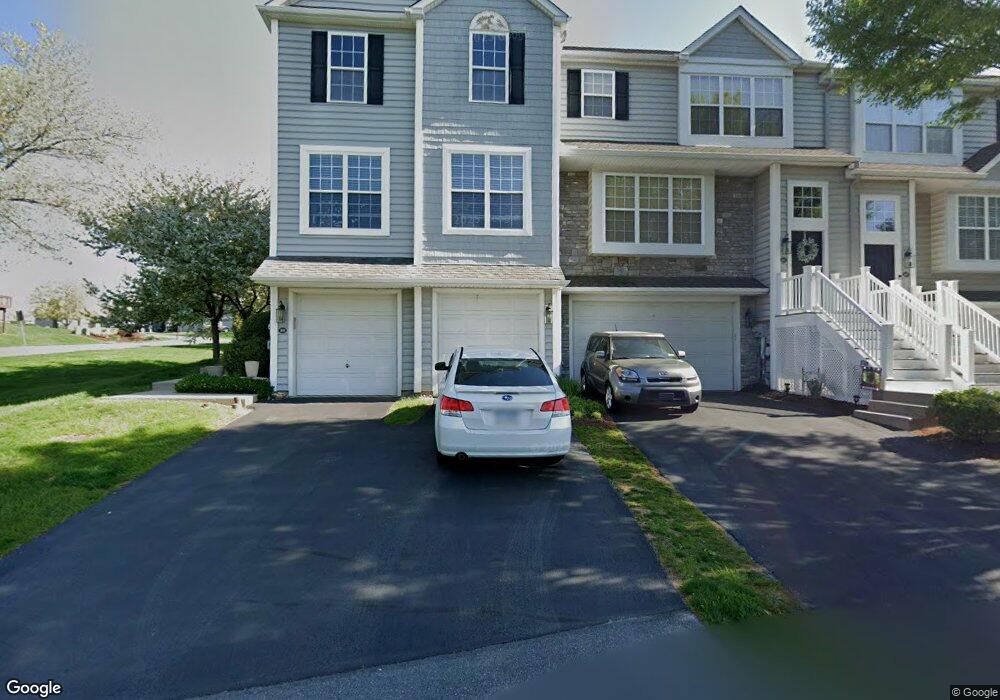

102 Heather Way Unit A1B Morgantown, PA 19543

Estimated Value: $370,000 - $395,960

3

Beds

3

Baths

2,472

Sq Ft

$155/Sq Ft

Est. Value

About This Home

This home is located at 102 Heather Way Unit A1B, Morgantown, PA 19543 and is currently estimated at $383,490, approximately $155 per square foot. 102 Heather Way Unit A1B is a home located in Berks County with nearby schools including Twin Valley Elementary Center, Twin Valley Middle School, and Twin Valley High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 10, 2022

Sold by

Brilliant Aaron S

Bought by

Schreiber Joslyn M and King John J

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$244,000

Outstanding Balance

$236,392

Interest Rate

6.92%

Mortgage Type

New Conventional

Estimated Equity

$147,098

Purchase Details

Closed on

May 16, 2007

Sold by

Heatherbrook Land Lp

Bought by

Brilliant Aaron S

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$197,452

Interest Rate

6.14%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Schreiber Joslyn M | $305,000 | -- | |

| Brilliant Aaron S | $263,270 | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Schreiber Joslyn M | $244,000 | |

| Previous Owner | Brilliant Aaron S | $197,452 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,306 | $187,600 | $27,500 | $160,100 |

| 2024 | $7,340 | $187,600 | $27,500 | $160,100 |

| 2023 | $7,347 | $187,600 | $27,500 | $160,100 |

| 2022 | $7,167 | $187,600 | $27,500 | $160,100 |

| 2021 | $6,949 | $187,600 | $27,500 | $160,100 |

| 2020 | $7,073 | $187,600 | $27,500 | $160,100 |

| 2019 | $7,070 | $187,600 | $27,500 | $160,100 |

| 2018 | $7,070 | $187,600 | $27,500 | $160,100 |

| 2017 | $6,871 | $187,600 | $27,500 | $160,100 |

| 2016 | $1,812 | $187,600 | $27,500 | $160,100 |

| 2015 | $1,812 | $187,600 | $27,500 | $160,100 |

| 2014 | $1,812 | $187,600 | $27,500 | $160,100 |

Source: Public Records

Map

Nearby Homes

- 44 Wexford Ct

- 24 Wexford Ct

- 102 Country Ln

- 1520 Lexington Way

- 3511 Main St

- 0 Heritage Dr Unit 4A PABK2058798

- 1 Senn Ln

- 28 W Main St

- 619 Homestead Dr

- 59 E Main St

- 112 Maxwell Hill Rd

- 601 Briarwood Dr

- 10 Woods Rd

- 20 Broad ax Pass

- 1250 Chestnut Tree Rd

- 319 Ironstone Ln

- 279 Furnace Rd

- 201 Pine Swamp Rd

- 87 Brownstone Ln

- 63 Brownstone Ln

- 102 Heather Way

- 101 Heather Way

- 103 Heather Way

- 103 Heather Way Unit A1C

- 104 Heather Way Unit A1D

- 104 Heather Way

- 105 Heather Way

- 106 Heather Way

- 201 Heather Way Unit A2A

- 204 Ridgeview Dr Unit 89

- 201 Ridgeview Dr

- 203 Ridgeview Dr

- 202 Ridgeview Dr

- 202 Heather Way

- 401 Ridgeview Dr

- 302 Heather Way

- 402 Ridgeview Dr

- 203 Heather Way Unit A2C

- 1200 Chatham Dr

- 403 Ridgeview Dr