1017 7th St Laurel, MD 20707

Estimated Value: $363,618 - $415,000

Studio

2

Baths

1,136

Sq Ft

$336/Sq Ft

Est. Value

About This Home

This home is located at 1017 7th St, Laurel, MD 20707 and is currently estimated at $381,905, approximately $336 per square foot. 1017 7th St is a home located in Prince George's County with nearby schools including Scotchtown Hills Elementary School, Dwight D. Eisenhower Middle School, and Laurel High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 1, 2017

Sold by

Mejia Oscar A and Mejia Osmin

Bought by

Mejia Oscar A

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$196,350

Outstanding Balance

$104,758

Interest Rate

3.89%

Mortgage Type

Stand Alone Second

Estimated Equity

$277,147

Purchase Details

Closed on

Nov 5, 2004

Sold by

Secretary Of Veterans Affai

Bought by

Mejia Oscar A

Purchase Details

Closed on

Sep 14, 2004

Sold by

Secretary Of Veterans Affai

Bought by

Mejia Oscar A

Purchase Details

Closed on

Oct 3, 2003

Sold by

Johnson Raymond W M

Bought by

Secretary Of Veterans Affairs

Purchase Details

Closed on

May 15, 2002

Sold by

Banschback Leroy G

Bought by

Johnson Raymond W M

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Mejia Oscar A | -- | None Available | |

| Mejia Oscar A | $205,000 | -- | |

| Mejia Oscar A | $205,000 | -- | |

| Secretary Of Veterans Affairs | $134,839 | -- | |

| Johnson Raymond W M | $148,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Mejia Oscar A | $196,350 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,837 | $299,400 | $100,400 | $199,000 |

| 2024 | $4,837 | $282,667 | -- | -- |

| 2023 | $4,589 | $265,933 | $0 | $0 |

| 2022 | $4,298 | $249,200 | $75,400 | $173,800 |

| 2021 | $4,068 | $236,867 | $0 | $0 |

| 2020 | $3,928 | $224,533 | $0 | $0 |

| 2019 | $3,781 | $212,200 | $75,200 | $137,000 |

| 2018 | $3,657 | $203,967 | $0 | $0 |

| 2017 | $3,555 | $195,733 | $0 | $0 |

| 2016 | -- | $187,500 | $0 | $0 |

| 2015 | $3,141 | $187,500 | $0 | $0 |

| 2014 | $3,141 | $187,500 | $0 | $0 |

Source: Public Records

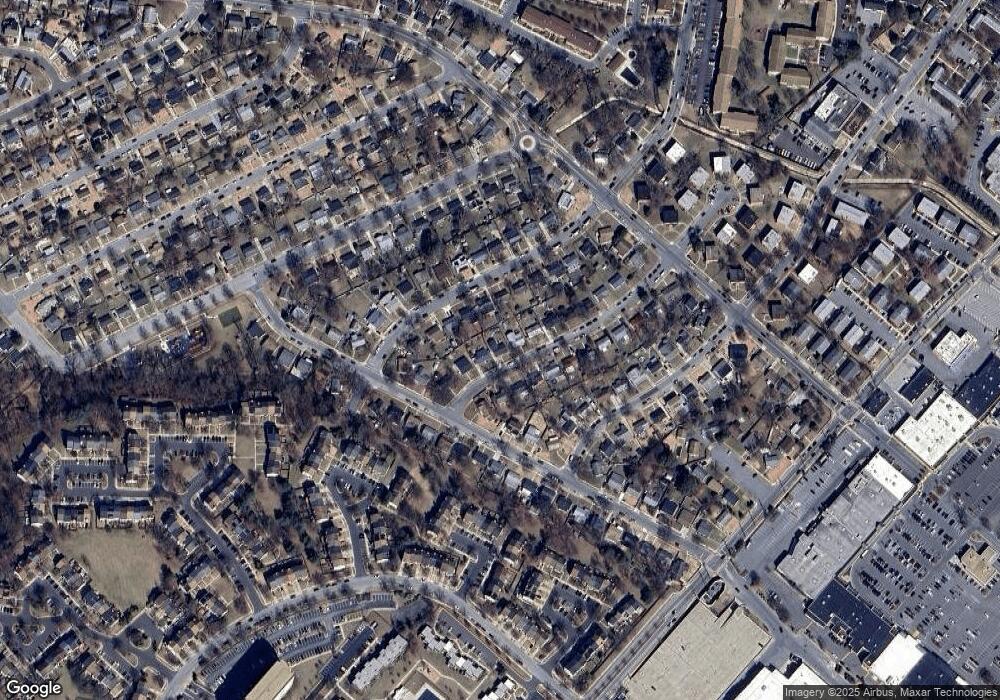

Map

Nearby Homes

- 1010 7th St

- 1000 8th St

- 1002 7th St

- 1004 Marton St

- 903 Montrose Ave

- 8218 Londonderry Ct

- 1009 Turney Ave

- 8112 Fenwick Ct

- 14902 Ashford Place

- 501 8th St

- 509 4th St

- 916 Philip Powers Dr

- 14633 Cambridge Cir

- 1016 Phillip Powers Dr

- 910 Montgomery St Unit A

- 1210 Westview Terrace

- 14811 Belle Ami Dr

- 505A Montgomery St

- 413 Montgomery St

- 1103 Montgomery St