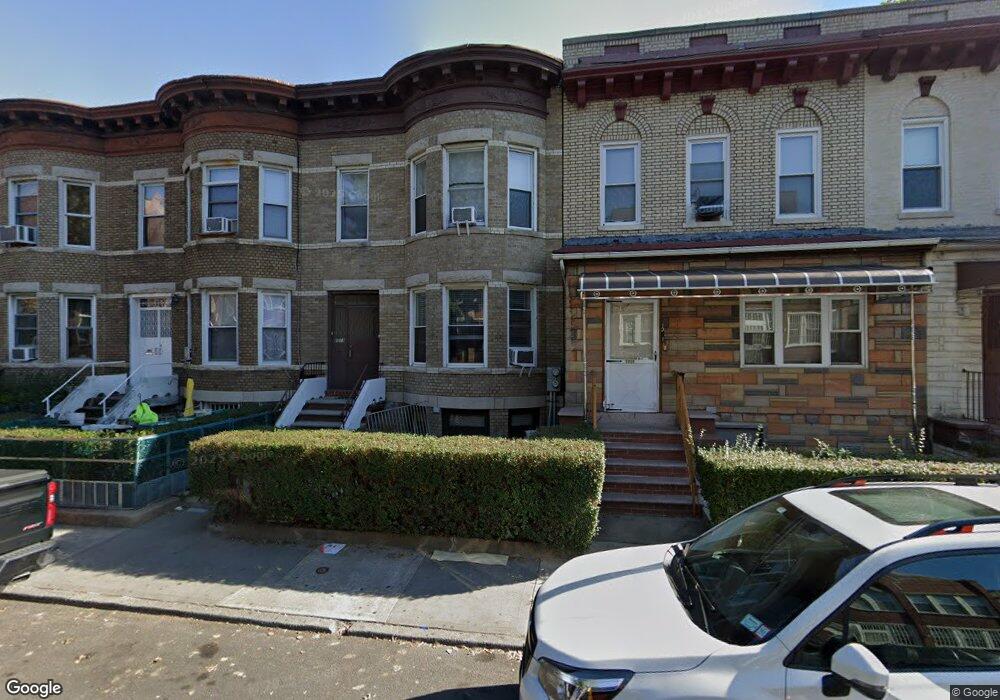

1021 E 15th St Brooklyn, NY 11230

Midwood NeighborhoodEstimated Value: $839,000 - $1,111,000

Studio

--

Bath

1,224

Sq Ft

$781/Sq Ft

Est. Value

About This Home

This home is located at 1021 E 15th St, Brooklyn, NY 11230 and is currently estimated at $956,489, approximately $781 per square foot. 1021 E 15th St is a home located in Kings County with nearby schools including P.S. 99 Isaac Asimov, Yeshiva Rabbi Chaim Berlin, and Yeshiva Ohr Shraga Veretzky.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 16, 2024

Sold by

Au Yeung C Mon and Kong Sau Kam

Bought by

Auyeung Family Irrevocable Trust and Kamlam Athena Auyeung Trustee

Current Estimated Value

Purchase Details

Closed on

Oct 7, 1996

Sold by

Miller Frank

Bought by

Kong Yeung C and Kong Sau Kam

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$90,000

Interest Rate

8.1%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Jul 6, 1995

Sold by

Olitsky Herbert and Olitsky Harriet

Bought by

Miller Frank

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Auyeung Family Irrevocable Trust | -- | -- | |

| Auyeung Family Irrevocable Trust | -- | -- | |

| Kong Yeung C | $150,000 | Commonwealth Land Title Ins | |

| Kong Yeung C | $150,000 | Commonwealth Land Title Ins | |

| Miller Frank | $50,000 | Commonwealth Land Title Ins | |

| Miller Frank | $50,000 | Commonwealth Land Title Ins |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Kong Yeung C | $90,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,654 | $48,900 | $13,920 | $34,980 |

| 2024 | $1,654 | $52,080 | $13,920 | $38,160 |

| 2023 | $1,655 | $47,760 | $13,920 | $33,840 |

| 2022 | $1,587 | $41,580 | $13,920 | $27,660 |

| 2021 | $1,576 | $42,180 | $13,920 | $28,260 |

| 2019 | $1,439 | $37,680 | $13,920 | $23,760 |

| 2018 | $1,276 | $18,987 | $6,970 | $12,017 |

| 2017 | $1,265 | $18,750 | $6,581 | $12,169 |

| 2016 | $1,149 | $17,704 | $6,519 | $11,185 |

| 2015 | $1,914 | $17,690 | $9,020 | $8,670 |

| 2014 | $1,914 | $16,719 | $10,221 | $6,498 |

Source: Public Records

Map

Nearby Homes

- 1067 E 15th St

- 1053 E 13th St Unit d1d

- 1053 E 13th St Unit d1

- 950 E 15th St

- 945 E 15th St

- 941 E 15th St

- 1049 E 18th St

- 1620 Avenue I Unit 307

- 1620 Avenue I Unit 507

- 1620 Avenue I Unit 502

- 1074 E 12th St

- 1504 Ocean Ave Unit 2A

- 1202 Avenue I

- 1615 Avenue I Unit 511

- 1615 Avenue I Unit 102

- 1916 Avenue K Unit 1E

- 902 E 12th St

- 870 E 16th St Unit 4

- 920 E 17th St Unit 212

- 1168 E 12th St

Your Personal Tour Guide

Ask me questions while you tour the home.