1024 E 450 North Cir American Fork, UT 84003

Estimated Value: $508,000 - $553,451

1

Bed

3

Baths

1,558

Sq Ft

$345/Sq Ft

Est. Value

About This Home

This home is located at 1024 E 450 North Cir, American Fork, UT 84003 and is currently estimated at $537,484, approximately $344 per square foot. 1024 E 450 North Cir is a home located in Utah County with nearby schools including Barratt Elementary School, American Fork Junior High School, and American Fork High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 9, 2022

Sold by

Reed Sr Lowell B and Reed Iris E

Bought by

Reed Family Living Trust

Current Estimated Value

Purchase Details

Closed on

May 3, 2022

Sold by

Reed Sr Lowell B and Reed Iris E

Bought by

Reed Family Living Trust

Purchase Details

Closed on

May 12, 2021

Sold by

Shimanek Melissa Smith and Smith Family Trust

Bought by

Reed Lowell B and Reed Iris E

Purchase Details

Closed on

Jun 14, 2004

Sold by

Miller Af Associates Lc

Bought by

Smith Milton E and Smith Valoy F

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Reed Family Living Trust | -- | None Listed On Document | |

| Reed Family Living Trust | -- | None Listed On Document | |

| Reed Lowell B | -- | Meridian Titel Co | |

| Smith Milton E | -- | Equity Title |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,678 | $300,410 | -- | -- |

| 2024 | $2,678 | $297,550 | $0 | $0 |

| 2023 | $2,364 | $278,465 | $0 | $0 |

| 2022 | $2,314 | $269,060 | $0 | $0 |

| 2021 | $2,072 | $376,300 | $100,000 | $276,300 |

| 2020 | $2,016 | $355,000 | $100,000 | $255,000 |

| 2019 | $1,808 | $329,300 | $100,000 | $229,300 |

| 2018 | $1,891 | $329,300 | $100,000 | $229,300 |

| 2017 | $1,683 | $158,235 | $0 | $0 |

| 2016 | $1,622 | $141,680 | $0 | $0 |

| 2015 | -- | $136,400 | $0 | $0 |

| 2014 | $1,514 | $123,750 | $0 | $0 |

Source: Public Records

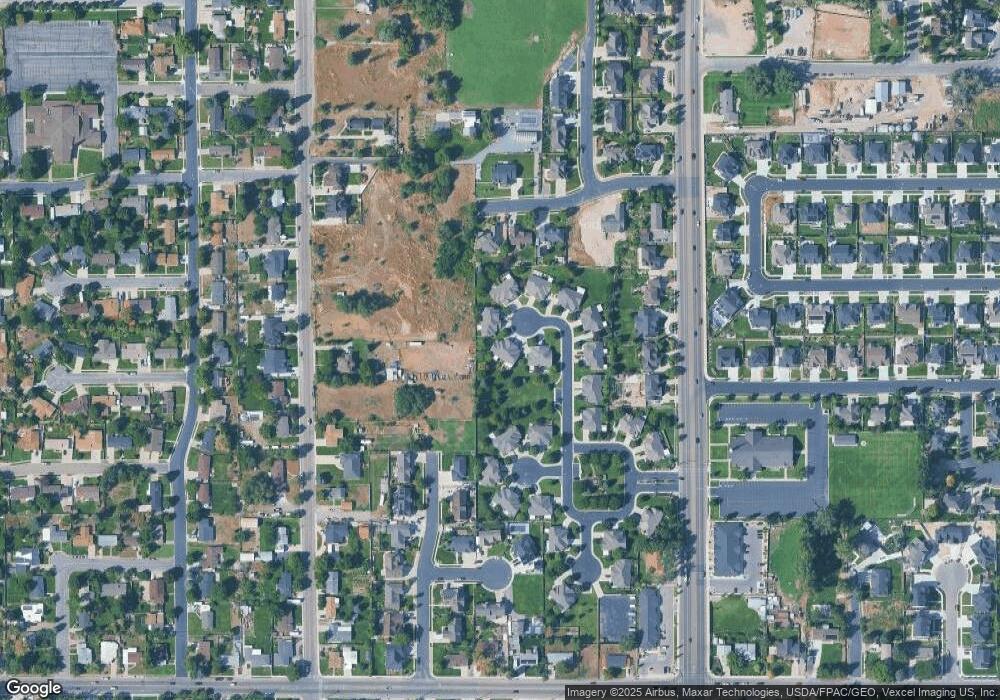

Map

Nearby Homes

- 1024 E 450 Cir N Unit 21

- 1026 E 450 North Cir

- 1026 E 450 Cir N Unit 22

- 1012 E 450 Cir N

- 1012 E 450 Cir N Unit 20

- 1012 E 450 North Cir

- 1038 E 450 North Cir

- 1017 E 450 North Cir

- 1038 E 450 Cir N Unit 23

- 1017 E 450 Cir N Unit 19

- 1042 E 450 North Cir

- 1042 E 450 Cir N Unit 24

- 1019 E 450 Cir N Unit 18

- 1019 E 450 North Cir

- 1021 E 450 North Cir

- 1021 E 450 Cir N Unit 17

- 1033 E 450 North Cir

- 1033 E 450 North Cir Unit 16

- 1035 E 450 Cir N

- 1035 E 450 Cir N Unit 15