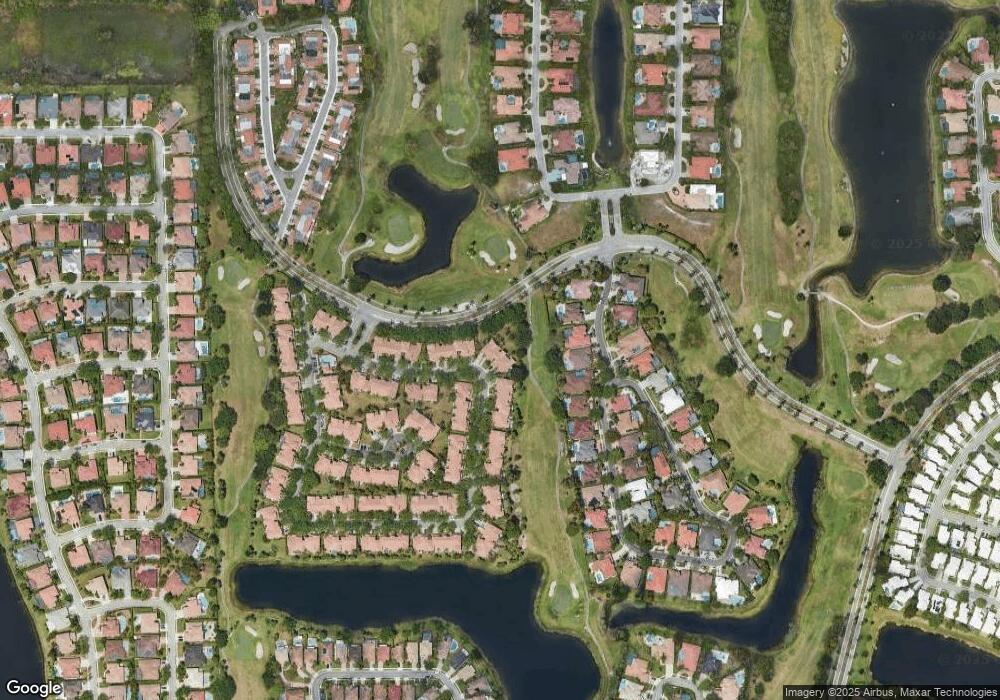

1013 SW 158th Ave Unit 2 Pembroke Pines, FL 33027

Hollywood Lakes Country Club NeighborhoodEstimated Value: $507,000 - $563,000

3

Beds

2

Baths

1,593

Sq Ft

$339/Sq Ft

Est. Value

About This Home

This home is located at 1013 SW 158th Ave Unit 2, Pembroke Pines, FL 33027 and is currently estimated at $539,470, approximately $338 per square foot. 1013 SW 158th Ave Unit 2 is a home located in Broward County with nearby schools including Silver Palms Elementary School, Walter C. Young Middle School, and Charles W Flanagan High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 14, 2017

Sold by

Velez Maria T

Bought by

Sanuders Mahala Jacqualine

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$294,566

Outstanding Balance

$249,756

Interest Rate

4.75%

Mortgage Type

FHA

Estimated Equity

$289,714

Purchase Details

Closed on

Jun 8, 2007

Sold by

Masson Jeannine M

Bought by

Velez Maria T

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$75,000

Interest Rate

6.1%

Mortgage Type

Credit Line Revolving

Purchase Details

Closed on

Jun 21, 2004

Sold by

Brown Michael T and Brown Mary

Bought by

Masson Jeannine M

Purchase Details

Closed on

Oct 26, 1998

Sold by

Shelby Homes At The Courtyards Ltd

Bought by

Brown Michael T

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$121,600

Interest Rate

6.76%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Sanuders Mahala Jacqualine | $300,000 | Trinity Title & Escrow Llc | |

| Velez Maria T | $335,000 | Dade County Title Corp | |

| Masson Jeannine M | $262,000 | Fidelity National Title Ins | |

| Brown Michael T | $152,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Sanuders Mahala Jacqualine | $294,566 | |

| Previous Owner | Velez Maria T | $75,000 | |

| Previous Owner | Velez Maria T | $130,000 | |

| Previous Owner | Brown Michael T | $121,600 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,033 | $346,280 | -- | -- |

| 2024 | $5,859 | $336,530 | -- | -- |

| 2023 | $5,859 | $326,730 | $0 | $0 |

| 2022 | $5,530 | $317,220 | $0 | $0 |

| 2021 | $5,434 | $307,990 | $0 | $0 |

| 2020 | $5,377 | $303,740 | $0 | $0 |

| 2019 | $5,289 | $296,920 | $77,170 | $219,750 |

| 2018 | $5,151 | $294,370 | $77,170 | $217,200 |

| 2017 | $6,050 | $296,320 | $0 | $0 |

| 2016 | $6,026 | $289,180 | $0 | $0 |

| 2015 | $5,746 | $267,640 | $0 | $0 |

| 2014 | $5,266 | $243,310 | $0 | $0 |

| 2013 | -- | $225,770 | $82,650 | $143,120 |

Source: Public Records

Map

Nearby Homes

- 15822 SW 10th St

- 15831 SW 10th St

- 1102 SW 158th Ave Unit 6

- 15827 SW 12th St

- 1091 SW 156th Ave

- 1113 SW 156th Terrace

- 1100 SW 156th Ave

- 15899 SW 12th St

- 561 Enclave Cir E

- 1423 SW 158th Ave

- 541 Enclave Cir E

- 15830 SW 3rd Ct Unit 1027

- 301 SW 158th Terrace Unit 104

- 1040 Wilshire Cir W

- 1490 SW 159th Ave

- 257 SW 159th Ct

- 15927 SW 2nd Place

- 238 SW 159th Ct

- 1170 Wilshire Cir E

- 245 SW 159th Ct

- 1013 SW 158th Ave Unit 1013

- 1021 SW 158th Ave

- 1001 SW 158th Ave

- 1021 SW 158th Ave Unit 3

- 1033 SW 158th Ave

- 15801 SW 10th St

- 1041 SW 158th Ave

- 15803 SW 10th St

- 1053 SW 158th Ave

- 1054 SW 158th Ave Unit 6

- 1061 SW 158th Ave

- 15811 SW 10th St

- 15813 SW 10th St

- 1073 SW 158th Ave

- 1062 SW 158th Ave

- 15821 SW 10th St Unit 15821

- 15821 SW 10th St Unit 1

- 15821 SW 10th St

- 1081 SW 158th Ave Unit 5

- 1074 SW 158th Ave