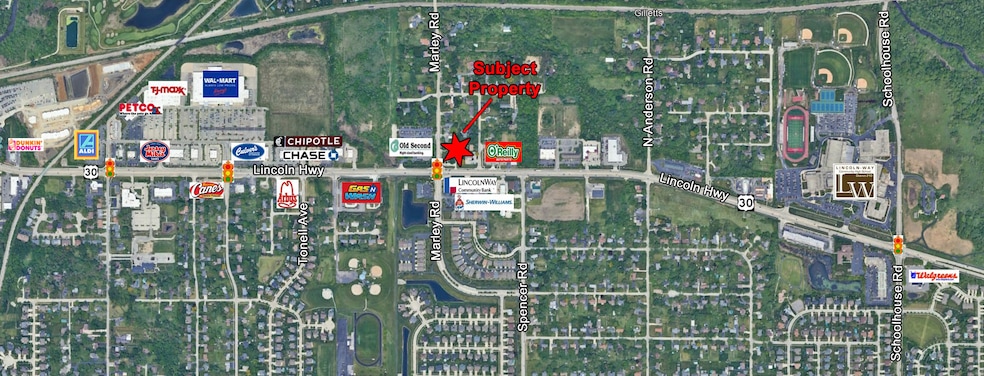

1017 E Lincoln Hwy New Lenox, IL 60451

Estimated payment $5,657/month

Total Views

25,389

0.91

Acre

$983,516

Price per Acre

39,640

Sq Ft Lot

Highlights

- Waterfront

- Bentley Elementary School Rated 9+

- 0.91 Acre Lot

About This Lot

This home is located at 1017 E Lincoln Hwy, New Lenox, IL 60451 and is currently priced at $895,000. 1017 E Lincoln Hwy is a home located in Will County with nearby schools including Bentley Elementary School, Arnold J Tyler School, and Alex M Martino Jr High School.

Property Details

Property Type

- Land

Est. Annual Taxes

- $9,816

Lot Details

- 0.91 Acre Lot

- Lot Dimensions are 160.48 x 153.08 x 183.18 x 131

- Waterfront

- Property fronts a state road

- Additional Parcels

- Property is zoned SINGL

Utilities

- Electricity To Lot Line

- Gas Available

Map

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2023 | $4,435 | $66,392 | $22,006 | $44,386 |

| 2022 | $4,351 | $61,163 | $20,273 | $40,890 |

| 2021 | $4,861 | $57,522 | $19,066 | $38,456 |

| 2020 | $4,732 | $55,470 | $18,386 | $37,084 |

| 2019 | $4,535 | $53,750 | $17,816 | $35,934 |

| 2018 | $4,439 | $51,897 | $17,202 | $34,695 |

| 2017 | $4,221 | $50,405 | $16,707 | $33,698 |

| 2016 | $4,105 | $49,056 | $16,260 | $32,796 |

| 2015 | $3,955 | $47,512 | $15,748 | $31,764 |

| 2014 | $3,955 | $46,926 | $15,554 | $31,372 |

| 2013 | $3,955 | $47,559 | $15,764 | $31,795 |

Source: Public Records

Property History

| Date | Event | Price | Change | Sq Ft Price |

|---|---|---|---|---|

| 11/20/2023 11/20/23 | For Sale | $895,000 | 0.0% | -- |

| 04/15/2023 04/15/23 | Rented | $2,150 | +7.5% | -- |

| 04/12/2023 04/12/23 | For Rent | $2,000 | 0.0% | -- |

| 08/02/2022 08/02/22 | Sold | $155,000 | +3.3% | $86 / Sq Ft |

| 06/23/2022 06/23/22 | Pending | -- | -- | -- |

| 06/07/2022 06/07/22 | For Sale | $150,000 | -- | $83 / Sq Ft |

Source: Midwest Real Estate Data (MRED)

Purchase History

| Date | Type | Sale Price | Title Company |

|---|---|---|---|

| Quit Claim Deed | -- | -- | |

| Warranty Deed | $155,000 | Old Republic Title | |

| Deed | -- | None Available | |

| Interfamily Deed Transfer | -- | -- | |

| Warranty Deed | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Loan Amount | Loan Type |

|---|---|---|---|

| Previous Owner | $100,000 | Unknown | |

| Previous Owner | $106,500 | No Value Available |

Source: Public Records

Source: Midwest Real Estate Data (MRED)

MLS Number: 11934067

APN: 15-08-14-303-023

Nearby Homes

- 449 Somerset Ln Unit 1

- 125 N Anderson Rd

- 1132 Georgias Way

- 1139 Georgias Way

- 1125 Georgias Way

- 1193 Georgias Way

- 1212 Georgias Way

- 935 Regent St

- 214 Somerset Ct

- 745 Longlane Rd

- 762 Lake Rd Unit 3

- 709 Garadice Dr

- 671 Princeton Ln

- 1351 E Lincoln Hwy

- 869 O Connell St

- 15707 Valley View St

- 920 Barnside Rd

- 621 Chatfield Rd

- 1108 Plaza Dr

- 1535 Glenbrooke Ln

- 718 Lake Rd Unit 1

- 208 N Prairie Rd

- 620 Northgate Rd

- 1224 N Cedar Rd Unit R

- 2874 Ryan Dr

- 869 Oakwood Dr

- 611 Cottonwood Rd

- 516 Lincoln Ln Unit 1N

- 17727 Mayher Dr

- 23852 S Scheer Rd

- 155 S Locust St

- 249 W Nebraska St

- 436 Burke Dr

- 1005 Parkwood Dr

- 11256 Lakefield Dr

- 9266 Maura Ct

- 411 Krakar Ave Unit 2E

- 10 Boulder Ave

- 17215 S Juniper Dr

- 107 Arizona Ave Unit 2S