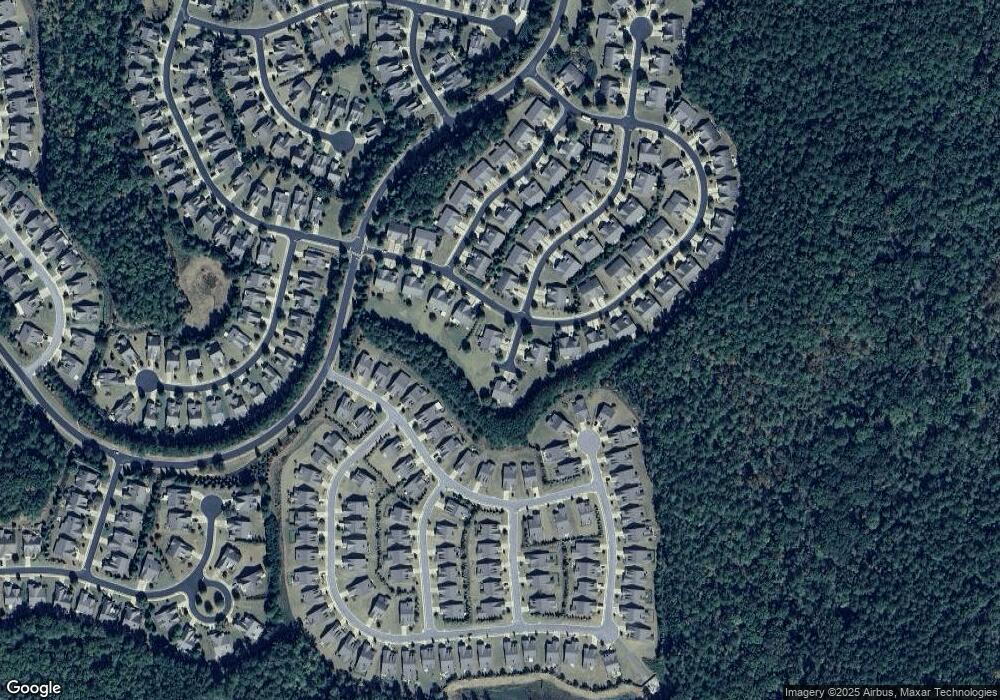

Map

Nearby Homes

- 1020 Flat Rock St

- 1300 Summer Hollow Rd

- 1310 Summer Hollow Rd

- 1000 Flat Rock St

- 1011 Flat Rock St

- 1021 Flat Rock St

- 1320 Summer Hollow Rd

- 1320 Summer Hollow Rd Unit 206

- 1040 Flat Rock St

- 1330 Summer Hollow Rd

- 1280 Summer Hollow Rd

- 1120 Summer Station St

- 1270 Summer Hollow Rd Unit 216

- 1041 Flat Rock St

- 0 Flat Rock St Unit 7140570

- 0 Flat Rock St Unit 7608529

- 0 Flat Rock St Unit 7318221

- 0 Flat Rock St Unit 8121823

- 0 Flat Rock St Unit 7518660

- 0 Flat Rock St Unit 7443560