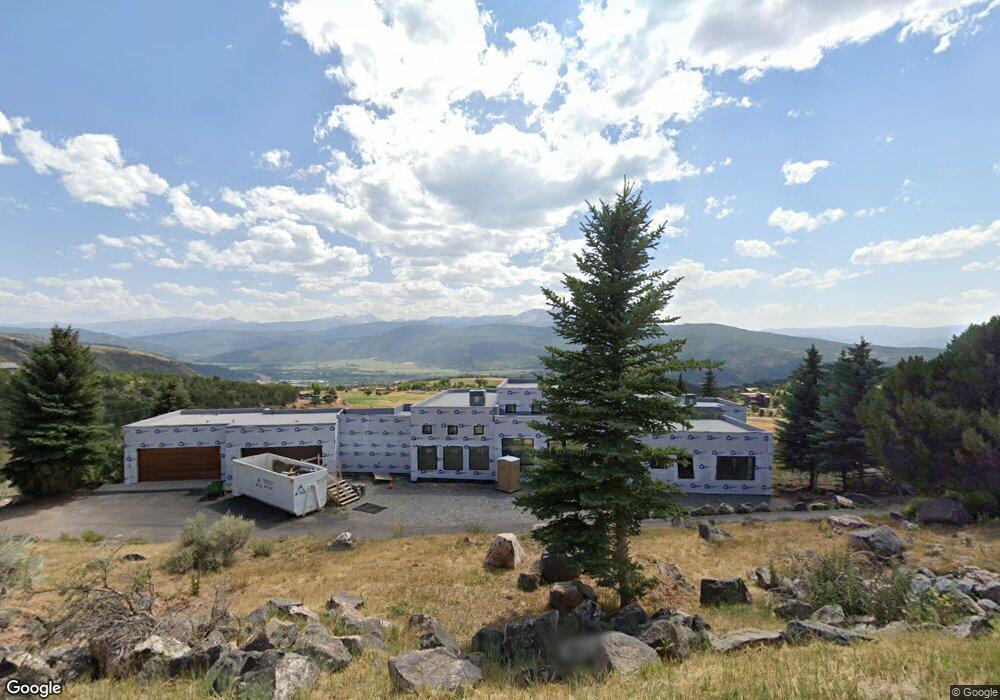

102 Blue Creek Trail Carbondale, CO 81623

Estimated Value: $5,130,000 - $5,721,425

5

Beds

6

Baths

9,859

Sq Ft

$560/Sq Ft

Est. Value

About This Home

This home is located at 102 Blue Creek Trail, Carbondale, CO 81623 and is currently estimated at $5,518,856, approximately $559 per square foot. 102 Blue Creek Trail is a home located in Eagle County.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 30, 2020

Sold by

Jm Family Associates Ltd

Bought by

Calesa Family Trust

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$2,500,000

Outstanding Balance

$2,219,563

Interest Rate

2.8%

Mortgage Type

Commercial

Estimated Equity

$3,299,293

Purchase Details

Closed on

Jan 3, 2011

Sold by

Jm Family Associates Ltd

Bought by

El Jebel Holdings Llc

Purchase Details

Closed on

Sep 15, 2008

Sold by

Mason Carol D

Bought by

Jm Family Associates Ltd

Purchase Details

Closed on

Mar 8, 2004

Sold by

Ccm Diversified Lllp

Bought by

Mason Carol D

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$1,260,000

Interest Rate

5.71%

Mortgage Type

Construction

Purchase Details

Closed on

Dec 8, 2000

Sold by

Mcleod Nonie V

Bought by

Ccm Diversified Lllp

Purchase Details

Closed on

Feb 3, 1995

Purchase Details

Closed on

Apr 13, 1994

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Calesa Family Trust | $3,800,000 | Land Title Guarantee Co | |

| El Jebel Holdings Llc | $2,200,000 | Land Title Guarantee Company | |

| Jm Family Associates Ltd | $3,600,000 | Fahtco | |

| Mason Carol D | -- | Pitkin County Title Inc | |

| Ccm Diversified Lllp | $312,500 | Stewart Title | |

| -- | $135,000 | -- | |

| -- | $90,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Calesa Family Trust | $2,500,000 | |

| Previous Owner | Mason Carol D | $1,260,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $28,483 | $382,630 | $37,490 | $345,140 |

| 2023 | $28,483 | $382,630 | $37,490 | $345,140 |

| 2022 | $16,408 | $204,140 | $17,380 | $186,760 |

| 2021 | $16,862 | $210,010 | $17,880 | $192,130 |

| 2020 | $9,171 | $119,900 | $15,730 | $104,170 |

| 2019 | $9,257 | $119,900 | $15,730 | $104,170 |

| 2018 | $8,682 | $111,390 | $16,200 | $95,190 |

| 2017 | $8,221 | $111,390 | $16,200 | $95,190 |

| 2016 | $10,366 | $137,990 | $17,910 | $120,080 |

| 2015 | -- | $137,990 | $17,910 | $120,080 |

| 2014 | $7,909 | $110,830 | $16,720 | $94,110 |

Source: Public Records

Map

Nearby Homes

- 450 Green Meadow Dr

- 81 Mountain View Rd

- 577 Fox Run Dr

- 735 Green Meadow Dr

- 298 Black Bear Trail

- 14 Fender Ln

- 456 Black Bear Trail

- 161 James Cir

- 110 Floyd Rd

- 123 Summit Dr

- TBD Whitecloud Rd

- 196 Dakota Meadows Dr

- 145 Juniper Trail

- 140 Juniper Trail Unit 140

- 604 Larkspur Dr

- 0 Larkspur Dr

- 364 Larkspur Dr

- 500 Whitecloud Rd

- TBD Lakeview Dr Unit The Northside

- TBD Lakeview Dr Unit 2

- 102 Blue Creek Trail Unit Trail

- 112 Blue Creek Trail Unit Trail

- 112 Blue Creek Trail

- 0095 Blue Creek Trail Unit Trail

- 122 Blue Creek Trail

- 32 Blue Creek Trail

- 111 Blue Creek Trail

- 111 Blue Creek Trail Unit Trail

- 95 Blue Creek Trail

- 007 Blue Creek Overlook

- 12 Blue Creek Trail

- 12 Blue Creek Trail Unit Trail

- 19 Blue Creek Trail

- 62 Blue Creek Overlook

- 42 Blue Creek Overlook

- 205 Blue Creek Trail

- 202 Blue Creek Trail

- 202 Blue Creek Trail Unit Trail

- 2158 Upper Cattle Creek Rd

- 2158 Upper Cattle Creek Rd