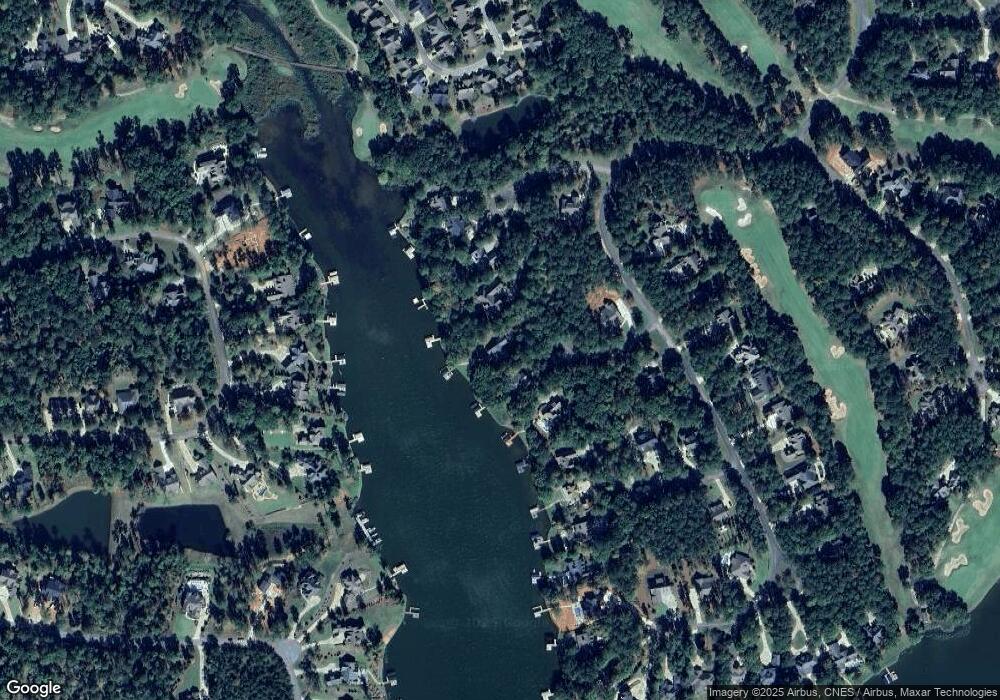

1021 Saint Andrews Ct Greensboro, GA 30642

Estimated Value: $1,048,000 - $1,371,000

--

Bed

3

Baths

1,956

Sq Ft

$639/Sq Ft

Est. Value

About This Home

This home is located at 1021 Saint Andrews Ct, Greensboro, GA 30642 and is currently estimated at $1,249,279, approximately $638 per square foot. 1021 Saint Andrews Ct is a home located in Greene County with nearby schools including Greene County High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 21, 2022

Sold by

Smith Shirley A

Bought by

Smith Shirley A and Smith Donald L

Current Estimated Value

Purchase Details

Closed on

Feb 28, 2008

Sold by

Fichtner David G

Bought by

Borland James

Purchase Details

Closed on

May 2, 2002

Sold by

Shields James G and Shields Sheila M

Bought by

Alexander Trust--

Purchase Details

Closed on

Aug 19, 1999

Sold by

Power Of Attn-Shields

Bought by

Shields James G and Shields Sheila M

Purchase Details

Closed on

Aug 18, 1999

Sold by

Carr David J and Helen Carr

Bought by

Power Of Attn-Shields

Purchase Details

Closed on

Jul 29, 1999

Sold by

Carr David and Helen Carr

Bought by

Carr David J and Helen Carr

Purchase Details

Closed on

Dec 23, 1997

Sold by

Par Ventures Inc

Bought by

Carr David and Helen Carr

Purchase Details

Closed on

Dec 22, 1995

Sold by

Reliance Trust Co/John Bell

Bought by

Par Ventures Inc

Purchase Details

Closed on

Feb 1, 1994

Sold by

Kenmore Clay

Bought by

Reliance Trust Co/John Bell

Purchase Details

Closed on

Sep 26, 1990

Sold by

Harbor Club Lp

Bought by

Kenmore Clay

Purchase Details

Closed on

Apr 12, 1989

Bought by

Harbor Club Lp

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Smith Shirley A | -- | -- | |

| Borland James | $790,000 | -- | |

| Alexander Trust-- | $518,000 | -- | |

| Shields James G | $459,000 | -- | |

| Power Of Attn-Shields | -- | -- | |

| Carr David J | -- | -- | |

| Carr David | $305,000 | -- | |

| Par Ventures Inc | $40,000 | -- | |

| Reliance Trust Co/John Bell | $39,000 | -- | |

| Kenmore Clay | $75,000 | -- | |

| Harbor Club Lp | -- | -- |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $7,492 | $470,880 | $241,040 | $229,840 |

| 2023 | $7,455 | $469,160 | $235,040 | $234,120 |

| 2022 | $7,520 | $420,720 | $235,040 | $185,680 |

| 2021 | $6,380 | $330,600 | $181,840 | $148,760 |

| 2020 | $4,940 | $231,640 | $105,000 | $126,640 |

| 2019 | $5,083 | $231,640 | $105,000 | $126,640 |

| 2018 | $4,958 | $226,400 | $105,000 | $121,400 |

| 2017 | $4,604 | $224,604 | $105,000 | $119,604 |

| 2016 | $4,631 | $226,332 | $105,000 | $121,332 |

| 2015 | $4,617 | $226,331 | $105,000 | $121,332 |

| 2014 | $4,547 | $217,329 | $105,000 | $112,329 |

Source: Public Records

Map

Nearby Homes

- 1010 Troon Ct

- 1132 Harbor Ridge Dr

- 1134 Harbor Ridge Dr

- 1121 Harbor Ridge Dr

- 1080 Glen Eagle Dr

- 1101 Harbor Ridge Dr

- 1070 Glen Eagle Dr

- 1390 Winged Foot Dr

- 1040 Turnberry Cir

- 1170 Harbor Ridge Dr

- 1211 Turnberry Cir

- 1091 Carnoustie

- 1991 Club Dr

- 1050 Spy Glass Hill

- 1000 Glen Eagle Dr

- 1261 Glen Eagle Dr

- 1041 Glen Eagle Dr

- 1020 Oak Valley Rd

- 1030 Saint Andrews Ct

- 1020 Olympic Ct

- 1011 Saint Andrews Ct

- 1020 Saint Andrews Ct

- 1030 Olympic Ct

- 0 Saint Andrews Ct Unit 8235822

- 0 Saint Andrews Ct Unit 8045313

- 0 Saint Andrews Ct Unit 9067556

- 0 Saint Andrews Ct Unit 2070

- 1010 Saint Andrews Ct

- 1001 St Andrews Unit 2070

- 1001 St Andrews

- 1001 Saint Andrews Ct

- 0 Olympic Ct Unit 7092371

- 0 Olympic Ct Unit 9040284

- 0 Olympic Ct Unit 8872953

- 0 Olympic Ct

- 1040 Olympic Ct

- 1021 Troon Ct

- 1241 Winged Foot Dr