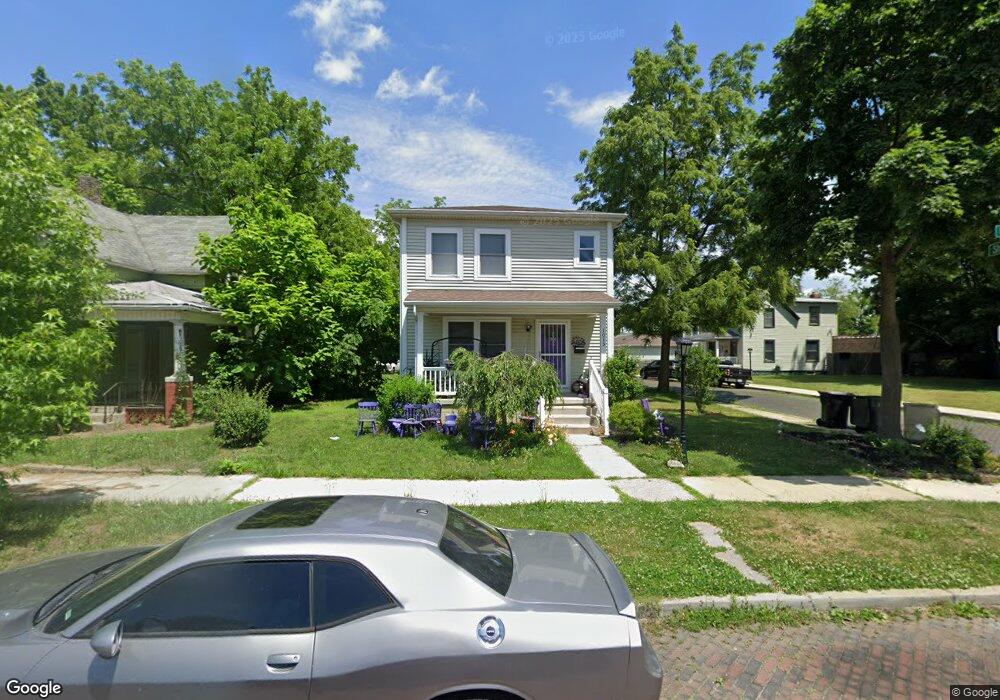

1015 W Oak St South Bend, IN 46616

Kennedy Park NeighborhoodEstimated Value: $154,000 - $216,000

4

Beds

2

Baths

1,260

Sq Ft

$150/Sq Ft

Est. Value

About This Home

This home is located at 1015 W Oak St, South Bend, IN 46616 and is currently estimated at $189,614, approximately $150 per square foot. 1015 W Oak St is a home located in St. Joseph County with nearby schools including Clay Intermediate Center, Marshall Traditional School, and Madison STEAM Academy.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 1, 2015

Sold by

Lincoln Park Dev Llc

Bought by

South Bend Mutual Homes Lp

Current Estimated Value

Purchase Details

Closed on

Oct 31, 2014

Sold by

St Joseph County Auditor

Bought by

Lincoln Park Development Llc

Purchase Details

Closed on

Jan 21, 2011

Sold by

Trozzy William A

Bought by

Hill Tracey

Purchase Details

Closed on

Oct 18, 2005

Sold by

Johnson Melvin E and Johnson Linda B

Bought by

Haste Aaron

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$57,600

Interest Rate

8.52%

Mortgage Type

Adjustable Rate Mortgage/ARM

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| South Bend Mutual Homes Lp | -- | Meridian Title | |

| Lincoln Park Development Llc | -- | -- | |

| Hill Tracey | -- | None Available | |

| Trozzy William A | -- | None Available | |

| Haste Aaron | -- | Title Express Inc |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Haste Aaron | $57,600 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $541 | $120,500 | $3,100 | $117,400 |

| 2023 | $494 | $20,900 | $3,100 | $17,800 |

| 2022 | $494 | $34,900 | $8,700 | $26,200 |

| 2021 | $655 | $27,300 | $3,100 | $24,200 |

| 2020 | $660 | $27,500 | $3,100 | $24,400 |

| 2019 | $548 | $27,400 | $2,800 | $24,600 |

| 2018 | $654 | $27,400 | $2,800 | $24,600 |

| 2017 | $690 | $137,900 | $2,800 | $135,100 |

| 2016 | $2,958 | $115,900 | $2,400 | $113,500 |

| 2014 | $73 | $2,800 | $2,800 | $0 |

| 2013 | -- | $2,800 | $2,800 | $0 |

Source: Public Records

Map

Nearby Homes

- 918 W Lasalle Ave

- 839 W Colfax Ave Unit 841

- 839 & 841 W Colfax St Unit 2 family dwelling ho

- 611 Blaine Ave

- 524 Euclid Ave

- 1209 Poplar St

- 1111 Lindsey St

- 529 Euclid Ave

- 213 N Walnut St

- 617 N Walnut St

- 322 Studebaker St

- 141 N Walnut St

- 418 Studebaker St

- 745 Allen St

- 1311 Liston St

- 317 Studebaker St

- 210 Chapin St

- 661 Lawndale Ave

- 121 Studebaker St

- 718 W Jefferson Blvd

- 1017 W Oak St

- 1021 W Oak St

- 1007 W Oak St

- 410 Sherman Ave

- 411 Sherman Ave

- 1001 W Oak St

- 1025 W Oak St

- 1020 Fuerbringer St

- 1024 W Oak St

- 1018 Fuerbringer St

- 415 Sherman Ave

- 1029 W Oak St

- 1016 W Oak St

- 1012 W Oak St

- 1020 W Oak St

- 414 Allen St

- 1014 Fuerbringer St

- 929 W Oak St

- 1033 W Oak St

- 417 Sherman Ave