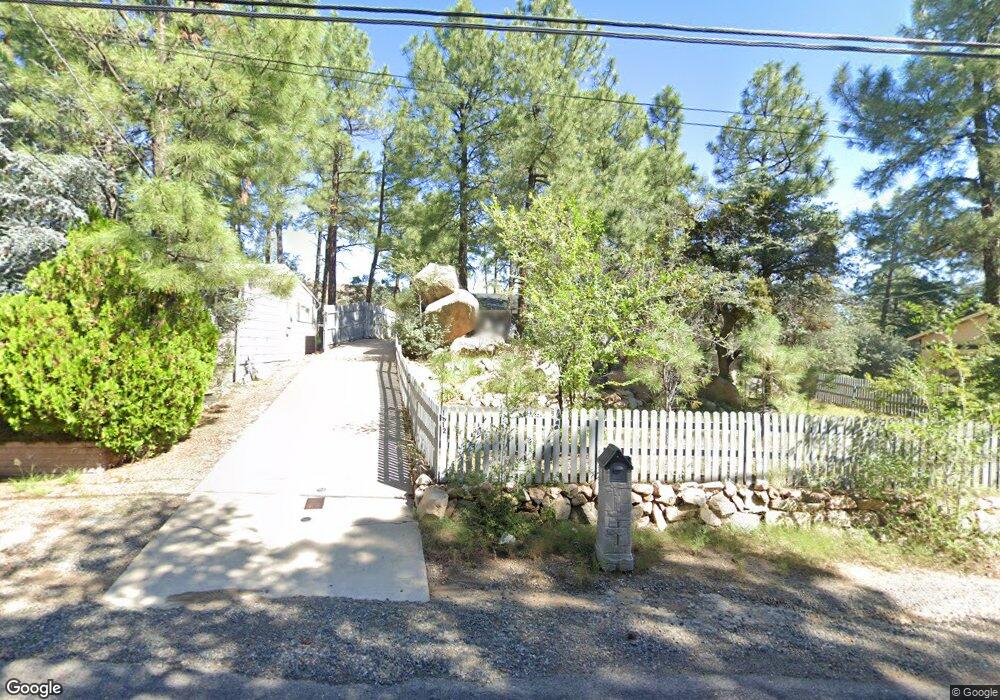

1012 Heap Ave Prescott, AZ 86303

Estimated Value: $423,000 - $481,000

Studio

--

Bath

1,188

Sq Ft

$381/Sq Ft

Est. Value

About This Home

This home is located at 1012 Heap Ave, Prescott, AZ 86303 and is currently estimated at $453,033, approximately $381 per square foot. 1012 Heap Ave is a home located in Yavapai County with nearby schools including Lincoln Elementary School, Granite Mountain Middle School, and Prescott Mile High Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 5, 2017

Sold by

Robinson Pterer D and Robinson Denise V

Bought by

Carr Casey and Carr Corrie

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$140,800

Outstanding Balance

$117,221

Interest Rate

4.14%

Mortgage Type

New Conventional

Estimated Equity

$335,812

Purchase Details

Closed on

Jun 27, 2002

Sold by

Berlowe Patricia Susan

Bought by

Robinson Peter D and Robinson Denise

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$111,600

Interest Rate

6%

Mortgage Type

New Conventional

Purchase Details

Closed on

Sep 18, 1996

Sold by

Berlowe Michael A

Bought by

Berlowe Patricia Susan

Purchase Details

Closed on

Sep 17, 1996

Sold by

Lampton Mary E

Bought by

Berlowe Patricia Susan

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Carr Casey | $176,000 | Pioneer Title Agency | |

| Robinson Peter D | $139,500 | First American Title Ins Co | |

| Berlowe Patricia Susan | -- | Westitle Agency | |

| Berlowe Patricia Susan | $100,000 | Westitle Agency |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Carr Casey | $140,800 | |

| Previous Owner | Robinson Peter D | $111,600 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2026 | $1,078 | $32,211 | -- | -- |

| 2024 | $1,056 | $29,224 | -- | -- |

| 2023 | $1,056 | $23,972 | $9,376 | $14,596 |

| 2022 | $1,035 | $19,691 | $7,497 | $12,194 |

| 2021 | $1,079 | $19,064 | $7,027 | $12,037 |

| 2020 | $1,081 | $0 | $0 | $0 |

| 2019 | $1,067 | $0 | $0 | $0 |

| 2018 | $1,029 | $0 | $0 | $0 |

| 2017 | $982 | $0 | $0 | $0 |

| 2016 | $832 | $0 | $0 | $0 |

| 2015 | $807 | $0 | $0 | $0 |

| 2014 | -- | $0 | $0 | $0 |

Source: Public Records

Map

Nearby Homes

- 103 San Carlos Rd

- 286 San Carlos Rd

- 253 S Willow St

- 910 W Gurley St Unit 127

- 910 W Gurley St Unit 8

- 910 W Gurley St Unit 32

- 910 W Gurley St Unit 19

- 217 Creekside Cir Unit 16E

- 217 Creekside Cir Unit 16D

- 212 Creekside Cir Unit C

- 212 Creekside Cir Unit 2c

- 221 Hidden Dr

- 715 W Gurley St

- 654 W Gurley St

- 121 N Willow St

- 425 Fairway View Dr

- 435 Fairway View Dr

- 1100 Deodora Ln Unit 206

- 530 Woolsey Dr

- 415 Gail Gardner Way

- 1016 Heap Ave

- 1006 Heap Ave

- 1020 Heap Ave

- 130 Cory Ave

- 127 Grace Ave

- 1004 Heap Ave

- 125 Grace Ave

- 1022 Heap Ave

- 123 Grace Ave

- 123 Grace Ave Unit 11

- 0 Heap Ave

- 202 Cory Ave

- 1019 Heap Ave

- 121 Grace Ave

- 121 Grace Ave Unit 10

- 1026 Heap Ave

- 120 Cory Ave

- 1025 Heap Ave

- 1025 Heap Ave Unit B

- 1025 Heap Ave Unit A