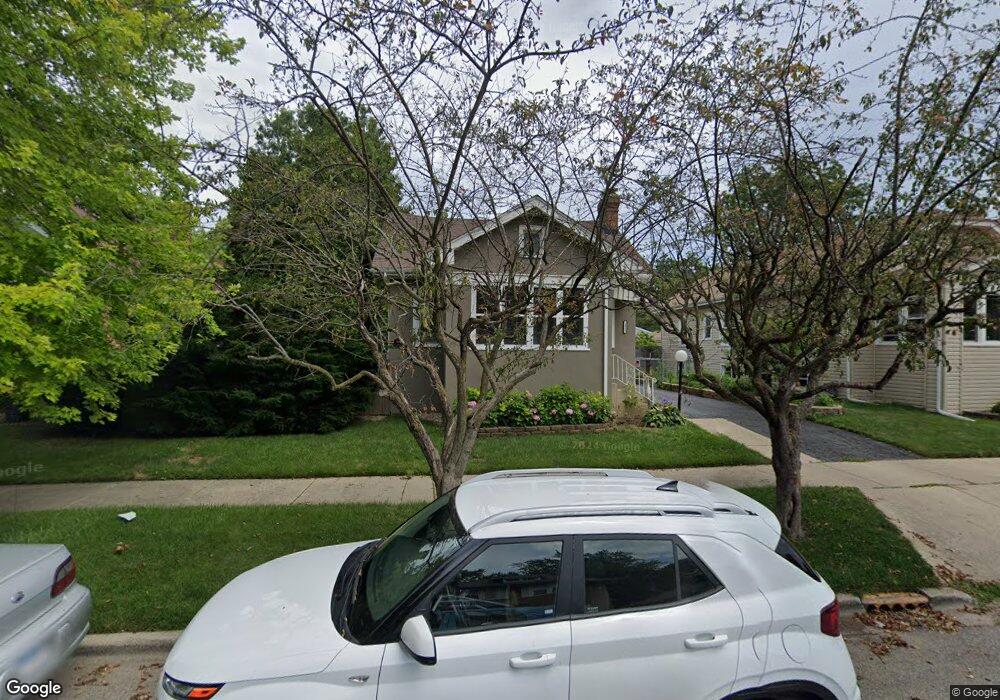

1025 N Ash St Waukegan, IL 60085

Estimated Value: $206,000 - $219,381

3

Beds

1

Bath

1,056

Sq Ft

$203/Sq Ft

Est. Value

About This Home

This home is located at 1025 N Ash St, Waukegan, IL 60085 and is currently estimated at $213,845, approximately $202 per square foot. 1025 N Ash St is a home located in Lake County with nearby schools including Glen Flora Elementary School, Edith M Smith Middle School, and Waukegan High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 20, 2009

Sold by

Contreras J Alfonso and Contreras Jose Alfonso

Bought by

Contreras Jose Alfonso and Sajuan Josefina

Current Estimated Value

Purchase Details

Closed on

Oct 23, 2002

Sold by

Contreras J Alfonso

Bought by

Contreras J Alfonso and Sajuan Josefina

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$116,955

Interest Rate

6.38%

Mortgage Type

FHA

Purchase Details

Closed on

Aug 21, 2000

Sold by

Bellows Richard P and Estate Of Ethel Bellows

Bought by

Contreras J Alfonso

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$116,955

Interest Rate

7.03%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Contreras Jose Alfonso | -- | None Available | |

| Contreras J Alfonso | -- | Greater Illinois Title Compa | |

| Contreras J Alfonso | $118,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | Contreras J Alfonso | $116,955 | |

| Previous Owner | Contreras J Alfonso | $116,955 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,530 | $50,744 | $9,504 | $41,240 |

| 2023 | $3,739 | $45,432 | $8,509 | $36,923 |

| 2022 | $3,739 | $44,243 | $7,426 | $36,817 |

| 2021 | $3,494 | $39,511 | $6,623 | $32,888 |

| 2020 | $3,492 | $36,809 | $6,170 | $30,639 |

| 2019 | $3,462 | $33,730 | $5,654 | $28,076 |

| 2018 | $3,676 | $33,694 | $7,201 | $26,493 |

| 2017 | $3,387 | $29,810 | $6,371 | $23,439 |

| 2016 | $3,076 | $25,904 | $5,536 | $20,368 |

| 2015 | $2,903 | $23,185 | $4,955 | $18,230 |

| 2014 | $2,286 | $19,050 | $5,111 | $13,939 |

| 2012 | $2,254 | $20,640 | $5,538 | $15,102 |

Source: Public Records

Map

Nearby Homes

- 1110 N Ash St

- 918 N Ash St

- 415 W Ridgeland Ave

- 1336 N Ash St

- 1335 Chestnut St

- 917 N Linden Ave

- 1105 Woodlawn Cir

- 1312 N Linden Ave

- 620 N Poplar St

- 1109 Massena Ave

- 723 N County St

- 702 Franklin St

- 325 4th St

- 1000 Pine St

- 522 N Poplar St

- 616 W Keith Ave

- 1018 W Atlantic Ave

- 511 Chestnut St

- 428 N Poplar St

- 824 N Butrick St