1010 Willow Bluff Dr Unit 1010 Columbus, OH 43235

Linworth Village NeighborhoodEstimated Value: $377,295 - $404,000

2

Beds

3

Baths

2,133

Sq Ft

$185/Sq Ft

Est. Value

About This Home

This home is located at 1010 Willow Bluff Dr Unit 1010, Columbus, OH 43235 and is currently estimated at $394,324, approximately $184 per square foot. 1010 Willow Bluff Dr Unit 1010 is a home located in Franklin County with nearby schools including Gables Elementary School, Ridgeview Middle School, and Centennial High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 28, 2005

Sold by

May Eugene S and May Patricia G

Bought by

Gutmann Roy K and Gutmann Margaret A

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$181,600

Outstanding Balance

$96,019

Interest Rate

5.86%

Mortgage Type

New Conventional

Estimated Equity

$298,305

Purchase Details

Closed on

Nov 14, 2002

Sold by

Hazlett Linda J and Hazlett Rex A

Bought by

May Eugene S and May Patricia G

Purchase Details

Closed on

Apr 22, 1996

Sold by

Donald R Kenney Trst

Bought by

Hazlett Linda J and Hazlett Rex A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$119,900

Interest Rate

7.44%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Gutmann Roy K | $227,000 | -- | |

| May Eugene S | $225,900 | Chicago Title | |

| Hazlett Linda J | $169,900 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Gutmann Roy K | $181,600 | |

| Previous Owner | Hazlett Linda J | $119,900 | |

| Closed | Gutmann Roy K | $22,700 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $5,110 | $123,660 | $21,000 | $102,660 |

| 2023 | $5,073 | $123,655 | $21,000 | $102,655 |

| 2022 | $4,397 | $93,520 | $16,800 | $76,720 |

| 2021 | $4,404 | $93,520 | $16,800 | $76,720 |

| 2020 | $4,410 | $93,520 | $16,800 | $76,720 |

| 2019 | $4,198 | $77,950 | $14,000 | $63,950 |

| 2018 | $4,182 | $77,950 | $14,000 | $63,950 |

| 2017 | $4,195 | $77,950 | $14,000 | $63,950 |

| 2016 | $4,598 | $78,160 | $14,980 | $63,180 |

| 2015 | $4,174 | $78,160 | $14,980 | $63,180 |

| 2014 | $4,184 | $78,160 | $14,980 | $63,180 |

| 2013 | $2,185 | $82,250 | $15,750 | $66,500 |

Source: Public Records

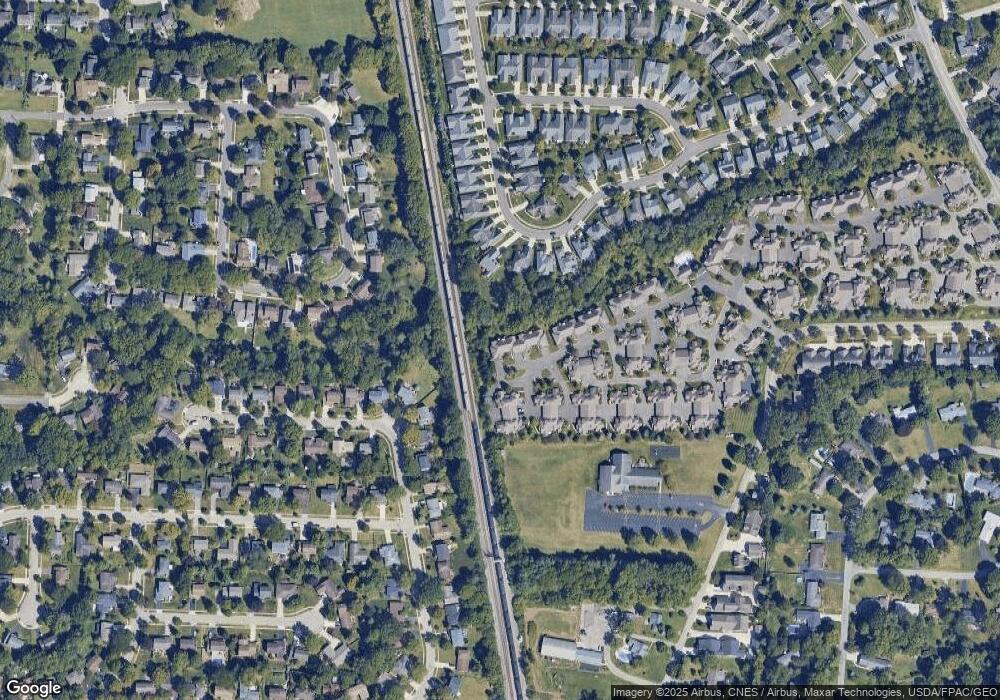

Map

Nearby Homes

- 928 Linworth Village Dr

- 5016 Postlewaite Rd Unit 5016

- 895 Linworth Village Dr

- 962 Augusta Glen Dr

- 1213 Nantucket Ave

- 1246 Southport Dr

- 1161 Bethel Rd Unit 103/104

- 1147 Langland Dr

- 5363 Godown Rd

- 5773 Middlefield Dr

- 5854 Aqua Bay Dr Unit 5854

- 1505 Eastmeadow Place

- 5881 Rocky Rill Rd

- 1540 Slade Ave Unit 303

- 511 W Kanawha Ave

- 5936 Aqua Bay Dr

- 5938 Aqua Bay Dr

- 409 Fenway Rd

- 6041 Rocky Rill Rd

- 652 Olde Towne Ave Unit 9-652E

- 1008 Willow Bluff Dr

- 1006 Willow Bluff Dr

- 1004 Willow Bluff Dr Unit 1004

- 1029 Willow Bluff Dr Unit 1029

- 1031 Willow Bluff Dr Unit 1031

- 1027 Willow Bluff Dr Unit 1027

- 1000 Willow Bluff Dr

- 1027 Linworth Village Dr

- 1019 Willow Bluff Dr Unit 1019

- 1025 Willow Bluff Dr

- 1001 Willow Bluff Dr Unit 1001

- 1017 Willow Bluff Dr Unit 1017

- 1015 Linworth Village Dr

- 998 Willow Bluff Dr

- 1011 Village Brook Way Unit 1011

- 1021 Willow Bluff Dr

- 5304 Rockport St

- 996 Willow Bluff Dr

- 1021 Linworth Village Dr

- 1015 Willow Bluff Dr Unit 1015