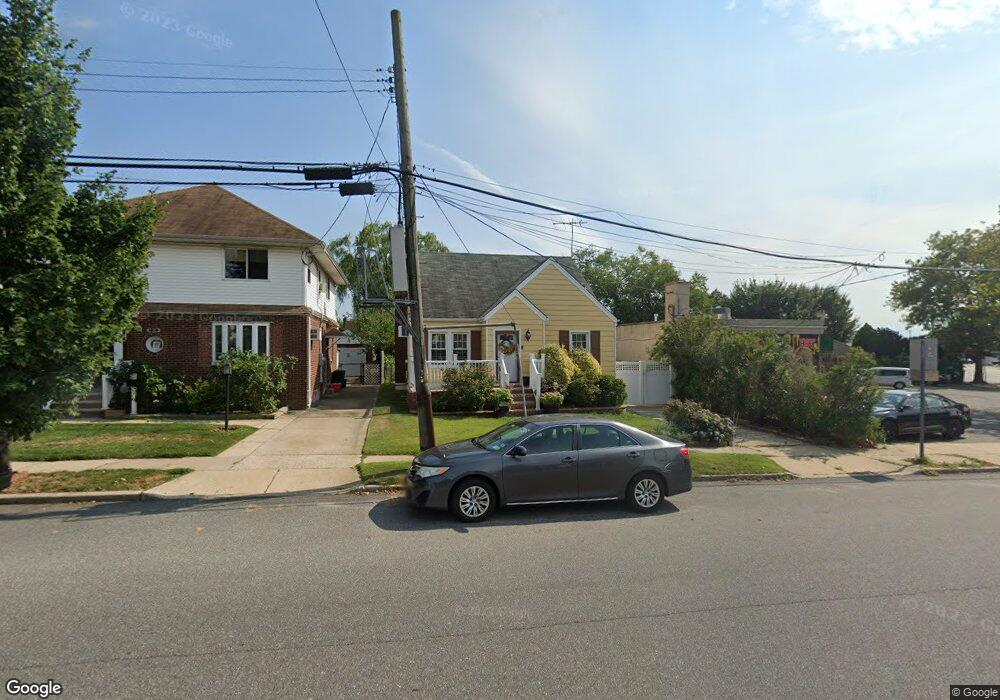

1023 Fenworth Blvd Franklin Square, NY 11010

Estimated Value: $670,658 - $732,000

3

Beds

2

Baths

928

Sq Ft

$756/Sq Ft

Est. Value

About This Home

This home is located at 1023 Fenworth Blvd, Franklin Square, NY 11010 and is currently estimated at $701,329, approximately $755 per square foot. 1023 Fenworth Blvd is a home located in Nassau County with nearby schools including St Anne's School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 31, 2016

Sold by

Rao Hassan and Rao Khurram

Bought by

Garcia Fausto R and Garcia Justina

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$370,878

Outstanding Balance

$296,463

Interest Rate

3.87%

Mortgage Type

FHA

Estimated Equity

$404,866

Purchase Details

Closed on

Mar 5, 2015

Sold by

Greco Ann Maria

Bought by

Hassan Rao and Hassan Khurram Rao

Purchase Details

Closed on

May 10, 2006

Sold by

Amalfitano Elizabeth

Bought by

Greco Anna

Purchase Details

Closed on

Apr 10, 2003

Sold by

Greco Frank

Purchase Details

Closed on

Feb 18, 1999

Sold by

Cardino Ralph E and Cardino Lori A

Bought by

Greco Anna Maria and Greco Frank

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Garcia Fausto R | $405,000 | Chicago Title Insurance Comp | |

| Hassan Rao | $270,000 | Judicial Title Insurance | |

| Greco Anna | $440,000 | -- | |

| -- | -- | -- | |

| Greco Anna Maria | $169,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Garcia Fausto R | $370,878 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $9,165 | $421 | $229 | $192 |

| 2024 | $3,688 | $421 | $229 | $192 |

| 2023 | $9,042 | $421 | $229 | $192 |

| 2022 | $9,042 | $421 | $229 | $192 |

| 2021 | $11,816 | $413 | $225 | $188 |

| 2020 | $9,142 | $567 | $415 | $152 |

| 2019 | $8,786 | $608 | $445 | $163 |

| 2018 | $9,067 | $649 | $0 | $0 |

| 2017 | $5,401 | $649 | $504 | $145 |

| 2016 | $8,778 | $649 | $504 | $145 |

| 2015 | $3,151 | $649 | $504 | $145 |

| 2014 | $3,151 | $649 | $504 | $145 |

| 2013 | $2,865 | $649 | $504 | $145 |

Source: Public Records

Map

Nearby Homes

- 1035 Wool Ave

- 1022 Rosegold St

- 249 Hoffman St

- 291 Lincoln St

- 242 James St

- 1041 Russell St

- 280 Franklin Ave Unit 11

- 1134 Rosegold St

- 301 Hoffman St

- 1098 Russell St

- 1022 Jackson Ave

- 956 Hancock Ave

- 298 Doris Ave

- 44 Catherine Ave

- 191 Litchfield Ave

- 342 Lucille Ave

- 51 Pacific St

- 190 Commonwealth St

- 422 Saint Agnes Place

- 23 Monroe St

- 1019 Fenworth Blvd

- 197 Franklin Ave

- 1015 Fenworth Blvd

- 1026 Wool Ave

- 1030 Wool Ave

- 1022 Wool Ave

- 1011 Fenworth Blvd

- 1018 Wool Ave

- 1034 Wool Ave

- 1038 Wool Ave

- 1014 Wool Ave

- 1007 Fenworth Blvd

- 1042 Esther St Unit Esther St

- 1042 Esther St

- 185 Franklin Ave

- 1046 Esther St

- 1010 Wool Ave

- 181 Franklin Ave

- 1003 Fenworth Blvd

- 1010 Fenworth Blvd