1020 Arcadia Blvd Unit 1020 Westerville, OH 43082

Genoa NeighborhoodEstimated Value: $502,000 - $536,000

2

Beds

3

Baths

1,714

Sq Ft

$299/Sq Ft

Est. Value

About This Home

This home is located at 1020 Arcadia Blvd Unit 1020, Westerville, OH 43082 and is currently estimated at $512,385, approximately $298 per square foot. 1020 Arcadia Blvd Unit 1020 is a home located in Delaware County with nearby schools including Walnut Creek Elementary School, Berkshire Middle School, and Orange High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 2, 2022

Sold by

Conley Douglas J and Conley Karen K

Bought by

Fosgate Steve G

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$403,700

Outstanding Balance

$391,872

Interest Rate

7.08%

Mortgage Type

New Conventional

Estimated Equity

$120,513

Purchase Details

Closed on

Mar 12, 2012

Sold by

Gussman Clara E

Bought by

Conley Douglas J and Conley Karen K

Purchase Details

Closed on

Jan 31, 2005

Sold by

Romanelli & Hughes Building Co

Bought by

Gussman Clara E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$199,894

Interest Rate

5.37%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Fosgate Steve G | -- | First Ohio Title | |

| Conley Douglas J | $91,666 | None Available | |

| Gussman Clara E | $285,800 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Fosgate Steve G | $403,700 | |

| Previous Owner | Gussman Clara E | $199,894 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $9,237 | $164,750 | $15,750 | $149,000 |

| 2023 | $9,271 | $164,750 | $15,750 | $149,000 |

| 2022 | $7,812 | $110,150 | $20,480 | $89,670 |

| 2021 | $7,849 | $110,150 | $20,480 | $89,670 |

| 2020 | $7,888 | $110,150 | $20,480 | $89,670 |

| 2019 | $6,529 | $93,730 | $15,750 | $77,980 |

| 2018 | $6,553 | $93,730 | $15,750 | $77,980 |

| 2017 | $6,072 | $86,240 | $15,750 | $70,490 |

| 2016 | $6,448 | $86,240 | $15,750 | $70,490 |

| 2015 | $5,651 | $86,240 | $15,750 | $70,490 |

| 2014 | $5,724 | $86,240 | $15,750 | $70,490 |

| 2013 | $6,048 | $89,180 | $15,750 | $73,430 |

Source: Public Records

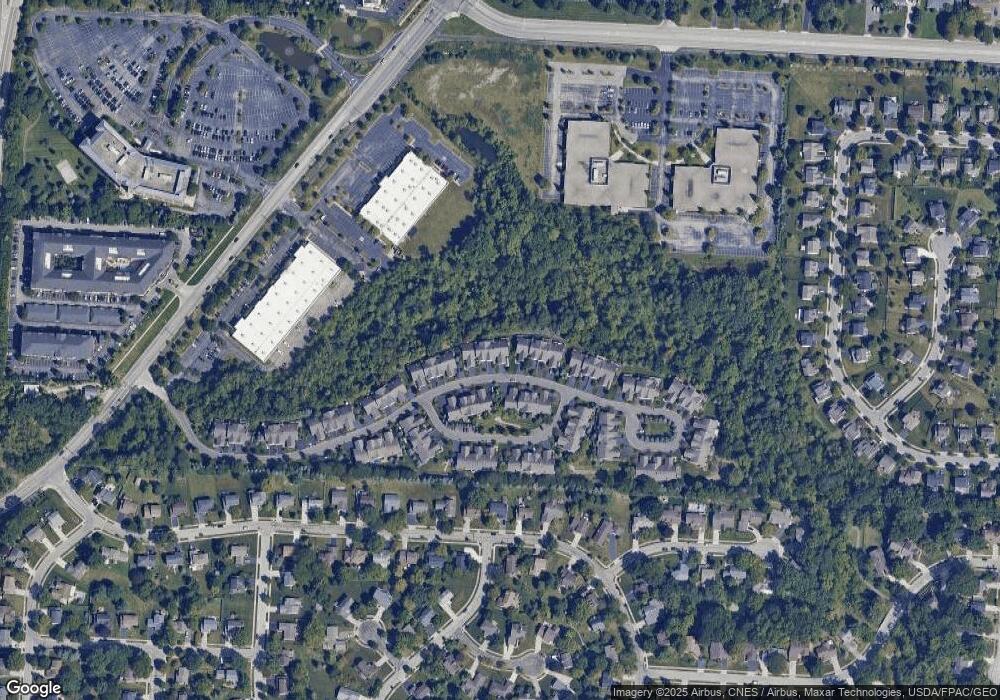

Map

Nearby Homes

- 1024 Arcadia Blvd

- 953 Arcadia Blvd

- 828 Memories Ln

- 8278 Mira St Unit 154

- 8282 Mira St Unit 153

- 106 Ormsbee Ave

- 0 Olde Worthington Rd

- 258 Bellefield Ave

- 1095 Belle Meade Place

- 640 Glacier Pass

- 658 River Trace

- 774 W Main St

- 7691 Key Deer Dr

- 7685 Key Deer Dr Unit 7685

- 1296 Blacksmith Dr

- 1585 Fawn Ct

- 1193 Hollytree Ln Unit 1193

- 1192 Blacksmith Dr

- 1143 Green Knoll Dr Unit 1143

- 7852 Heathcock Ct

- 1020 Arcadia Blvd

- 1010 Arcadia Blvd Unit 1010

- 1010 Arcadia Blvd Unit 1010

- 1010 Arcadia Blvd

- 1014 Arcadia Blvd Unit 1014

- 1022 Arcadia Blvd Unit 1022

- 1022 Arcadia Blvd

- 1024 Arcadia Blvd Unit 1024

- 1006 Arcadia Blvd Unit 1006

- 1006 Arcadia Blvd

- 1026 Arcadia Blvd Unit 1026

- 1026 Arcadia Blvd

- 1011 Arcadia Blvd

- 1011 Arcadia Blvd Unit 1011

- 1028 Arcadia Blvd Unit 1028

- 1028 Arcadia Blvd Unit 1028

- 1028 Arcadia Blvd

- 1019 Arcadia Blvd Unit 1019

- 1019 Arcadia Blvd

- 1023 Arcadia Blvd Unit 1023