1022 S Leopard Rd Berwyn, PA 19312

Estimated Value: $1,894,000 - $2,224,000

4

Beds

3

Baths

5,398

Sq Ft

$378/Sq Ft

Est. Value

About This Home

This home is located at 1022 S Leopard Rd, Berwyn, PA 19312 and is currently estimated at $2,041,340, approximately $378 per square foot. 1022 S Leopard Rd is a home located in Chester County with nearby schools including Beaumont Elementary School, Tredyffrin-Easttown Middle School, and Conestoga Senior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 31, 2008

Sold by

Love Love John Barry John Barry and Love Bader Hillary

Bought by

Parayre Roch and Parayre Rebecca M

Current Estimated Value

Purchase Details

Closed on

Jun 13, 2006

Sold by

Love John Barry and Love Renee M

Bought by

Love John Barry and Love Renee M

Purchase Details

Closed on

Jul 11, 1998

Sold by

King Graham O and King Leola J

Bought by

Love John Barry and Love Renee M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$625,000

Outstanding Balance

$127,680

Interest Rate

6.98%

Estimated Equity

$1,913,660

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Parayre Roch | $1,470,000 | None Available | |

| Love John Barry | -- | None Available | |

| Love John Barry | $1,125,000 | Commonwealth Land Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Love John Barry | $625,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $29,292 | $785,310 | $180,940 | $604,370 |

| 2024 | $29,292 | $785,310 | $180,940 | $604,370 |

| 2023 | $27,388 | $785,310 | $180,940 | $604,370 |

| 2022 | $26,639 | $785,310 | $180,940 | $604,370 |

| 2021 | $26,061 | $785,310 | $180,940 | $604,370 |

| 2020 | $25,336 | $785,310 | $180,940 | $604,370 |

| 2019 | $24,630 | $785,310 | $180,940 | $604,370 |

| 2018 | $24,204 | $785,310 | $180,940 | $604,370 |

| 2017 | $23,658 | $785,310 | $180,940 | $604,370 |

| 2016 | -- | $785,310 | $180,940 | $604,370 |

| 2015 | -- | $785,310 | $180,940 | $604,370 |

| 2014 | -- | $785,310 | $180,940 | $604,370 |

Source: Public Records

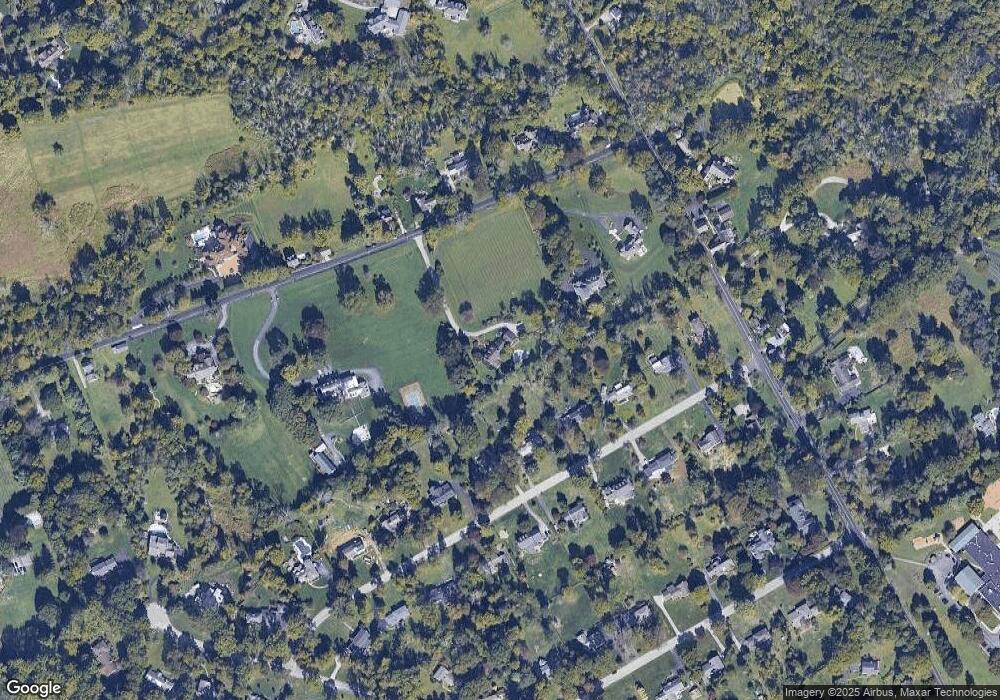

Map

Nearby Homes

- 709 Newtown Rd

- 837 Nathan Hale Rd

- 191 Stony Point Dr

- 1179 Beaumont Rd

- 206 Yorktown Place Unit 106

- 718 Lot 1 Waterloo

- 0 Prescott Rd Unit PACT2110528

- 1052 Prescott Rd

- 6 Wingstone Ln

- 659 Andover Rd

- 520 Hawthorne Place

- 422 S Waterloo Rd

- 641 Andover Rd

- 600 Waynesfield Dr

- 201 Church Rd

- 650 Augusta Ct

- 91 Central Ave

- 2000 Saint Andrews Dr

- 119 Waterloo Ave

- 404 Dorset Rd

- 1029 Tenby Rd

- 1023 Tenby Rd

- 1035 Tenby Rd

- 1014 S Leopard Rd

- 1017 Tenby Rd

- 1041 Tenby Rd

- 1054 S Leopard Rd

- 1011 Tenby Rd

- 1023 S Leopard Rd

- 1031 S Leopard Rd

- 1006 S Leopard Rd

- 1017 S Leopard Rd

- 1047 Tenby Rd

- 1030 Tenby Rd

- 1024 Tenby Rd

- 1036 Tenby Rd

- 1005 Tenby Rd

- 1011 S Leopard Rd

- 1018 Tenby Rd

- 1043 S Leopard Rd