1020 Hidden Landing Trail Unit 262 Dayton, OH 45449

Estimated Value: $69,000 - $79,067

2

Beds

1

Bath

757

Sq Ft

$97/Sq Ft

Est. Value

About This Home

This home is located at 1020 Hidden Landing Trail Unit 262, Dayton, OH 45449 and is currently estimated at $73,267, approximately $96 per square foot. 1020 Hidden Landing Trail Unit 262 is a home located in Montgomery County with nearby schools including West Carrollton High School and Bethel Baptist School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 28, 2022

Sold by

Hammond Edward A

Bought by

Alvarado Nelly Carmen Marti

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$48,450

Outstanding Balance

$44,995

Interest Rate

3.56%

Mortgage Type

New Conventional

Estimated Equity

$28,272

Purchase Details

Closed on

Feb 28, 2020

Sold by

Stanford Sheila L

Bought by

Hammond Edward A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$36,000

Interest Rate

3.6%

Mortgage Type

New Conventional

Purchase Details

Closed on

May 1, 2018

Sold by

Royalties Real Estate Ltd

Bought by

Stanford Sheila L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$33,950

Interest Rate

4.4%

Mortgage Type

New Conventional

Purchase Details

Closed on

Aug 10, 2017

Sold by

Kelley Betty L

Bought by

Royalties Real Estate Ltd

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Alvarado Nelly Carmen Marti | -- | None Listed On Document | |

| Hammond Edward A | $40,000 | Landmark Ttl Agcy South Inc | |

| Stanford Sheila L | $35,000 | None Available | |

| Royalties Real Estate Ltd | $7,000 | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Alvarado Nelly Carmen Marti | $48,450 | |

| Previous Owner | Hammond Edward A | $36,000 | |

| Previous Owner | Stanford Sheila L | $33,950 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,008 | $16,400 | $3,890 | $12,510 |

| 2023 | $1,008 | $16,400 | $3,890 | $12,510 |

| 2022 | $927 | $11,830 | $2,800 | $9,030 |

| 2021 | $929 | $11,830 | $2,800 | $9,030 |

| 2020 | $933 | $11,830 | $2,800 | $9,030 |

| 2019 | $794 | $9,230 | $2,800 | $6,430 |

| 2018 | $757 | $9,230 | $2,800 | $6,430 |

| 2017 | $752 | $9,230 | $2,800 | $6,430 |

| 2016 | $889 | $10,720 | $2,800 | $7,920 |

| 2015 | $819 | $10,720 | $2,800 | $7,920 |

| 2014 | $819 | $10,720 | $2,800 | $7,920 |

| 2012 | -- | $11,870 | $3,360 | $8,510 |

Source: Public Records

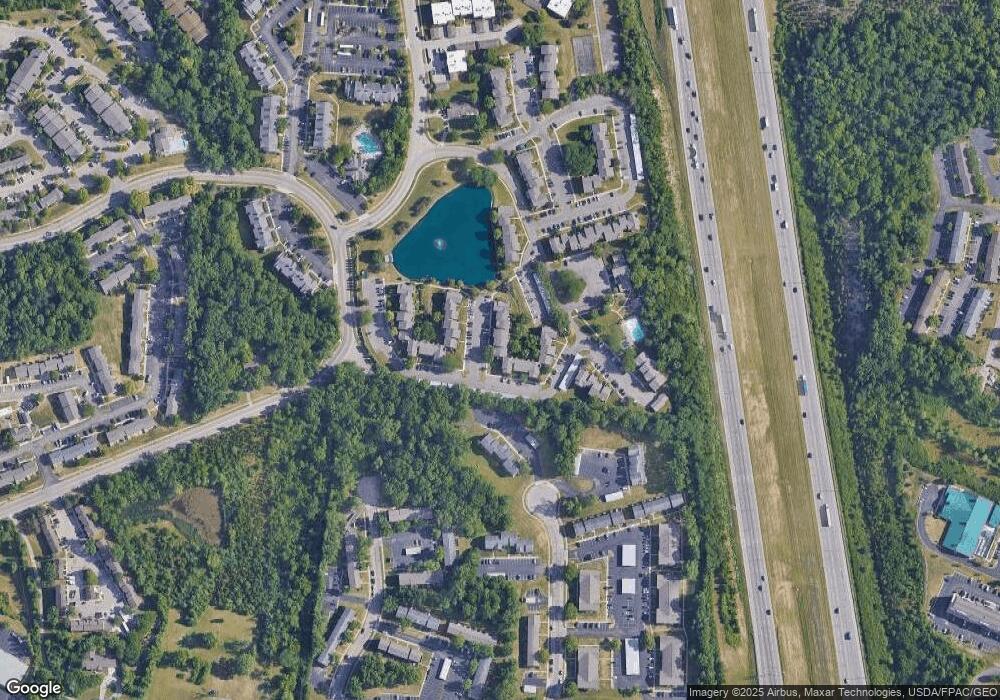

Map

Nearby Homes

- 1008 Lookout Trail Unit C

- 1124 Eagle Feather Cir Unit 161

- 1788 Cherokee Dr Unit F

- 1122 Eagle Feather Cir Unit C

- 1792 Cherokee Dr Unit A

- 1792 Cherokee Dr Unit F

- 1116 Eagle Feather Cir Unit E

- 1112 Eagle Feather Cir Unit A

- 1109 Arrowhead Crossing Unit A

- 1105 Arrowhead Crossing Unit A

- 3324 Ultimate Way Unit 36

- 6484 Quintessa Ct Unit 29

- 3316 Vanquil Trail Unit 387

- 3304 Ultimate Way Unit 399

- 6433 Interlude Ln Unit 438

- 3254 Gambit Square Unit 451

- 3074 Bright Bounty Ln Unit 38

- 3060 Bright Bounty Ln Unit 13

- 3056 Bright Bounty Ln Unit 220

- 3034 Bright Bounty Ln Unit 29

- 1020 Hidden Landing Trail Unit 266

- 1020 Hidden Landing Trail Unit 265

- 1020 Hidden Landing Trail Unit 264

- 1020 Hidden Landing Trail Unit 263

- 1020 Hidden Landing Trail Unit 261

- 1020 Hidden Landing Trail Unit B

- 1020 Hidden Landing Trail

- 1020 Hidden Landing Trail Unit 2-6

- 1020 Hidden Landing Trail Unit F

- 1030 Lookout Trail

- 1030 Lookout Trail

- 1030 Lookout Trail

- 1030 Lookout Trail

- 1030 Lookout Trail Unit A

- 1030 Lookout Trail Unit 272

- 1030 Lookout Trail Unit 271

- 1030 Lookout Trail Unit 270

- 1030 Lookout Trail Unit 269

- 1030 Lookout Trail Unit 268

- 1030 Lookout Trail Unit 267